Key Insights:

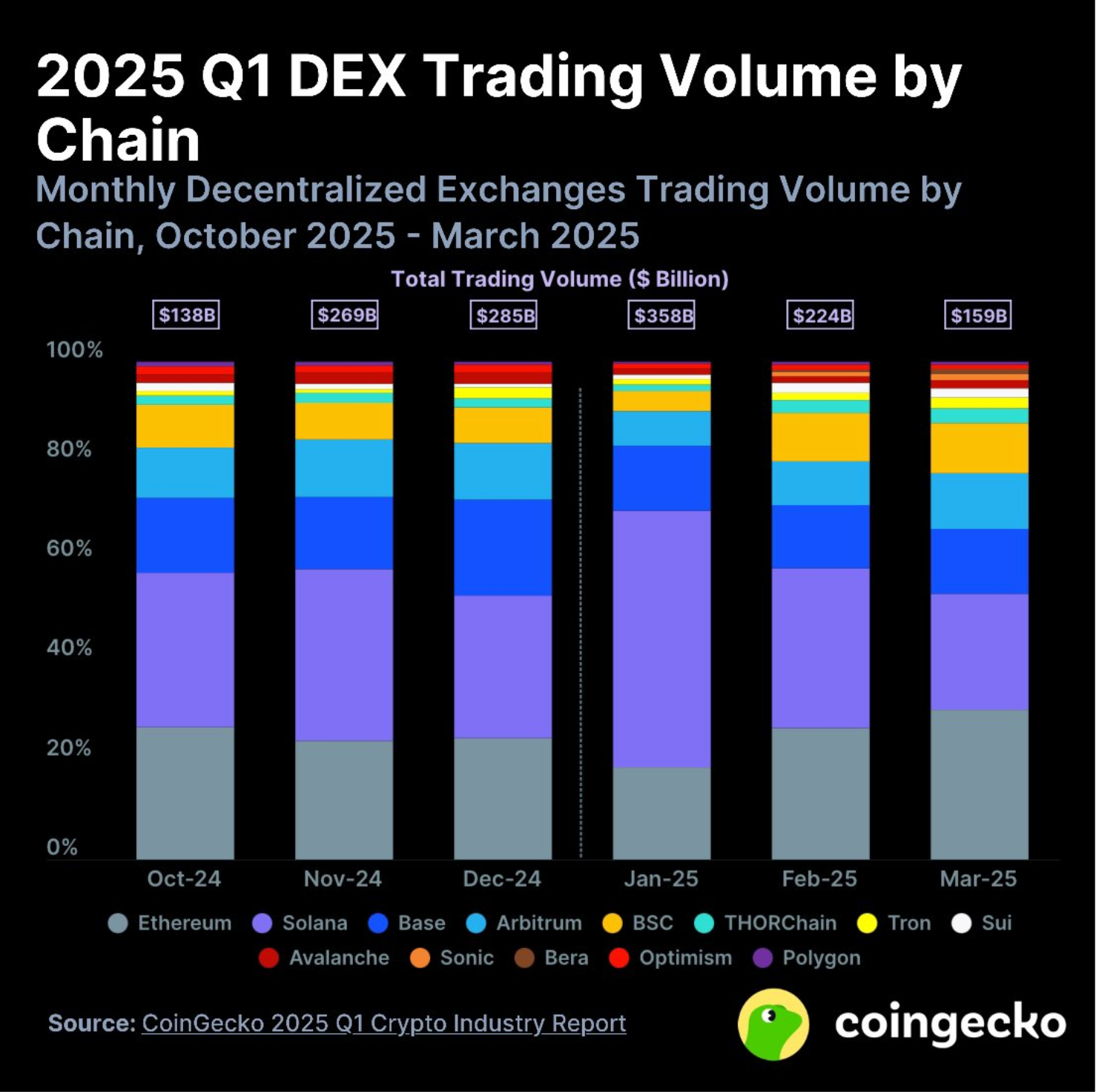

- Solana handled over $293.7B in Q1 2025 DEX volume, securing a 39.6% market share.

- Solana DEXs like Orca and Meteora beat rivals with faster speeds and lower fees.

- Network averaged 4,500–4,900 TPS with fees under $0.001 during high-volume periods.

In Q1 2025, Solana became the most used blockchain for decentralized exchange activity, accounting for nearly 40% of the market. Solana is redefining the DEX landscape with over $293 billion in trading volume, fast transaction speeds, and ultra-low fees.

Solana Leads Q1 DEX Market With $293.7B in Volume

Solana led the decentralized exchange (DEX) trading activities in Q1 2025, accounting for $293.7 billion in total volume. CoinGecko’s Q1 2025 Crypto Industry Report shows Solana accounted for 39.6% of all DEX trades in Q1.

In January 2025, Solana’s dominance became more visible when it represented 52% of total DEX volume. The trading volume across all chains reached $358 billion that month alone.

This sharp increase was due to the TRUMP meme coin, which caused high-frequency trading across Solana-based platforms. During February and March, Solana maintained its lead in trading volume over Ethereum and BNB Chain.

Both chains remained active but couldn’t match Solana’s dominance. Solana continued to dominate, as trading volume cooled slightly across the board. This further cemented its reputation as a high-performance chain for fast-moving market segments.

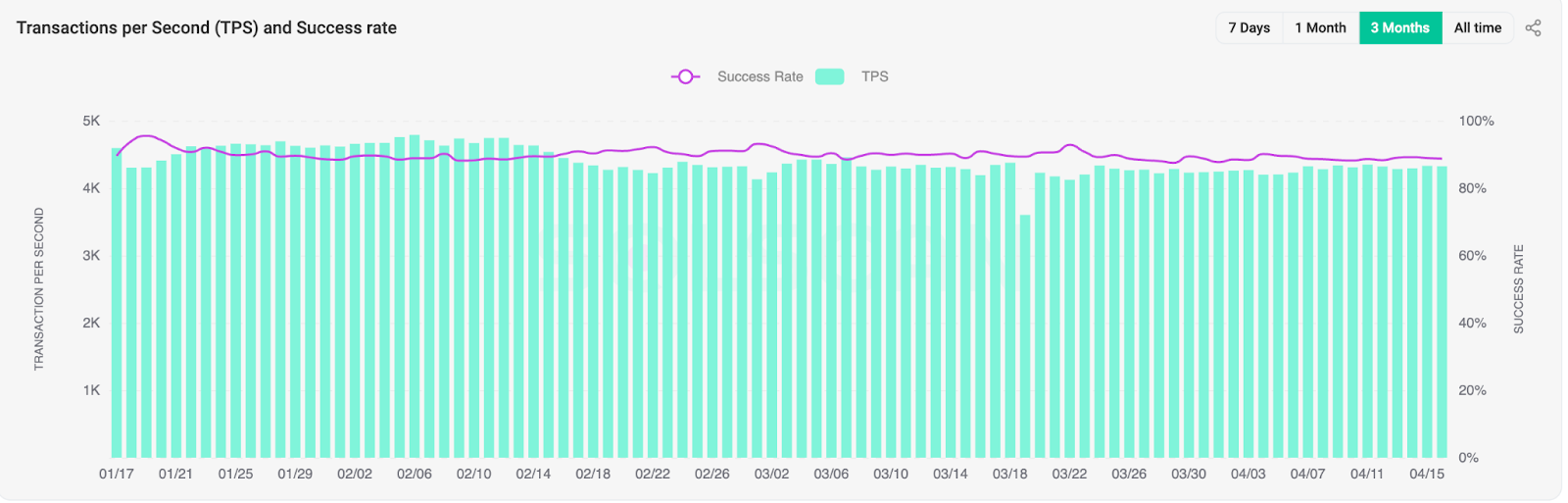

High TPS and Network Stability Support Solana’s Position

One of the reasons Solana is attractive is that its network can process many transactions without slowing down. For three consecutive months, the blockchain maintained a steady processing rate of 4,500 to 4,900 transactions per second (TPS).

This consistency underscores its reliability, even during periods of high activity. This metric remained constant even during peak periods when trading volume spiked.

Meanwhile, Solana’s transaction success rate ranged between 85% and 90%. This indicated a stable and resilient infrastructure. Many blockchains fail or delay transactions during network congestion.

Unlike Solana, however, most transactions have flowed smoothly. Fast settlement times make throughput and reliability crucial for users.

This ensures their transactions are completed efficiently without delays. It’s also useful for developers who want a stable base layer to build trading applications and automated protocols on top of.

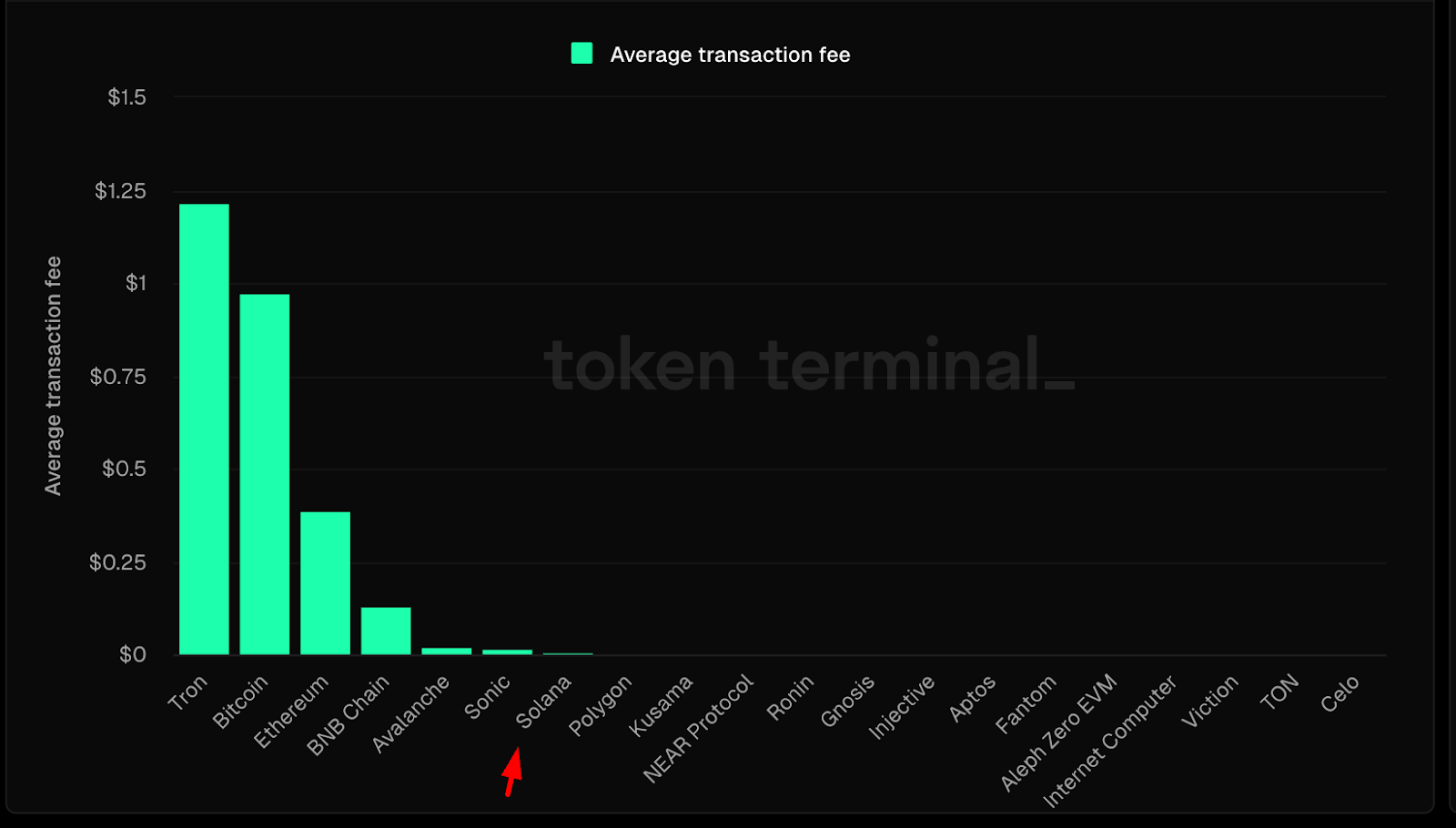

Ultra-Low Fees Give Solana an Edge

Solana’s DEX dominance is also due to its cost efficiency. Solana’s average transaction fee is relatively low compared to the rest of the industry.

According to data from Token Terminal, Solana’s average transaction cost is much lower than that of Ethereum, Bitcoin, and BNB Chain.

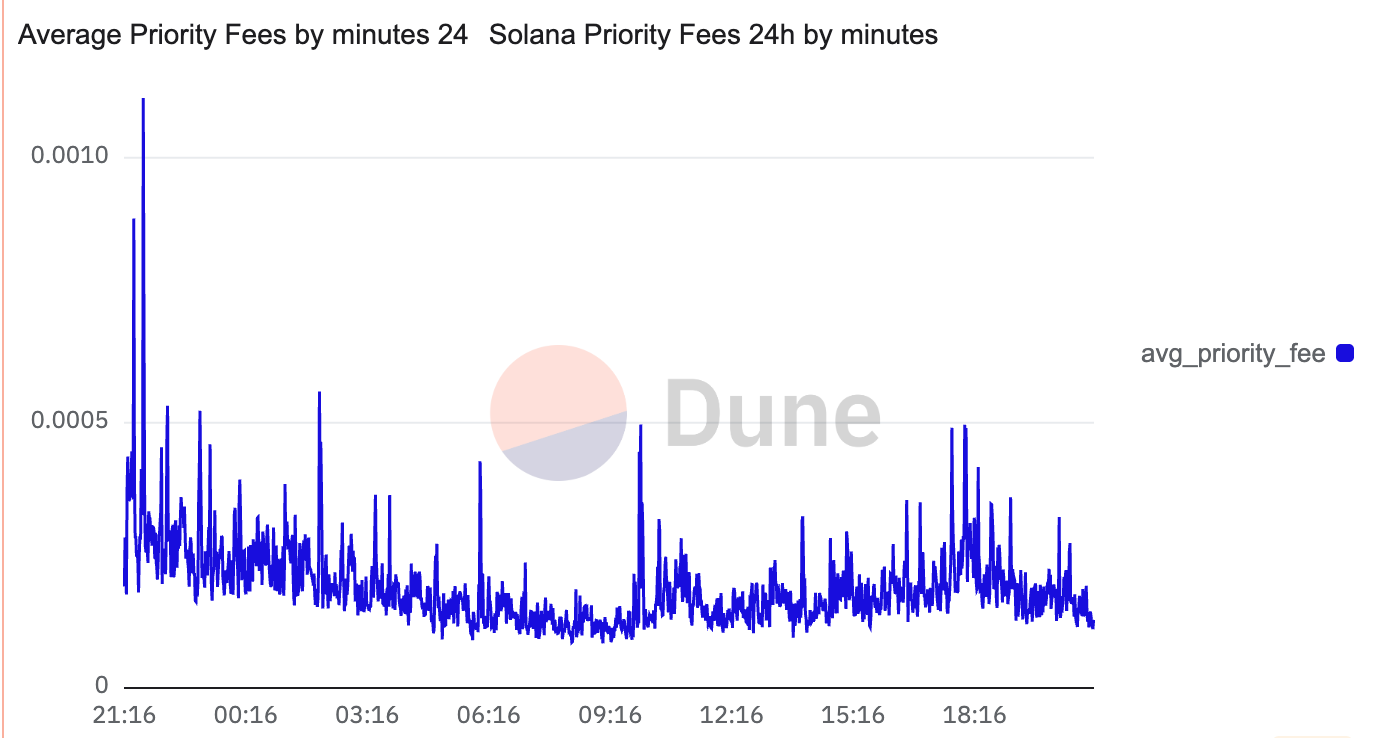

Bitcoin’s fees are just above that, while Ethereum’s are around $1 on average. Solana, by comparison, charges a fraction of a cent per transaction. According to 24-hour Dune Analytics data, Solana’s priority fees rarely exceed $0.001, even during periods of higher activity.

The affordability also benefits the smaller traders and frequent transactions. Users can engage more often without worrying about cost by paying large fees for each swap or transfer.

This is why memecoin traders, NFT users, and DeFi participants who need to interact with the blockchain often find Solana appealing.

Developers subsidize transactions to improve user experience, and fee efficiency impacts them. Deploying on Solana allows them to decrease operating costs and make it easier to onboard.

Solana-Based DEXs Gain Traction

The rise of Solana’s trading volume is also related to the growth of its native decentralized exchanges. Orca is the number one DEX with $693 million in 24-hour trading volume. It has a 12.5% market share, more than Ethereum’s Uniswap V3’s $655 million.

Meteora, another Solana-native DEX, holds the third position globally with $441 million in daily volume. It supports over 2,300 trading pairs and has experienced a spike in interest in the $TRUMP/EPJFWD pair. It saw almost $94 million in trading.

These Solana DEXs offer access to memecoins and new tokens unavailable on Ethereum or BSC. This, combined with lower fees and faster speeds, makes them highly appealing to users.

They also have user-friendly interfaces and integrate with Solana wallets like Phantom, which attracts a growing retail user base.

These platforms continue to see user traffic increase. For instance, Orca recorded more than 580,000 monthly visits. Although Ethereum’s Uniswap still dominates monthly traffic with over 6.8 million visits, Solana’s platforms are catching up fast.

Strong Fundamentals Drive Continued Interest

In 2025, Solana gained significant attention for its low fees, impressive throughput, and rapid DEX growth. This combination cemented its position as a leading blockchain platform. Developers and traders use Solana not only for savings but also for the performance benefits it offers.

Solana’s infrastructure has also been shown to be scalable enough to cover trading spikes, especially during the memecoin rushes. This lets the network handle thousands of transactions per second without degrading performance.

This makes for a smoother experience even when the network is under stress. The network has firmly established itself as a leading layer one chain for DeFi. Its appeal comes from projects launching directly on Solana and users preferring its cost-effective and faster alternatives.