Key Insights:

- Solana is trading near $151 and shows strong signs of a potential major breakout, supported by growing momentum.

- Analysts confirm that Solana has formed a bullish cup-and-handle pattern on the weekly chart since late 2021.

- Solana is currently consolidating just below critical resistance levels around $153.65 with a possible rally toward $180.

Solana (SOL) shows strong signs of a potential major breakout after consolidating within a critical price range.

The cryptocurrency trades near $151, reflecting increased interest from large firms and positive technical patterns.

With growing momentum and significant capital inflows, market conditions are setting up an important move for Solana.

SOL Forms Bullish Cup-and-Handle Pattern

Analysts have noted that Solana has been quietly forming a classic cup-and-handle pattern on the weekly chart since late 2021.

SOL is now at the handle phase while maintaining position at critical resistance levels, which stand at $153.65.

Professional analysts read this pattern as a potential indicator of robust bullish momentum, which would translate into a breakaway movement for SOL.

Crypto trader Kamil observed a significant rise in Solana’s Social Volume metrics, which points to growing community engagement.

Growing internet interest supports the likelihood of an extended price increase because the pattern has emerged during this period.

The analysts predict SOL will begin an upward climb from its current price range towards $180 if its price breaks above $153.65.

According to Ali Martinez, the current technical features of Solana’s price chart remain intact during its current price movements.

Despite its recent price reduction, SOL’s broader bullish trend pattern continues strong since selling pressure has remained unsuccessful.

Positive momentum indicators support the view that Solana could soon transition into a strong upward trend.

Solana Attracts Heavy Investments From Firms

Several major investment firms have recently committed significant capital to the Solana ecosystem, reinforcing its growth prospects.

GSR led a $100 Million private investment into UPEXI to develop a Solana-based treasury management system.

Astra Fintech also launched a $100 Million fund focused exclusively on supporting innovations within Solana.

Meanwhile, Galaxy Digital completed a careful $100 Million swap from Ethereum into Solana over two weeks using Binance channels.

The systematic buildup of Solana shows lasting organizational dedication, even though it excludes speculations about instant profits.

The accumulation underscores growing trust in Solana’s fundamentals among prominent financial players.

SOL Strategies obtained up to $500 Million through a funding agreement with ATW Partners for acquiring SOL tokens dedicated to stakeholding activities.

RockawayX announced a $125 Million fund supporting developers building within the Solana ecosystem.

Together, these investments represent a strong signal of institutional belief in Solana’s future and technology.

Solana Maintains Support Above Key Averages

On April 28, 2025, Solana closed at $147.43, posting a minor loss of 0.41% compared to the previous day.

While registering a small drop, the asset holds positions above all three exponential moving averages at 20, 50, and 100 days, indicating intermediate power.

The price of SOL is below its important 200-day EMA resistance, which currently sits at $162.51. A Relative Strength Index (RSI) value of 59.98 signals a bullish trend, less than overbought levels.

A positive crossover in the Moving Average Convergence Divergence (MACD) indicator verifies increasing buying strength beneath the market.

The way these indicators combine shows that extended market indicators predict upward price movement, yet traders must contend with the present-day volatility.

Liquidation data on CoinGlass reveals neutral behavior between long and short positions, as no substantial liquidation activities have occurred recently.

The current levels of total liquidations sit below what the markets experienced when they reached $300 in February.

Derivative market stability suggests better trading conditions, reducing the possibility of rapid price drops.

Spot Market Activity Suggests Steady Sentiment

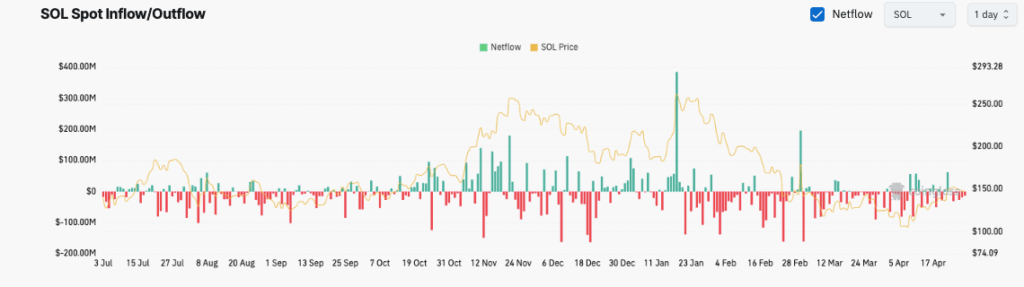

According to updated CoinGlass data, Solana’s spot market inflows and outflows have stabilized over the past week.

The consistent outflows that occurred from February to March 2025 led to a drastic decline in SOL price.

The latest trading sessions show reduced movements in the spot market, which indicates a stabilizing trading environment.

Investors are trading Solana between $145 and $150 since buying and selling activities remain in equilibrium.

The market’s level behavior during this period is completely different from previous months, when price fluctuations ran rampant with changing influxes and outflows.

The spot markets exhibit decreased volatility alongside moderate liquidation levels, creating a healthier marketplace.