Key Insights:

- A crypto expert shared a SUI price prediction, suggesting that the asset’s price could crash to the $2 level.

- Both traders and investors appear to be betting against the market and offloading their holdings in fear of a further price crash.

Amid the ongoing geopolitical tensions between Israel and Iran, Sui price prediction has become a key topic of discussion among holders. The reason for this growing interest is the appearance of four consecutive red candles and a 20% drop in the asset’s value amid the uncertainty.

With the notable price decline, SUI has reached its key support level at $2.85. In the current market structure, this level appears to be a make-or-break point for the asset.

Current Price Momentum

At press time, SUI was trading near $2.90, having lost over 5.5% of its value in the past 24 hours. During this period, investor and trader activity declined sharply, resulting in a 55% decline in trading volume compared to the previous day.

This significant drop in trading volume, alongside the price decline, suggests weakening bearish momentum and may lead to a pause or price consolidation in the coming days.

SUI Price Action and Technical Analysis

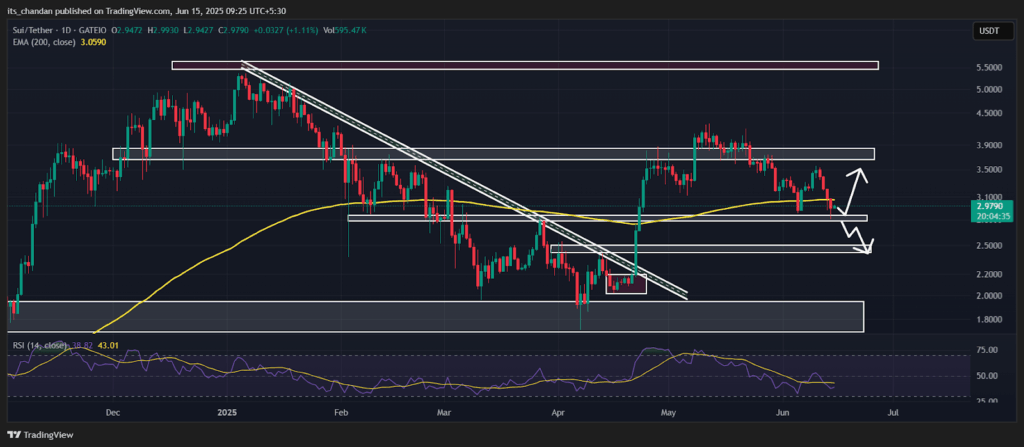

According to expert technical analysis, the SUI price prediction suggests that the asset’s upcoming rally depends on several factors, including market structure, the Israel-Iran tension, and overall trader and investor sentiment.

As per the daily chart, after forming four consecutive red candles, the SUI coin has reached a key support level at $2.85.

SUI Price Prediction: Bearish and Bullish Side

Based on recent price action and historical momentum, the last time the asset’s price fell to this level, it experienced a reversal and saw notable upside momentum. However, the sentiment has now shifted drastically.

If the current market sentiment remains unchanged and SUI falls below its key support level, the SUI price prediction suggests that the asset could crash by 15%, potentially reaching its next support at the $2.40 level.

On the other hand, if sentiment shifts and the price holds above this key support level, the SUI price prediction suggests that the asset could either consolidate sideways or gain upside momentum.

At present, the SUI coin is trading below the 200-day Exponential Moving Average (EMA), indicating that the asset is in a downtrend and may face resistance during any upward movement.

Whereas SUI’s Relative Strength Index (RSI) stands at 38, indicating that the asset is approaching oversold territory and may witness a potential rebound if buying interest picks up.

Expert’s Bold SUI Price Prediction

Given the current market sentiment, a well-followed crypto expert shared a post on X (formerly Twitter), suggesting that SUI’s price could crash to the $2 level, the asset’s strongest support zone. Interestingly, the post contained no text, but the visuals spoke volumes.

On-Chain Metrics Flashes Bearish Signal

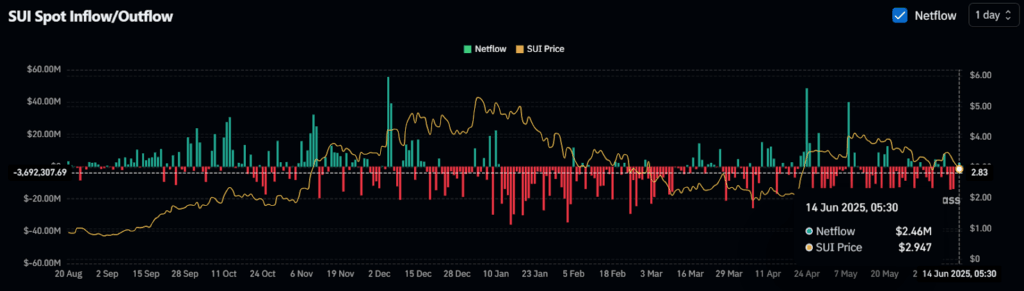

At press time, both traders and investors appear to be betting against the market and offloading their holdings in fear of a further price crash, as reported by the on-chain analytics firm Coinglass.

$2.93 Million Worth of SUI Inflow

Data from spot inflow/outflow reveals that exchanges across the globe have recorded an inflow of $2.93 million worth of SUI coins in the past 48 hours.

This substantial inflow, in the context of the current market structure, suggests potential accumulation and could lead to increased selling pressure and further downside momentum.

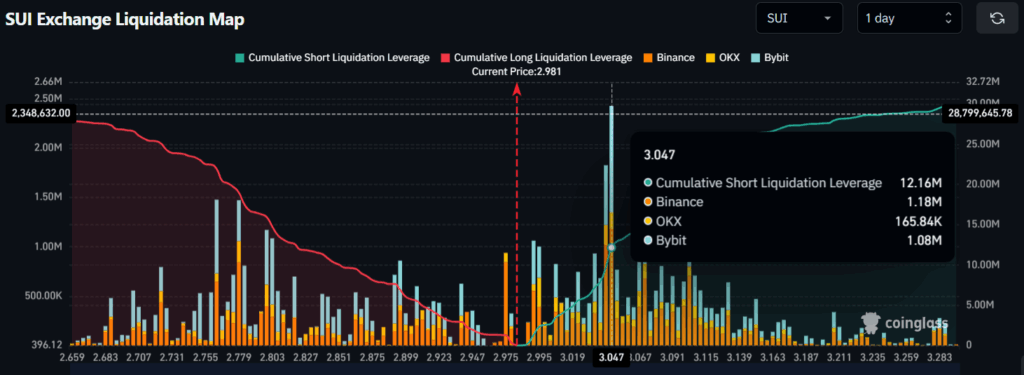

Major Liquidation Levels

Meanwhile, traders, following the same market outlook, are strongly betting on the bearish side. According to the latest data, traders are over-leveraged around the $2.895 support level and the $3.047 resistance level.

At these price points, they have built $6.91 million worth of long positions and $12.16 million worth of short positions — clearly reflecting the current market sentiment and traders’ bearish bias.