- Bitcoin fell below $105K, sparking over $345M in liquidations within a single hour across the crypto market

- Over 20,000 BTC bought by whales in 48 hours as large holders increase accumulation despite volatility

- Demand growth is slowing, but capital inflows remain near peak bull market levels at $1.8B daily

The crypto market saw a wave of forced liquidations across leveraged positions after Bitcoin briefly dropped under $105,000. However, as retail traders were rapidly losing money, whales came in hard and bought over 20,000 BTC in just two days.

This contrast in behaviour highlights the market’s evolving structure, as short-term volatility continues while large-scale capital inflows and whale holdings persist. Long-term accumulation remains a key support factor for Bitcoin, despite cooling demand growth.

Bitcoin Drops Below $105K, $345M Liquidated in Just One Hour

Bitcoin’s sudden fall below $105,000 caused market turmoil on the spot, with $345 million in crypto liquidations within 60 minutes.

Major cryptocurrencies like Ethereum, Solana, and XRP all posted sharp intraday losses. Margin calls accelerated across exchanges, hitting the hardest overleveraged long positions.

The drop also featured one major event, the liquidation of a high-leverage whale trading at 40x exposure. As the price dropped below the crucial $105,000 mark, this whale lost 949 BTC, or $99.3 million.

However, the flash crash did not break Bitcoin’s 4-hour chart out of a rising wedge pattern. Near the lower trendline, the price rebounded, which may indicate a technical support zone.

Bulls will have to defend this range and reclaim $110,000 to reenter the picture of upside targets like $117,000.

Whales Accumulate 20,000 BTC During Market Dip

While retail traders were shaken by the decline, Bitcoin whales took advantage of the pullback to add over 20,000 BTC in just 48 hours.

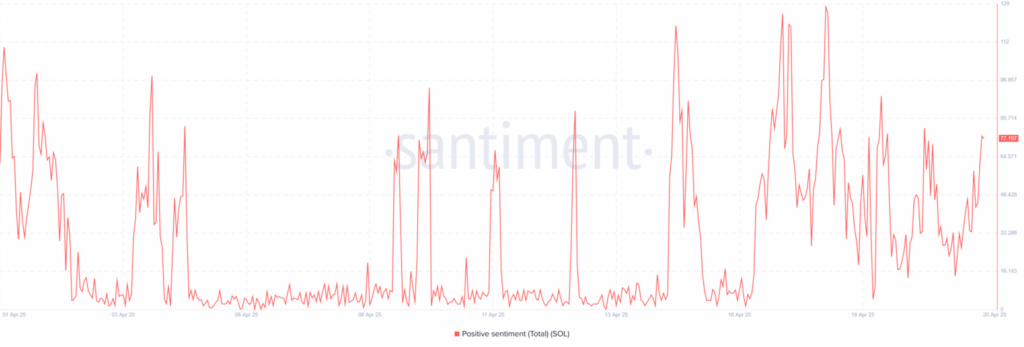

The selling was broader, suggesting that this accumulation was part of a strategic entry by large investors who saw the dip as a good buying opportunity. Santiment data tracked the move, as the number of addresses holding 100–1,000 BTC increased.

These whales now hold a total of 4.71 million BTC, which has been growing steadily over the past few weeks.

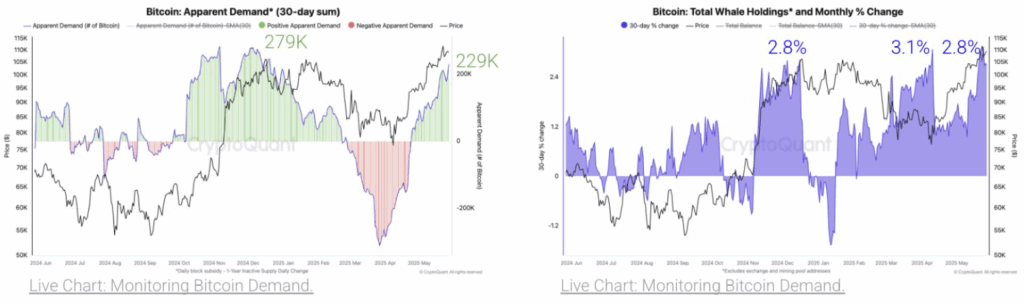

Whale balances increased by 2.8% month over month, which confirms the previous accumulation phases before major rallies. Price volatility notwithstanding, the ongoing buildup shows strong conviction from long-term holders.

Also, the pattern of accumulation is consistent with the notion that institutional participants are gradually accumulating. Despite fragile short-term retail sentiment, large wallets look confident about Bitcoin’s medium- to long-term outlook.

Capital Inflows Remain Strong Though Demand Growth Slows

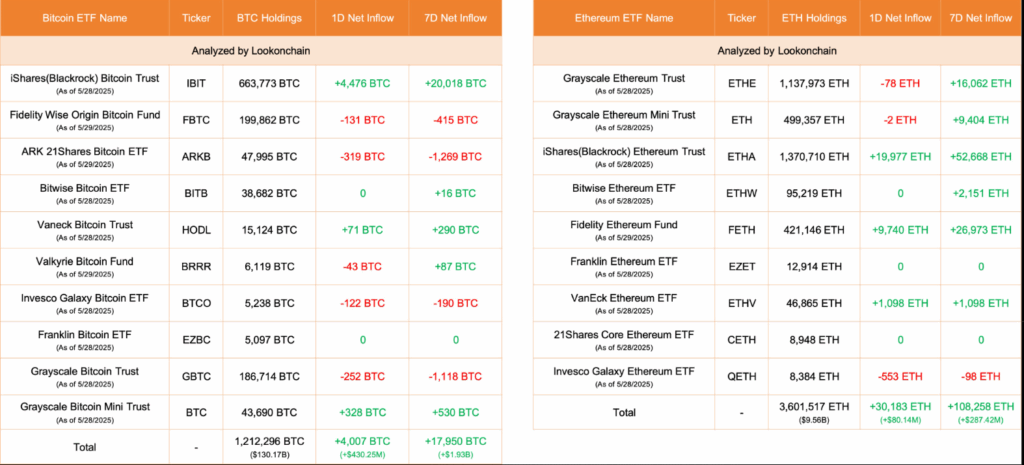

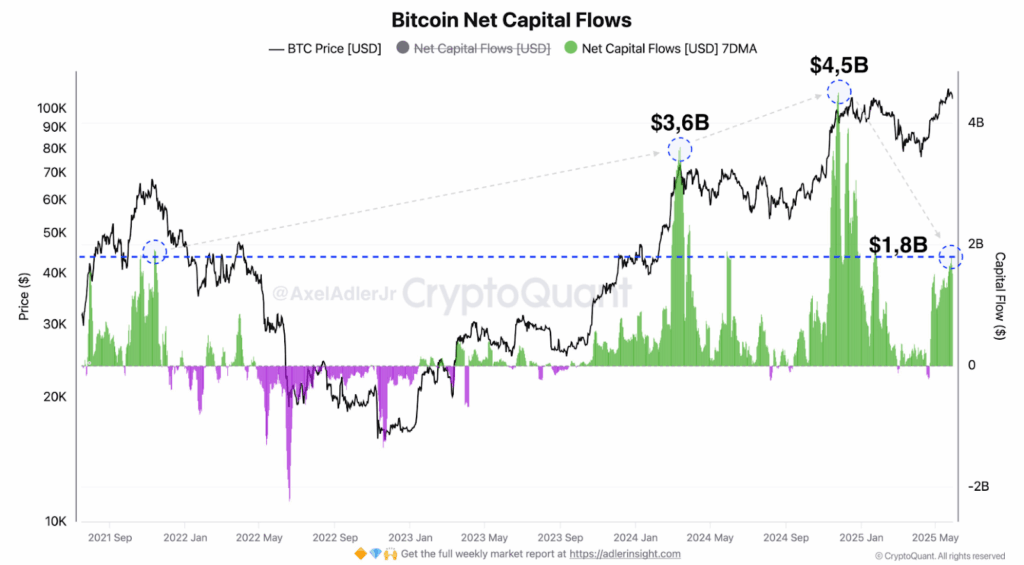

Demand growth has slowed, but overall capital inflows into Bitcoin are historically robust. The network saw an average of $1.8 billion in net capital flow per day, a level last seen during the 2021 bull run when Bitcoin was priced around $64,000. There was no sign of a structural retreat in these inflows, which reinforce overall resilience.

Looking at historical data, we see that peak capital inflows were $3.6 billion at $73,000 and $4.5 billion at $92,000 in earlier phases of this cycle.

With current levels now holding firm near $1.8 billion, the market is consolidating strength after rapid expansions. But metrics show the rate at which demand is growing is starting to slow.

From December 2024 to May 2025, Bitcoin’s 30-day apparent demand fell from 279,000 BTC to about 229,000 BTC. This is still positive, but the decline suggests that investor appetite is starting to slow a bit.

Whale holdings also grew by 2.8% this month, the same rate seen before previous local tops, which has led some to ask if another consolidation phase is coming.

Despite this, price structure is still intact, backed by capital inflows, whale activity, and key technical patterns. So long as the ascending trend channel holds, major holders are keeping Bitcoin’s downside risks in check.