Key Insights:

- Geopolitical tensions, including the Iran-Israel war, triggered sharp but limited pullbacks across major crypto assets.

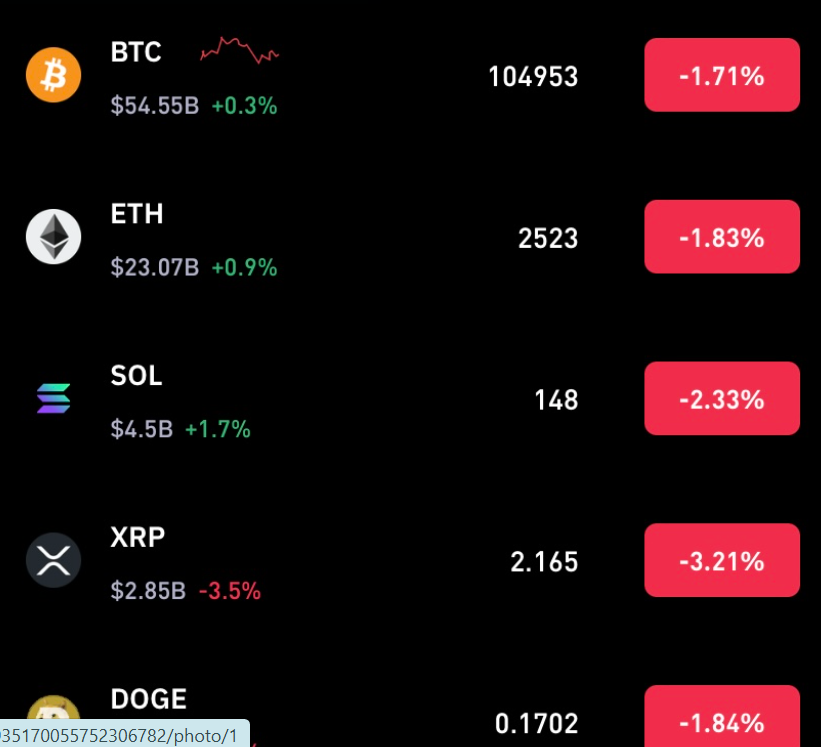

- Bitcoin, ETH, and DOGE slipped over 1.7% as traders await clarity from today’s critical Fed meeting and Powell’s stance.

- Despite red prices, rising market caps in BTC and ETH show investors are holding positions rather than panic selling.

Analysts have wondered why crypto is down today after experiencing moderate declines amid global tensions and central bank uncertainty.

Traders and investors are closely monitoring geopolitical and monetary policy developments, with price charts indicating a broad yet contained correction across top digital assets.

Why is Crypto Down? Geopolitical Tensions Add Pressure to Digital Markets

One of the reasons why crypto is down is the latest round of geopolitical instability, driven by renewed conflict in the Middle East. This has added pressure on global risk assets, including cryptocurrencies.

Notably, analyst Ted Pillows noted that the Iran-Israel war has contributed to investor caution, with many opting to reduce exposure in the short term.

While the conflict has not triggered a severe market reaction, it has introduced enough uncertainty to influence selling activity.

Bitcoin and Ethereum saw intraday declines as traders weighed the potential consequences of a prolonged geopolitical crisis. Historical patterns suggest that such periods of turmoil often coincide with market corrections.

During past macro shocks, such as the COVID crash and the Yen Carry Trade event, Bitcoin experienced drawdowns before staging large rallies. This pattern may be informing some investor decisions today, though broader sentiment is cautious.

Bitcoin, ETH, and DOGE Post Declines Ahead of Fed Meeting

More so, Bitcoin price fell by 1.71%, trading at approximately $104.9K during the session, while Ethereum dropped 1.83% to around $2.52K. On the meme coins, DOGE dipped 1.84%, reflecting widespread, if modest, losses across large-cap digital assets.

Consequently, these declines came as the U.S. Federal Reserve prepares for a key policy meeting, with investors awaiting signals from Chair Jerome Powell. This uncertainty adds pressure to the digital assets and is another reason why crypto is down today.

Additionally, traders and investors are concerned that any deviation from the Fed’s expected stance could cause further volatility. Should Powell indicate a shift toward tighter policy or express concern over inflation, risk assets such as crypto may face additional headwinds.

At the same time, any bullish remarks or signs of stability could provide short-term relief. Particularly, as markets seek direction after the geopolitical shock.

Liquidity Constraints and Reduced Trading Volume

Another contributing factor to why crypto is down today is tightening global liquidity. As interest rates remain elevated, risk appetite across markets has declined. Investors are rotating capital into safer assets like bonds or cash, reducing demand for speculative instruments such as cryptocurrencies, especially during periods of elevated macro uncertainty.

Another reason why crypto is down is that exchanges have also seen a decline in trading volume, reflecting lower participation from both retail and institutional traders. With fewer transactions occurring, price movements become more sensitive to large orders, amplifying volatility. This drop in liquidity can accelerate short-term declines, particularly when external factors such as geopolitical stress persist.

Market Caps Rise Despite Price Pullbacks

Meanwhile, as token prices declined across the board, market capitalization data revealed a different trend. Bitcoin’s market cap rose 0.3% during the session, and Ethereum posted a 0.9% gain. This suggests that large holders are not exiting the market but may instead be shifting positions or preparing for renewed entry after short-term corrections.

Moreover, the divergence between price action and market cap movement often indicates that selling pressure is not deep or broad-based. Instead, some investors may be accumulating or maintaining positions, anticipating a rebound once external conditions stabilize. Tokens such as BNB and Solana also recorded gains in market cap despite intraday losses, supporting this observation.