Key Insights:

- Pi Network has surged past the $0.60 mark and reached a high of $0.6441 before entering a consolidation phase.

- Analysts believe the coin may soon test the $1 resistance level if current momentum continues.

- The RSI and MACD indicators show bullish signals, pointing to possible upward movement.

Pi Network has recently shown intense price action, surged past the $0.60 mark, and hit a high of $0.6441. Analysts expect a potential rally to the $1 resistance, which has become a key psychological level.

With momentum building, technical indicators and fundamentals are now being reviewed to determine the next direction.

Pi Network Builds Momentum with Strong Fundamentals

After rising to $0.6441, the Pi Network stabilized by consolidating its value between $0.63 and $0.64. The RSI tracks investing pressure in the market with its upward trend while maintaining its position slightly above $0.63.

The MACD indicator has shown bullish signals, suggesting potential upward price movements in the upcoming market sessions. This indicated growing positive momentum in the asset’s performance.

Market analyst Xia believes that fundamental aspects of Pi Network drive its increasing market potential. She showcased the Pi ecosystem using the Map of Pi during the Pi Fest exhibition. It revealed that the ecosystem has over 1.8 million users actively participating.

More than 58,000 sellers engaged in transacting activities on the platform, indicating robust transactional behavior at this event. The current market perception toward Pi Network appears uncertain because some investors doubt the robustness of recent price fluctuations.

The buying activity continues, while coin owners express doubt since they have incurred past losses. Maintaining current market momentum could allow Pi Coin to verify higher resistance points shortly.

Support at $0.61 Holds, $1 Target in Sight

The market analysts believe Pi Coin’s support level at $0.61 is essential for future price growth. Moon Jeff observed through analysis that the coin successfully upholds this price level because of its strong purchasing power.

This area is a launching platform for another price increase toward the $1 target. According to technical chart indicators, when Pi Coin surpasses $0.6441, another test will probably occur at approximately $0.70.

The market continues to watch volume strength and price consolidation patterns, seeking signs that indicate a breakout possibility. The current price outlook remains positive since it maintains positions above the main moving averages.

PiNewsZone’s analysis suggested that reaching $1 could drive significant market momentum. Achieving this milestone might greatly strengthen the position of Pi Network.

An expert analyst emphasized the importance of purchasing more coins. A potential price breakout might initiate the discovery of Pi Coin’s true market value.

The market sentiment matches this outlook because the short positions are falling while support levels are getting stronger.

PiCoreTeam Updates Seen as Vital for Long-Term Growth

The rally faces sustainability questions when there is no adequate structural foundation. Dr Altcoin stressed that exchange accessibility needs improvement because increasing platforms with KYB approval is vital.

According to his assessment, the expansion of OKX into additional geographical markets represents a strong opportunity to boost market demand. Major players, including BANXA, have the solution to stabilize Pi prices by strategically purchasing large quantities from exchange markets.

He believes such purchasing actions would promote market liquidity and decrease market sales. The rally could encounter problems at upper price levels when institutional support is lacking.

Dr Altcoin pointed out that updates from the PiCoreTeam were essential for stabilizing long-term price movements. Successful product releases or strategic business announcements lead to growing demand.

This is driven by renewed consumer interest after the brand breaks into the market. Traders need ongoing updates from PiCoreTeam to validate the long-term viability of the current price growth.

Bearish Funding Rates Raise Doubts Despite Pi Network Gains

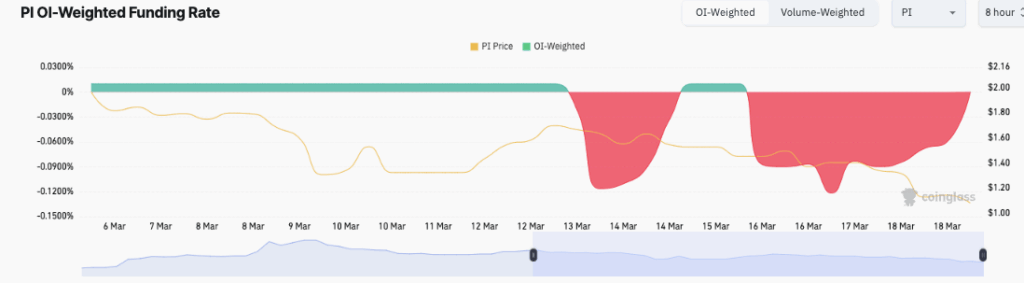

While price indicators appear optimistic, derivatives data has introduced concerns about sentiment shifts. Short traders intensified their bearish bets, resulting in a negative reading on the PI OI-Weighted Funding Rate on March 13.

The funding rate kept a negative value from March 13 to March 18. This indicated that short positions were stronger than long ones.

The premium payments shown in red shaded areas demonstrate bearish activities, since traders paid extra to maintain short-exposure positions. The market displayed neutral or reversing tendencies even though the coin continued its upward movement.

Market traders now watch to determine if growth indicators will succeed in reversing the negative trading positions within derivatives instruments. Substantial volume above $0.70 in Pi Network may drive short position liquidations toward surpassing the $1 barrier.

The analysts predicted that such a price breakout would modify investor sentiment and diminish the downward market force from derivatives trading. The upcoming market sessions will play a vital role in determining Pi Coin’s price movement within the short term.