Key Insights:

- SEC may approve Solana ETFs within 3-5 weeks, boosting institutional access to Solana assets.

- Staking features in Solana ETFs could attract investors seeking rewards and exposure.

- Solana’s price surge toward $300 possible as SEC nears ETF approval, testing key resistance levels.

Solana (SOL) is showing signs of a major price surge, with some analysts predicting a potential rally to $300. This optimism stems from recent developments regarding Solana Exchange-Traded Funds (ETFs).

The U.S. Securities and Exchange Commission (SEC) has requested amendments to the S-1 forms from Solana ETF issuers, which could pave the way for approval in the coming weeks.

These updates bring Solana one step closer to being integrated into mainstream financial products, which may positively influence the altcoin’s price.

SEC Requests Amendments for Solana ETF Approval

The SEC’s recent request for Solana ETF issuers to amend their S-1 forms signals a potential acceleration in the approval process. This amendment includes key updates such as in-kind redemptions and staking features.

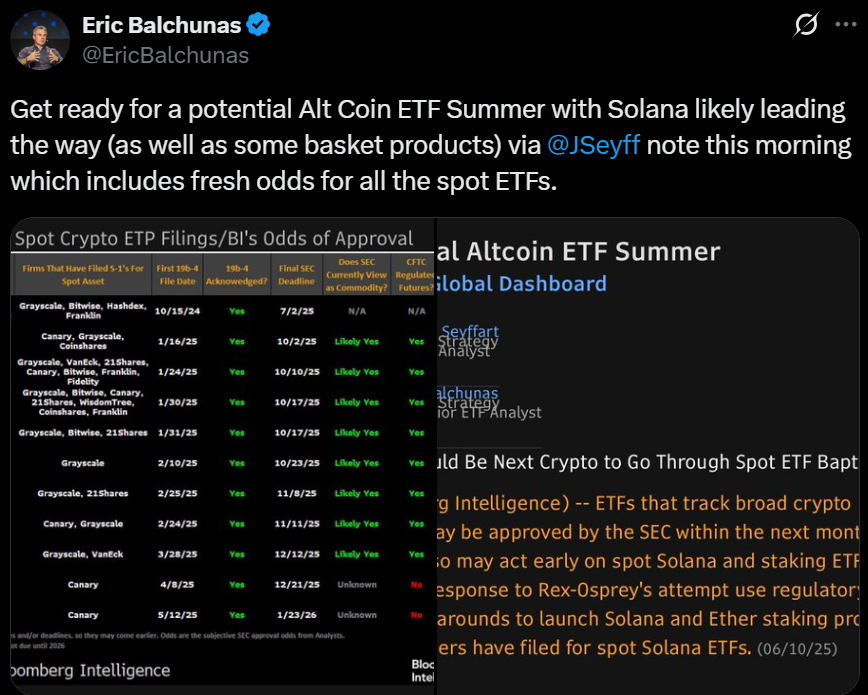

According to Bloomberg analyst James Seyffart, the SEC’s actions indicate a shift toward faster approval of Solana ETFs, possibly within the next few weeks.

If approved, Solana ETFs could be available to institutional investors sooner than expected, marking a significant step for the cryptocurrency.

The inclusion of staking in these ETFs is especially important, as it ties into Solana’s core network function.

Staking allows investors to lock their tokens, secure the blockchain, and earn rewards in return. This feature could attract more investors, enhancing demand for Solana and potentially driving its price upward.

If Solana ETFs are approved, it could spark further interest in the altcoin market, with other cryptocurrencies possibly following Solana’s path toward similar regulatory approvals.

Potential Solana ETF Approval Timeline

Solana ETFs would be the first to bring a regulated and secure means of institutional investors to gain exposure to Solana, unlike Bitcoin ETFs, which have already received widespread attention. This would pave the way to increased institutional involvement in the altcoin market.

According to Bloomberg analyst James Seyffart, the SEC may give a green light to Solana ETFs in a period of three to five weeks, but a final ruling may take longer.

The attention of the regulatory body to Solana and staking ETFs improves the chances of quicker approval. Should these ETFs be accepted, they would become the first altcoin ETF that institutions could invest in within the U.S., which could bring heavy altcoin interest to Solana.

The listing of Solana ETFs is likely to lead to the wider adoption of cryptocurrencies in the traditional financial system.

Staking Integration Boosts Solana ETFs’ Appeal to Investors

The proposed Solana ETFs will be a major feature because they will include staking that enables investors to receive rewards without taking any action. The action is an indication of the increased receptiveness of staking in crypto-related financial products by the SEC.

Staking is now an important process in the Solana blockchain, and it offers security and incentives to participants. The SEC is reversing its approach to crypto regulation by permitting staking in the ETFs.

Marinade Finance, a leading staking provider, has been chosen as the sole staking partner of the Canary Marinade Solana ETF, the first Solana ETF available in the U.S to feature staking.

The growth creates additional attractiveness among investors who want to gain exposure to Solana through financial products and get rewards.

This indication of flexibility in approach to regulation given by the SEC in allowing staking integration indicates a possibility of wider progress in other crypto assets, should high-growth projects such as Solana be allowed to pioneer the way.

Solana Price Poised for Surge: $300 Target in Sight

The price of Solana has been displaying bullish signs following a recent decrease in its value, generating a bullish pattern, which indicates a possible breakout. The price had zoomed up since April low of $95 to a high of $184, forming a bull flag pattern.

The pullback of the flag was formed by a decline of 23% towards the end of May to a low of $141 and Solana is currently testing a breakout of the flag resistance level and the price is trading at around $160.

The technicals are indicating a bullish setup. The Moving Average Convergence Divergence (MACD) has presented a buy signal, and should Solana manage to break and close above the $160 resistance level and construct three strong candlesticks, it may commence a rise to a fresh all-time high of $300.

However, the Relative Strength Index (RSI) is yet to break the 50 level, indicating that the bears have not lost all control. The bullish trend would be confirmed and aid the price explosion in case of a decisive close above 50 on the RSI.

Provided that it maintains the current momentum and manages to overcome major resistance areas, Solana may experience a massive bull run, with $300 being a possible target in the short term. As the price action continues to unfold, investors will be waiting to be confirmed by the technical indicators.