Key Insights:

- James Wynn has placed another $100 million Bitcoin bet days after a previous loss in May.

- His new 945 BTC long position has a liquidation price of $103,630, which shows extreme fragility and high risk.

- Wynn has openly accused “market makers” of intentionally targeting his positions.

James Wynn, a crypto trader with bold gambling strategies, has made another huge bet on Bitcoin. This time, he placed a $100 million leveraged trade. This move comes only days after he lost nearly the same amount in another gamble-trade.

Wynn’s trading style relies on extreme leverage and public transparency. His approach has led to accusations of market manipulation. These factors have sparked heated debates within the crypto industry.

Some see him as a strategist fighting against an unfair market, while others believe he’s recklessly fueling volatility. Here are the details of the most recent $100 million bet and what it could mean for the price of Bitcoin.

Doubling Down After a $100 Million Loss

On 30 May, James Wynn lost nearly $100 million when his famous 40x leveraged long position on Bitcoin was liquidated. His trade, worth an eye-watering $1.25 billion, collapsed after BTC’s price briefly dipped below $105,000.

This event triggered an automatic margin call, and the high leverage meant little room for error. However, rather than stepping back and reassessing his position, Wynn has bet again similarly within days.

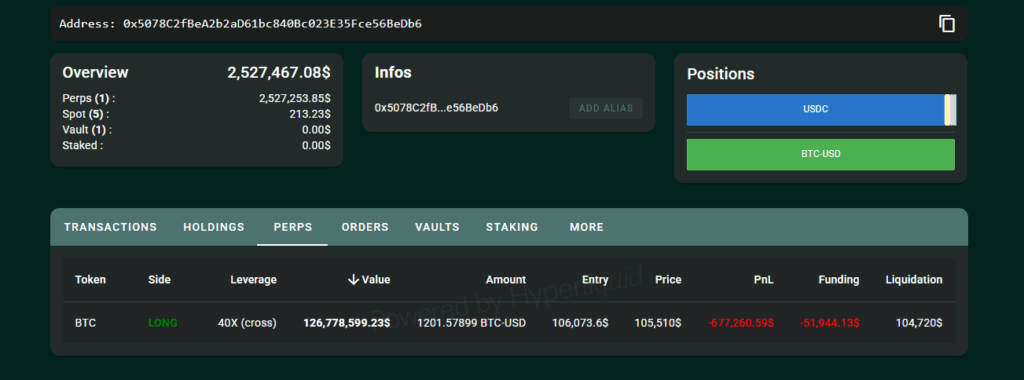

According to blockchain data from Hypurrscan, he opened a new long position worth approximately 945 BTC, worth around $100 million. The liquidation price for this new position is $103,630, which makes it just as fragile as the last one.

So far, Wynn is currently nursing an unrealized loss of over $677,000. This shows the cryptocurrency’s ongoing volatility and how quickly things can go wrong.

He added $480,000 in margin to lower his risk of sudden liquidation. His total stake in the trade has now reached nearly $3 million.

Wynn Accuses Market Makers

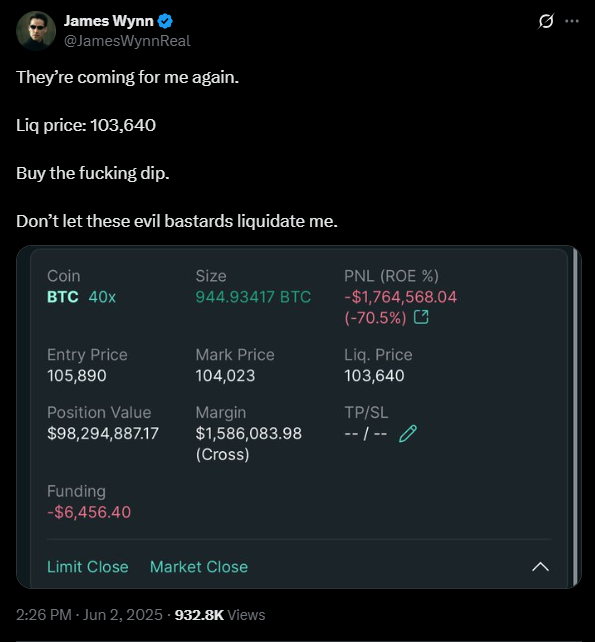

As usual, Wynn didn’t keep quiet about his new position. He took to X and claimed that his trades are being intentionally targeted by market makers.

In a post that quickly went viral, he called these actors “evil bastards.” He accused them of coordinating to push prices just low enough to force him into liquidation.

This isn’t the first time market manipulation claims have surfaced in crypto. However, Wynn’s public transparency is making him an easy target.

Crypto influencer Altcoin Gordon backed Wynn’s accusations. He pointed out that BTC’s price dipped just seconds after Wynn’s new position went live.

The price drops have nearly reached Wynn’s liquidation level. Many believe it was an intentional attempt to push him out of his trade.

Supporters Rally Behind Wynn

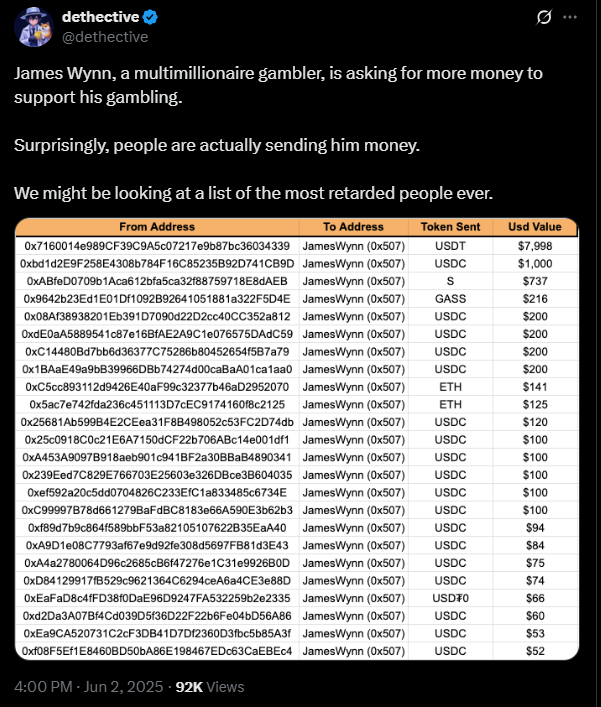

An interesting twist entered the picture. Wynn’s trading journey quickly became a public spectacle, especially with some people donating money to support him.

According to a crypto researcher known as “dethective,” over 24 wallets have sent stablecoins to Wynn in a crowdfunded comeback campaign.

The largest donation is close to $8,000. Wynn has encouraged these donations, even promising to reimburse contributors “assuming I win.”

Crowdfunding such a high-risk leveraged bet may seem reckless. Many disagree with Wynn’s gambling approach. However, his supporters view him as a symbol of resistance against algorithmic trading giants.

So far, Bitcoin trades at around $105,000 according to data from CoinMarketCap. However, if the cryptocurrency drops below the $103,630 liquidation mark, Wynn’s position could be wiped out again, just like the first.

Wynn’s position is large, making liquidation a serious risk. If he gets liquidated, it could lead to a broader market sell-off. This could be devastating for many traders.