Key Insights :

- Galaxy Digital sold $105 million worth of Ethereum and purchased $98 million in Solana, signaling a strong shift in market focus.

- The firm transferred 65,600 ETH to Binance and withdrew 752,240 SOL, reflecting high confidence in Solana’s future performance.

- A crypto whale who had previously sold large amounts of SOL returned to the market. They boldly purchased $52.78 million for $141 per SOL.

Solana price surged as market activity intensified following Galaxy Digital’s $105 million Ethereum shift. The firm used the funds to buy $98 million worth of SOL, fueling bullish momentum.

On-chain movements and whale re-entry into the market further boosted confidence in Solana’s short-term upside potential. However, bearish signals on the SOL/BTC pair present challenges for sustained outperformance against Bitcoin.

Solana Price Eyes $200 Amid Positive Trends

About 374,161 SOL came into the possession of an active whale, who first sold 451,594 SOL during April. After initially disposing of SOL assets in April, the whale invested $52.78 million in SOL by purchasing it at $141.

This change suggests renewed optimism and confidence in Solana’s near-term price performance. Fresh SOL wallet activity demonstrates bullish price expectations because a new wallet has staked more than 44,116 SOL tokens.

Reducing supply and strengthening buying pressure have supported the Solana price. Increased staking activity shows growing belief in Solana’s long-term network value.

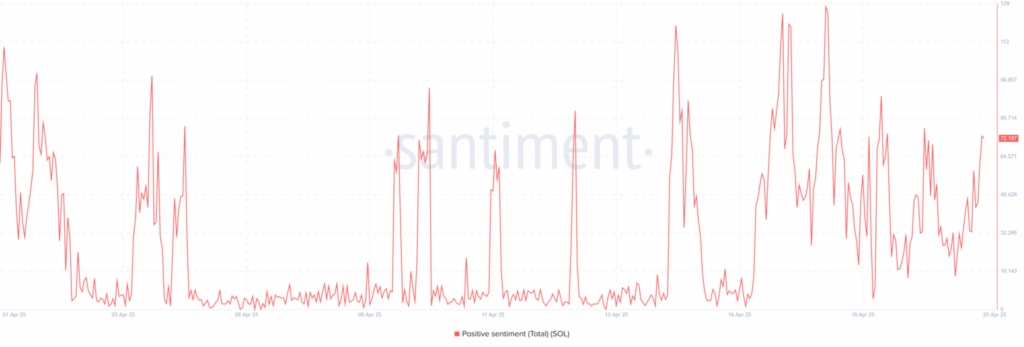

Market sentiment data from Santiment shows a sharp increase in positive views toward Solana over the past two days.

The positive recovery indicators match the growing trend of big investors buying SOL tokens. The market conditions generated by these trends establish favorable conditions for Solana prices to exceed $200 shortly.

Galaxy Digital Bets Big on Solana, Exits Ethereum Holdings

Galaxy Digital recently executed a major crypto portfolio shift by exiting Ethereum and acquiring a significant amount of Solana. The business moved Ethereum worth $105 million to Binance in the form of 65,600 ETH to get back 752,240 SOL.

This move highlighted Galaxy Digital’s confidence in Solana price growth for 2025. The firm’s investment signaled a strong belief in SOL’s future upside potential.

In the past two weeks, the firm’s wallet activity aligns with strong accumulation behavior, reflecting confidence in Solana price trajectory. The SOL withdrawal totaling $98.37 million increases the quantity of institutional involvement in the network.

Significant digital asset funds have changed their capital allocation preference in this new market. Galaxy Digital’s aggressive buy-in has energized market participants, coinciding with growing bullish sentiment around Solana.

While Ethereum faces price stagnation near key levels, Solana shows fresh momentum. On-chain activity coupled with staking rewards has become a key factor institutional buyers use to make token acquisition decisions.

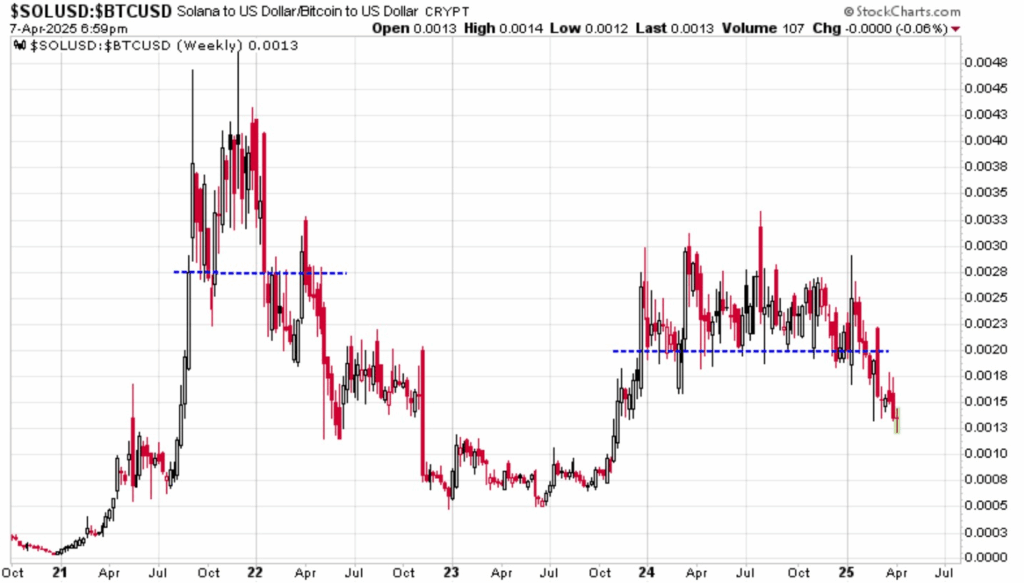

SOL/BTC Pair Shows Weakness Despite USD Price Strength

While Solana gains momentum in USD terms, it remains weak compared to Bitcoin’s recent price surge. Bitcoin surpassed $88,000 for the first time in three weeks.

However, Solana demonstrated weakness by declining beneath its resistance zone. The recent market dynamics indicate underperformance and caution as key elements within the crypto sector.

The trading pair fell from its 0.0020 zone, where bullish turning points have occurred. A price point failure in the past produced an 82% annual decline, which suggests another significant price correction.

According to historical behavior, this trading pair may reach as low as 0.00036. Analyst Tuur Demeester noted this breakdown could extend Solana’s weakness relative to Bitcoin, despite substantial USD price gains.

While Solana price may rally due to staking and accumulation, it could lag behind Bitcoin in relative strength. The market continues to show divergence as hedge fund managers apply varied approaches. Different automated strategies further shape the dynamics of this trading cycle.

Solana Faces Key Resistance at $140

Pump.fun contributes heavily to Solana’s daily supply, creating additional volatility amid bullish signals. During the last 24 hours, the market received 96,000 SOL tokens, a market value of $13.34 million.

The total sales from this source amounted to 1.818 million SOL, with a value of $324.06 million for 2025. The increased supply from this distribution mechanism reduces specific bullish pressures in the Solana price market.

Users’ staking and accumulation of SOL still contribute to its upward momentum. This new supply entered the market, which was received without a price drop, indicating substantial market demand.

The ability to handle such pressure reflects strength in Solana’s trading environment. ****SOL price must surpass $140 to establish ground for a significant rally. The $140 level remains strong resistance, limiting Solana’s breakout despite bullish sentiment.