Key Insights:

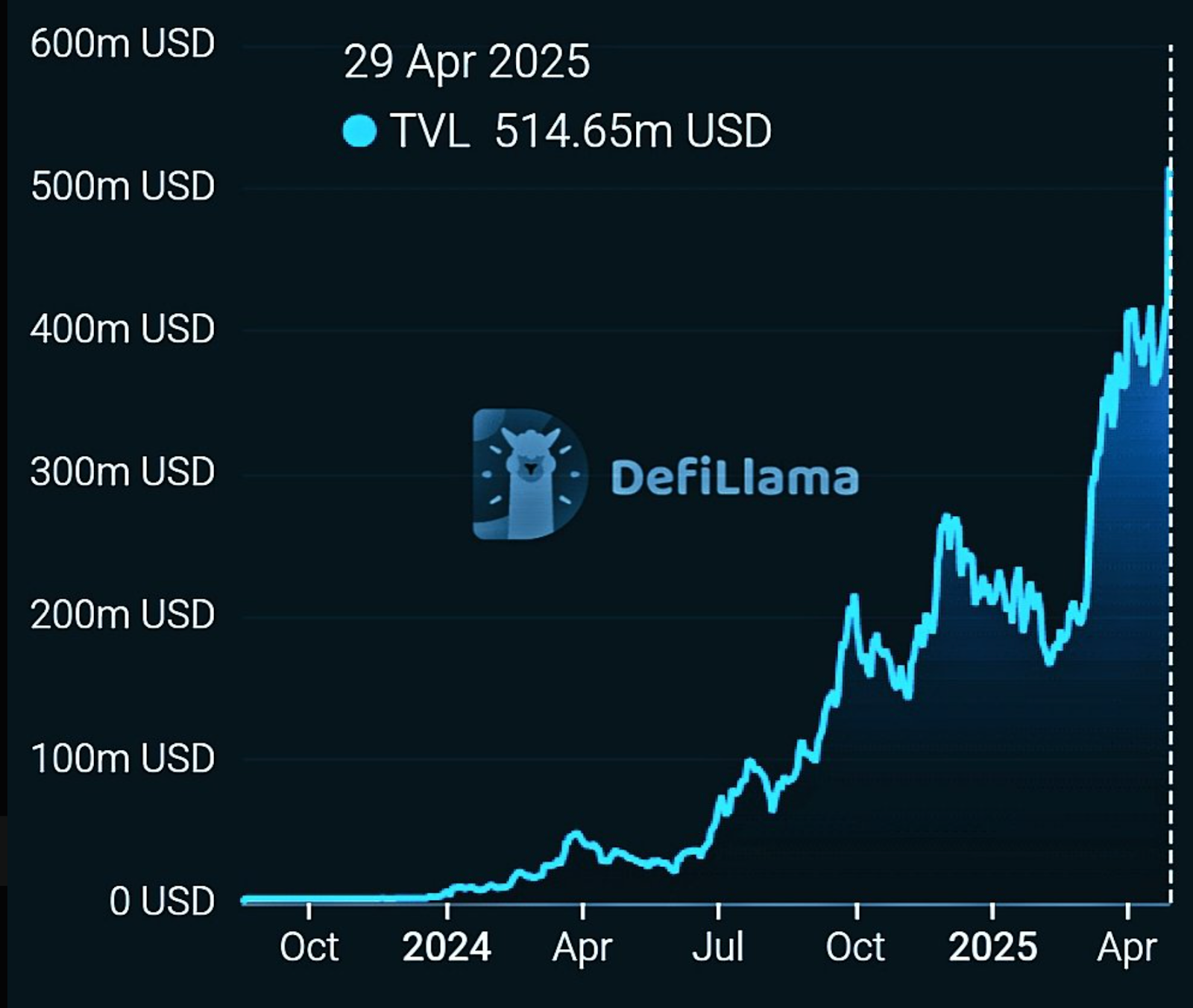

- Sei Network’s TVL hits an all-time high of $514M, up 300% in 60 days.

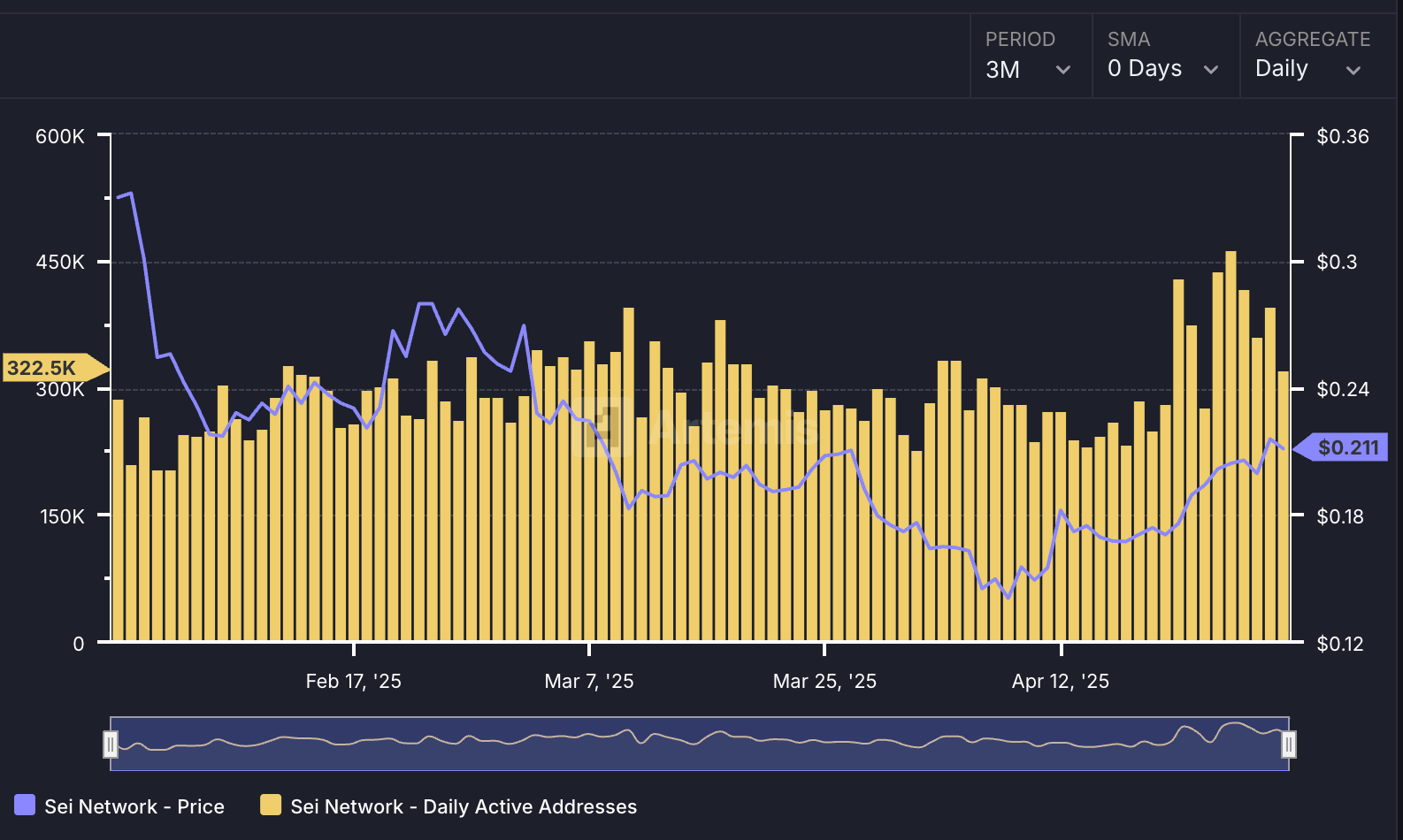

- Active addresses remain above 200K, peaking at 465K on April 25.

- Open Interest rebounds as SEI climbs 50% from April lows, signalling renewed confidence.

The Total Value Locked (TVL) on Sei Network is heating up, passing $500 million, and daily user activity is still strong.

As performance-focused infrastructure continues to drive demand and utility, the network is getting renewed attention from DeFi users, as well as AI and DeSci developers.

Total Value Locked Hits All-Time High

Sei Network has officially hit an all-time high of over $500 million in Total Value Locked (TVL).

This is a major rise from under $10 Million that was recorded just a year ago.

In the past 60 days alone, TVL on Sei has grown by 300%, indicating strong capital inflow into the ecosystem.

Although TVL has hit new highs, the SEI token price is still far below its previous all-time high. According to DefiLlama, at press time, SEI was trading at around $0.21, nearly 80% down from its all-time high.

The rising TVL and relatively lower price, however, indicate that users are putting capital into the network faster than the token price is rising.

And sometimes this divergence can suggest long-term user trust and platform stickiness.

Daily Activity Shows Growth and User Retention

However, Sei Network’s daily active addresses have been strong over the last three months.

The network has always had more than 200,000 addresses, indicating that the network is in use. Active users grew steadily from mid-April, reaching around 465,000 on April 25.

Since then, activity has dipped slightly, but the overall trend is still positive. The network is not only attracting capital, but it is also keeping users and keeping them active over time with sustained high address activity and TVL growth.

This is important for network health as it implies that applications are being used and not just holding locked assets.

Moreover, Sei’s ongoing momentum gets another layer from futures market data. The Open Interest, which measures the total value of outstanding futures contracts, peaked at over $300 Million in December 2024.

For months, it declined, reaching near $65 Million by March 2025. But the rebound was clear in early April.

As of writing, Open Interest has recovered to above $100 Million. This rebound occurs at the same time as a price increase in SEI, which went from under $0.15 to over $0.20.

In this alignment, we see that traders are beginning to reenter the market, probably in anticipation of more price movement or more activity. It also implies better confidence in SEI’s short-term direction.

Strong Use Case in AI and DeSci Pushes Interest

Moreover, SEI has once again become the focus of renewed attention because it plays a role in AI-driven infrastructure.

SEI is the third-highest ranked AI-focused crypto asset on DappRadar, behind only NEAR Protocol and Fetch.ai. The ranking is based on both its technical capacity and growing adoption.

SEI’s infrastructure is built to deal with high workloads and low latency, a good fit for AI applications.

It can scale large datasets and real-time processing as it supports multithreaded execution and fast block times.

The performance advantages of SEI are why developers building AI-powered apps are increasingly turning to SEI.

SEI has also taken steps in the decentralised science (DeSci) space to support innovation. The Sei Foundation launched a $65 Million venture fund, Sapien Capital, to back DeSci startups in January 2025.

This fund is in wearable health technology, gamified drug discovery, and secure health data platforms.

The aim is to empower users to have more control over their personal data and move forward with personalised medicine with blockchain tools.

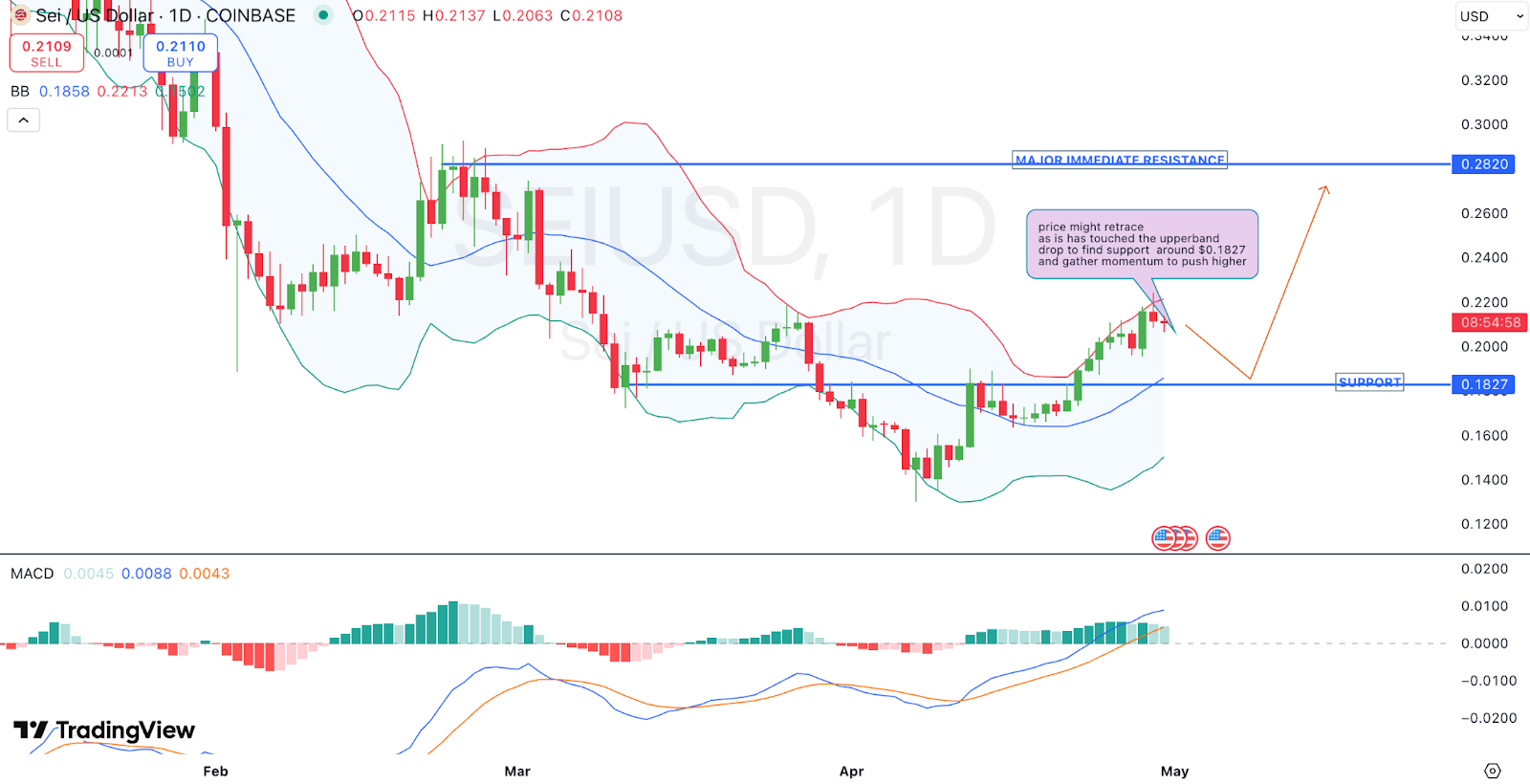

Key Technical Levels and Price Outlook

SEI had recently touched the upper Bollinger Band. $0.2820 is the nearest resistance, which can be a price ceiling unless strong momentum breaks through.

However, if the price is rejected, it could fall back to test support around $0.1827 and bounce to restart the trend.

The early convergence of the MACD indicator indicates that price momentum is still alive but might take a pause or consolidation before the next move.

The network fundamentals are still improving, and traders are watching this zone closely for a clearer signal.

With TVL still climbing and new sectors like AI and DeSci gaining developer and investor interest, the outlook for SEI is still on real-world use cases and on chain activity, not just short-term speculation.