Key Insights:

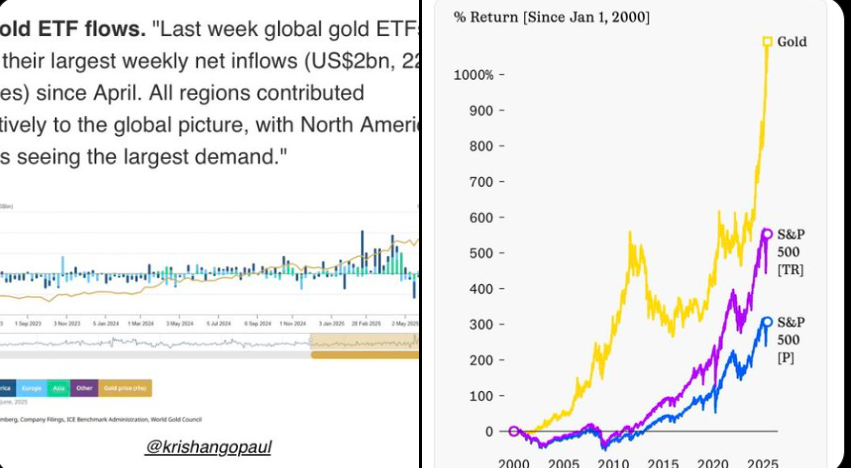

- Gold ETFs have surged nearly 30% YTD in 2025 as investors seek safe-haven assets amid global equity outflows and rising tensions.

- U.S. and Chinese gold ETF inflows lead. However, recent outflows and slower Chinese demand in late June suggest caution.

- Despite short-term consolidation signs, central bank buying and geopolitical risks continue to support gold ETF momentum.

Investor demand for gold ETFs hit multi-year highs in mid-2025. This surge reflects growing concerns over geopolitical tensions and inflation. Additionally, exchange-traded gold instruments are attracting broad participation amid ongoing uncertainty in global equities.

Gold ETFs Near 30% YTD Gains

Gold ETFs have delivered returns close to 30% since January 2025, outperforming most asset classes. These returns follow a long stretch of market volatility. Equity deleveraging and a shift toward safe-haven assets drove the change.

According to a Reuters report, investors withdrawn nearly $20 billion from global equity funds in June alone. A considerable portion of that was redirected toward gold-backed ETFs.

In addition, data showed that both physically backed and synthetic gold ETFs have recorded strong net inflows through the second quarter. Spot gold prices have hovered between $3,350 and $3,400 per ounce in June. It is maintaining levels seen during April’s multi-year highs.

Global equity markets remain inconsistent across major regions. In contrast, gold ETFs continue to provide a more stable store of value. This has led to renewed investor engagement.

U.S. and China Lead Gold ETF Inflows in First Half of 2025

Investor activity in the United States and China has been central to gold ETF demand in the first half of 2025. Chinese ETFs added nearly 65 tonnes of gold holdings in April, while U.S.-listed funds contributed over 42 tonnes.

These two markets account for a large share of the global ETF inflow volume. It was supported by local investor sentiment and shifting macroeconomic conditions.

However, inflow momentum slowed in June. Data from the past week indicated a modest pullback, particularly among Chinese funds, where retail participation has declined slightly.

Analysts attribute the reduced demand to temporary profit-taking following strong early-year returns and regulatory caution from regional authorities. U.S. ETF flows have also flattened, although holdings remain elevated compared to 2024.

Demand Sustain Gold ETF Strength

Central banks have played a major role in supporting gold prices throughout 2025. Reserve accumulation by multiple sovereign banks, particularly in Asia and the Middle East, has continued into the second quarter.

Investing Haven reported that over 240 tonnes of gold were added to official reserves in the year’s first quarter. According to Investing Haven, this amount is significantly higher than the five-year average.

This sustained buying has provided a secondary support layer for gold ETF valuations. The ETF holdings do not directly influence central bank purchases. However, their performance closely tracks macro drivers such as interest rates, inflation expectations, and currency volatility.

Heightened geopolitical developments have also pushed investors toward gold-backed instruments. Tensions in the Middle East and trade uncertainty between the U.S. and China have shaken investor confidence.

Volatile oil prices have added to global market unease. This has led to a risk-off sentiment among investors. In response, many are turning to gold ETFs for convenient access to gold without the hassle of owning it physically.

Short-Term Consolidation Appears, But Broader Demand Holds

Despite strong year-to-date performance, ETF providers and analysts note that consolidation may continue in the short term. The sharp price swings in March and April prompted some funds to adjust their portfolios.

This was particularly true for funds that track daily spot prices or use leveraged strategies. Weekly data showed a slight reduction in total gold ETF holdings, although assets under management remain historically high.

When writing, total global gold ETF assets are estimated at over $370 billion, with holdings exceeding 3,500 tonnes. Volumes remain above long-term averages. This suggests the underlying demand is stable even as investor behavior adjusts to shifting market conditions