Key Insights:

- The SUI coin price continues to trade within a narrow range around the key support level of $3.83 for several weeks.

- Over $13.70 million worth of SUI coins have flowed out of exchanges, indicating potential accumulation.

- Despite the ongoing price correction, 65% of top traders appear to be taking long positions on SUI.

SUI coin appears to be garnering significant attention from traders and investors, as its value holds above the key support level of $3.83 despite market uncertainty. Moreover, SUI’s price action and on-chain metrics indicate that the asset has the potential to soar significantly in the coming days.

Market Sentiment and SUI Coin Price Momentum

At press time, SUI coin was trading near $3.93 and had registered a price surge of over 6.5% in the past 24 hours. This surge strengthens the asset’s bullish outlook and has led to increased participation from traders’ and investors’.

According to recent CoinMarketCap data, SUI’s 24-hour trading volume has surged by 7.5% compared to the previous day. This surge in trading volume, along with the rising price, indicates that the strength of the asset is strong and that it could continue its momentum in the coming days.

SUI Price Action and Upcoming Levels

According to the TradingView chart, the the SUI coin price appears bullish and is on the verge of a a massive upside rally.

On the daily timeframe, it has been observed that the SUI coin price has been consolidating in a tight range between $3.80 and $4.20 for an extended period.

With the recent dip, the asset has reached the lower boundary and is currently witnessing upside momentum.

SUI Coin Price Prediction

Based on recent price action and historical patterns, if the SUI coin price maintains or holds above the key support level or the lower boundary of consolidation, there is a strong possibility that it could initially soar by 7% until it reaches the $4.20 level.

Moreover, if this momentum continues and the SUI coin price breaks out of the consolidation range, it could pave the way for a massive 30% upside rally in the future.

This bullish speculation could fail if the SUI coin price falls below the $3.80 level and closes a daily candle beneath it. If this happens, there is a strong possibility that it could drop by 23% until the price reaches the $2.87 level in the future.

Moreover, SUI’s Relative Strength Index (RSI) stands at 63, indicating that it is near the overbought area but still has enough room to soar and break out of the consolidation.

Bullish On-Chain Metrics

While examining the on-chain metrics, it appears that traders and investors are seizing the current opportunity, as they have been observed betting on and accumulating the tokens, according to the on-chain analytics firm CoinGlass.

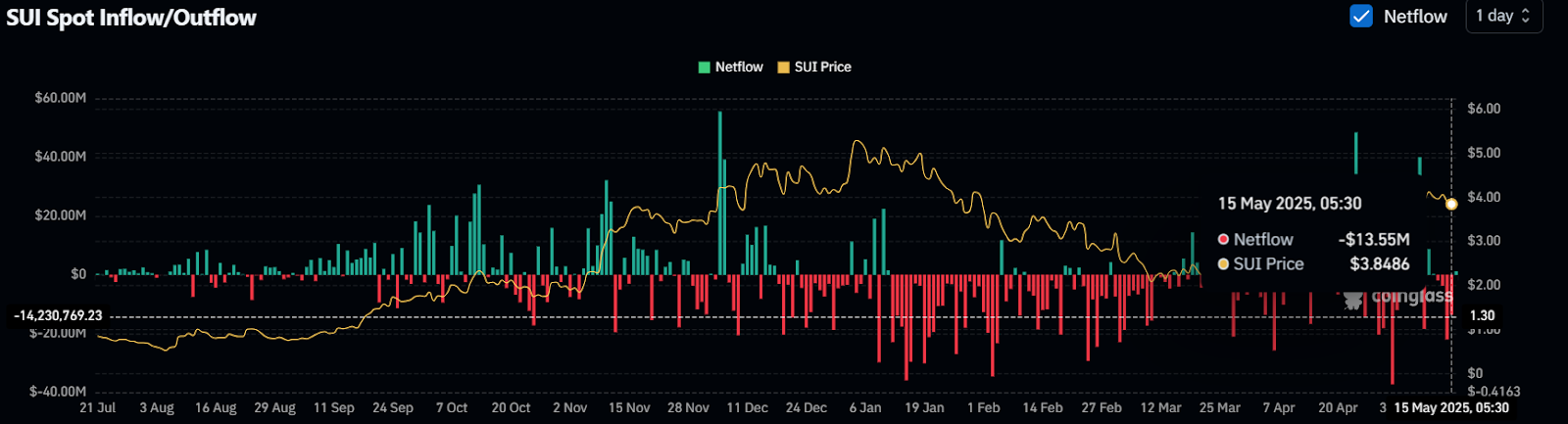

$13.70 Million Worth of SUI Outflow

Data from the spot inflow/outflow reveals that experts across the crypto landscape have observed an outflow of over $13.70 million worth of SUI coins over the past 24 hours.

This substantial outflow from exchanges indicates potential accumulation and could lead to buying pressure and an upside rally.

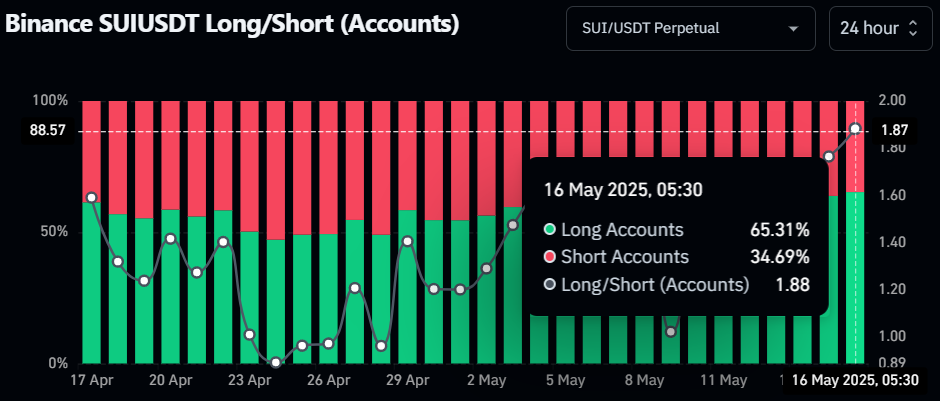

65% Traders Go For Long Postions

Meanwhile, traders are closely following the current price recovery, as they have been strongly betting on the bullish side. At press time, the Binance SUIUSDT long/short ratio stands at 2.65, indicating strong bullish sentiment among traders. This ratio means that for every 2.65 long positions, there is one short position.

At press time, 65% of traders on Binance are betting on long positions for SUI coin, whereas 35% are on short positions.

When combining these on-chain metrics with the technical analysis, it appears that bulls are dominating the asset, and traders and investors seem to be pushing it to breach the consolidation zone and begin its real rally.