Key Insights

- Sei price prediction eyes $0.34 as price holds rising channel structure.

- SEI/USD trades at $0.2454 and may reach $0.34 if rising price channel holds.

- Sei Giga upgrade boosts speed to 200K TPS, driving new user and developer activity.

Sei price prediction gained momentum as SEI/USD moved steadily within a rising parallel channel. At the same time, Sei topped EVM-compatible chains in address growth, with 1.6 million active addresses and a 101% surge in user activity. These factors, combined with protocol upgrades, are fueling bullish sentiment around SEI.

The token traded at $0.2454 during writing and may reach $0.34 if the current structure holds. Technical indicators and on-chain growth are reinforcing this outlook.

Sei Leads in Active Address Growth as Activity Surges

Sei has the greatest number of active address changes among all EVM-compatible chains, according to new data on the blockchain.

At present, there are 1,688,653 active addresses on the network and the number increased by 101% during the observed period. As a result, Sei is now ahead of Polygon, Ethereum and Ronin in terms of percentage growth.

Polygon and Ethereum are the top two, with 2.22 million and 2.25 million addresses each. Still, Sei’s quicker development reflects more people using the network and putting extra demand on it.

Other major players, Viction and Gravity, experienced high growth rates too, but their volumes were much lower than those of Sei.

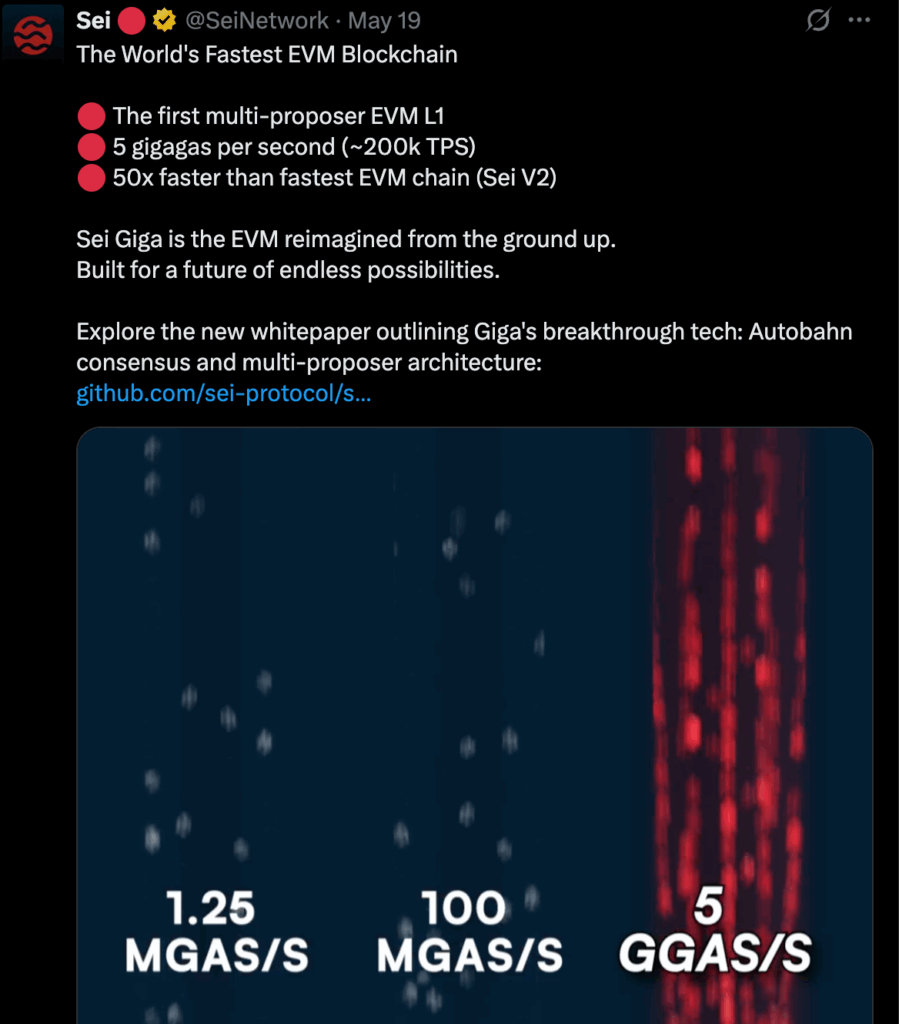

Sei Giga and DeFi Ecosystem Drive Network Expansion

The rise in activity is partly due to the recent introduction of Sei Giga. The new version of the protocol launched the first EVM Layer 1 that uses parallel processing and Autobahn BFT consensus, with multiple proposers.

Sei Labs claims that Sei Giga can perform 5 gigagas of transactions each second, which is about 200,000 transactions per second.

Sei is now 50 times faster than it was in the previous version, Sei v2. It also provides a 400-millisecond block finality which helps make perpetuals and AMMs function more efficiently.

Consequently, Sei is drawing interest from both developers and traders who want faster completion of their transactions.

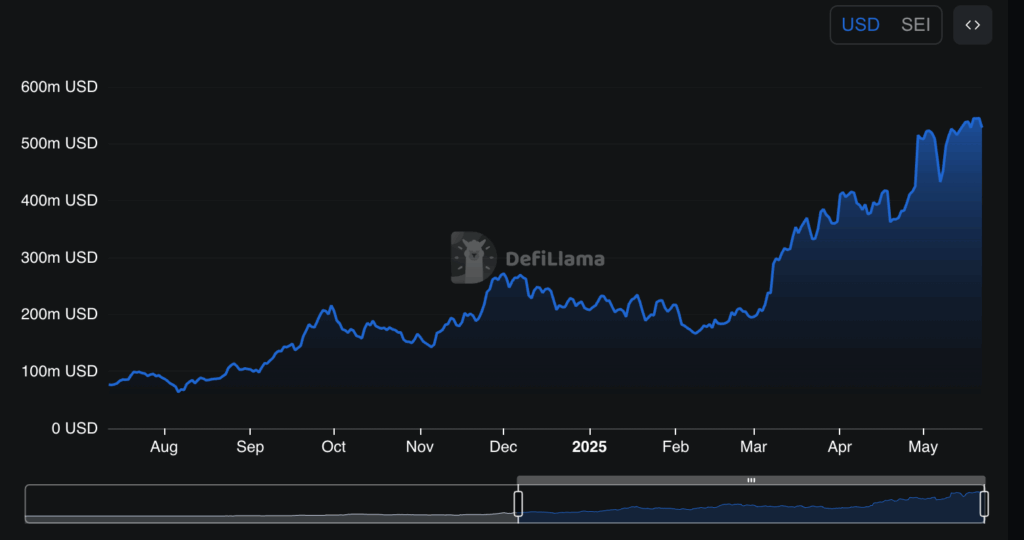

Moreover, TVL has experienced the same trend. Sei’s total value locked (TVL) is reported by DeFiLlama to be $527.93 million, which is 3.1% lower than the past day.

The company earns $8,110 a day from apps and $167 from chain sales. TVL is still very high, indicating that the ecosystem is being used and adopted more widely.

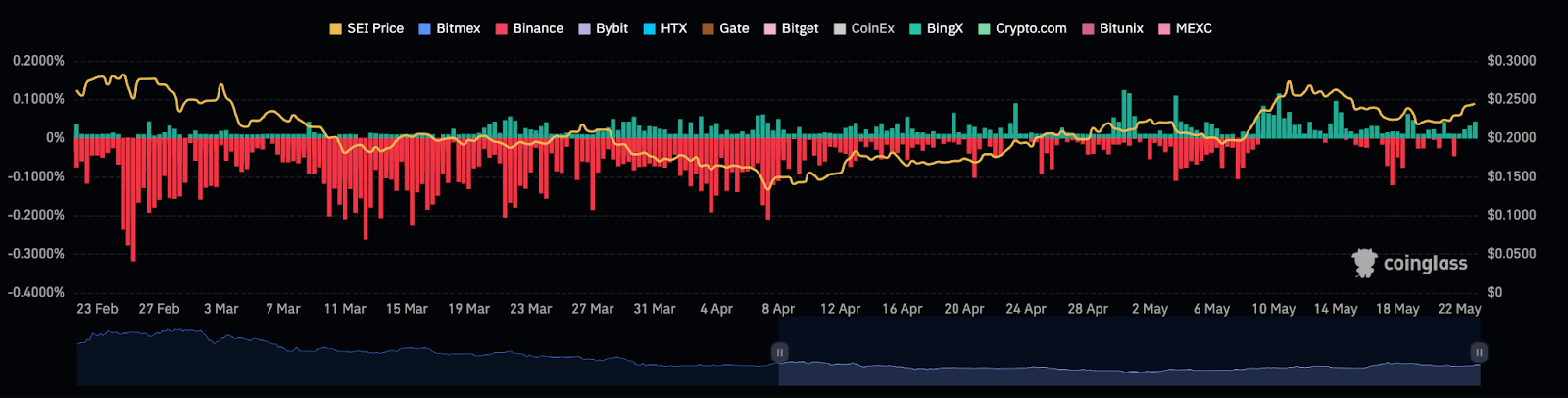

The trading of SEI futures has led to greater activity in the funding rates on most exchanges. According to Coinglass, after a period of negative funding rates on Binance and other exchanges from February to mid-April, May saw the rates become more positive.

It seems that traders are increasing their long interest, as they are willing to pay more to hold SEI positions, which have risen from $0.13 to $0.24.

SEI/USD Chart Structure Aligns With Bullish Sei Price Prediction

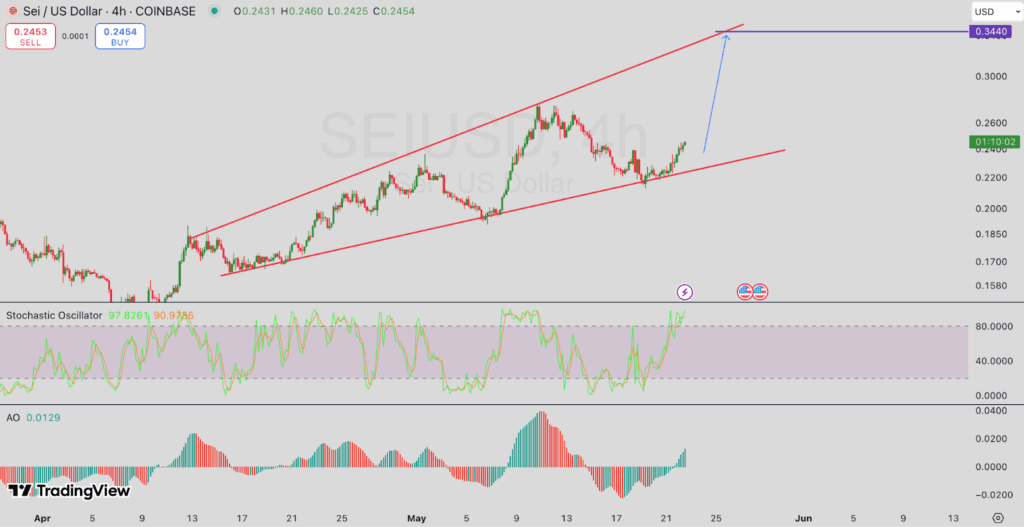

According to the SEI/USD 4-hour chart, the token is moving inside a rising parallel channel. As of writing, SEI is trading at $0.2454.

Since early April, the structure has stayed the same and if the channel holds, the next short-term goal is $0.3440 due to resistance at the upper trendline.

The market is considered overbought because the Stochastic Oscillator is above 97. However, it is showing strength because green bars are visible on the Awesome Oscillator. There has been little change in volume over the past week, which points to steady accumulation.

Fundamentals Could Set Stage for All-Time High Revisit

Sei reached its all-time high around $1.30. While current price action remains far from that peak, the combination of bullish on-chain metrics, consistent trading patterns, and upgraded network performance is renewing talk of an eventual breakout.

Open interest and funding rate trends show increasing trader conviction. As DeFi activity rises and new users join the network, SEI may attract more institutional and retail attention.

For now, the market remains focused on whether the rising channel will deliver a breakout toward the projected $0.34 zone. If so, the sei price prediction narrative could expand beyond short-term resistance and open room for retesting longer-term highs.