March’s Consumer Price Index (CPI) revealed a five-month low in retail inflation at 4.85 percent, driven by decreased food prices. Economists foresee FY25 inflation averaging 4.5 percent, with April’s CPI projected at 4.8 percent, mitigated by reduced LPG and fuel prices, though rising vegetable costs pose a concern.

In February, CPI-based retail inflation was 5.09%, down from 5.66% in March 2023 and the lowest since October 2023 at 4.87%. NSO data reveals food basket inflation at 8.52% in March, decreasing from 8.66% in February.

Assessing India’s Inflation Terrain: Trends, Risks, and Outlooks

Nikhil Gupta, Chief Economist at MOFSL Group, noted that India’s inflation hit a 10-month low of 4.85% YoY in March 2024, aligning with forecasts. This suggests FY24 inflation at 5.4%, the lowest in four years.

Murthy Nagarajan, Head-Fixed Income at Tata Asset Management, anticipates the ten-year yield to retract to 7.15% levels due to the low state loan auction.

Sanjeev Agrawal, President of PHDCCI, attributed the softening of CPI inflation in March to declining food and fuel prices, a result of government measures and improved supply chains.

Rajani Sinha, Chief Economist at Care Edge Rating, highlights sustained high food inflation, particularly in vegetables, pulses, eggs, and spices, despite marginal general CPI moderation.

Aditi Nayar, Chief Economist at ICRA Ltd, warns of lingering food inflation risks due to potential heatwave impacts and rising international crude oil prices. Shlok Srivastav, Co-founder and COO of Appreciate, underscores geopolitical and global commodity price risks, despite ongoing deflation in the fuel and light category.

Suman Chowdhury, Chief Economist & Head of Research at Acuite Ratings & Research, expresses concern over potential food inflation escalation, especially in cereals and animal products.

Dharmakirti Joshi, Chief Economist at CRISIL, predicts a CPI inflation easing to 4.5% this fiscal, with food inflation risks slightly tilted upwards due to weather uncertainties.

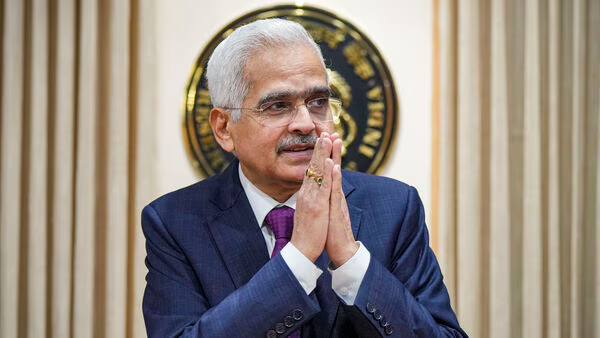

RBI’s Rate Cut Consideration

Government interventions and recent price reductions may mitigate inflation pressures, but external risks remain heightened, caution economists.

Economists foresee the RBI maintaining its current monetary policy stance until August 2024, with potential rate cuts expected in FY25 to reach the 4% inflation target, according to Rajani Sinha of CareEdge Rating.

Shreya Sodhani from Barclays suggests the RBI will maintain current policies, leveraging growth momentum. Rate adjustments may start in August, aligned with declining inflation and cautious Federal Reserve policy.