Key Insights:

- After a 7% drop over two days, the meme coin has landed at a crucial support level, hinting potential bullish reversal.

- If TRUMP remains above $8.50, it could rally over 10% toward $9.55. A breakdown below this level could trigger a 14% drop.

- A well-known crypto analyst on X suggests a breakout toward $15 is imminent.

After two consecutive days of red candles and a 7% price drop, TRUMP crypto has officially landed at its key support level of $8.50. Since April 2025, this is the second time the meme coin has reached this level.

Previously, when the asset price hit this level, it recorded an upward momentum — a pattern that experts and analysts are expecting to repeat this time as well.

Expert Bold Prediction for TRUMP Crypto

Recently, a crypto expert made a bold prediction that surfaced on X (formerly Twitter). In the post, the expert noted that TRUMP crypto is gaining serious momentum at the $8 level, and a breakout toward $15 looks imminent.

This bold prediction has gained massive attention from crypto enthusiasts and is spreading like wildfire.

At press time, TRUMP crypto stands at $8.60 and has recorded a modest price dip of over 1.25% in the past 24 hours. During this period, participation from investors and traders also declined, resulting in a massive 30% drop in trading volume compared to the previous day.

This drop in trading volume, along with the price decline, suggests weak downside momentum, indicating that selling pressure may be fading and a potential price reversal or consolidation could be on the horizon.

TRUMP Crypto Price Action and Key Technical Levels

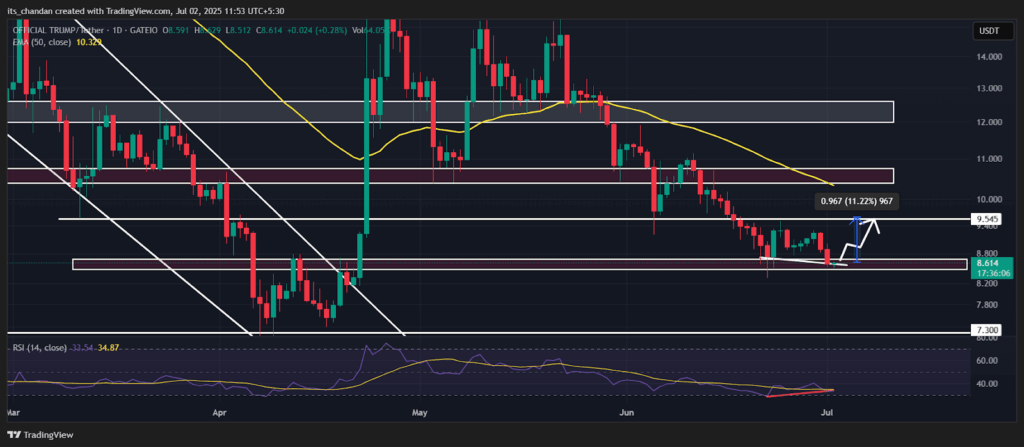

According to expert technical analysis, TRUMP crypto appears bullish and may record impressive upside momentum. The daily chart reveals that the meme coin has been forming a bullish double bottom pattern at a key support level of $8.50, which has a history of price reversals.

Additionally, during this period of consistent support, TRUMP crypto’s Relative Strength Index (RSI) has been making higher highs, indicating a bullish divergence — a sign of potential upside momentum. However, there is a catch.

Based on recent price action and historical patterns, if TRUMP crypto maintains its position above the $8.50 level, there is a strong possibility that history could repeat itself and the price could see an upside momentum of over 10%, potentially reaching the $9.55 level.

On the other hand, if TRUMP crypto fails to hold this level and falls below $8.50, the asset could experience a price drop of up to 14% in the near future.

At press time, the meme coin is trading below the 50-day Exponential Moving Average (EMA), indicating a bearish trend and suggesting that selling pressure may persist in the near term.

Bullish On-Chain Metrics

Given the current market sentiment, investors and long-term holders have been accumulating the meme coin and seizing the recent dip as an opportunity, according to on-chain analytics firm CoinGlass.

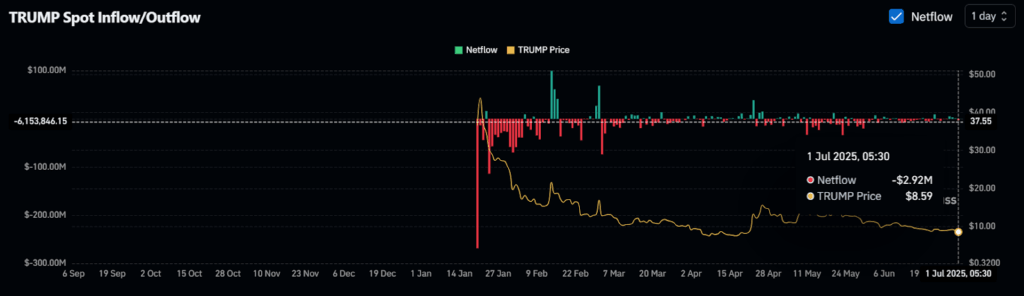

Data from spot inflow/outflow reveals that exchanges across the crypto landscape have witnessed an outflow of $2.92 million worth of TRUMP meme coin.

This substantial outflow, given the current market structure, suggests potential accumulation and could lead to increased buying pressure and further upside momentum.

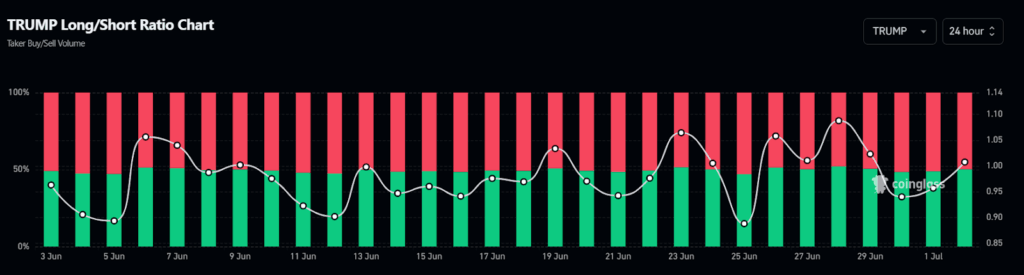

At press time, the TRUMP Long/Short ratio stood at 1, indicating strong bullish sentiment among traders.

The data reveals that this is the third consecutive day the TRUMP Long/Short ratio has increased — previously recorded at 0.94 and 0.95 — showing that traders’ interest in the meme coin is shifting toward the bullish side.

When combining this on-chain metric with technical analysis and expert bullish views, it appears that the bulls are back to propel the meme coin.

It also suggests that the bulls are currently in control, with no signs of selling pressure evident for TRUMP crypto at the moment.