Tesla‘s Chairwoman, Robyn Denholm, recently sold $17.3 million worth of her shares in the electric vehicle company. This brings her total stock sales for this year to over $50 million.

Denholm, who joined Tesla’s board in 2014 and became chair in 2018, sold these shares as part of a program called 10b5-1, which she started in October. With this sale, she’s now sold all the shares allowed in this agreement.

While Denholm still owns most of the 1.66 million shares she had at the end of last year, other big stakeholders have also sold shares. For example, Drew Baglino, a former Tesla Senior Vice President, sold shares worth around $181.5 million after he resigned in April.

Another Tesla board member, Kathleen Wilson-Thompson, set up a trading plan similar to Denholm’s earlier this year, allowing her to sell up to 280,000 shares by February 2025.

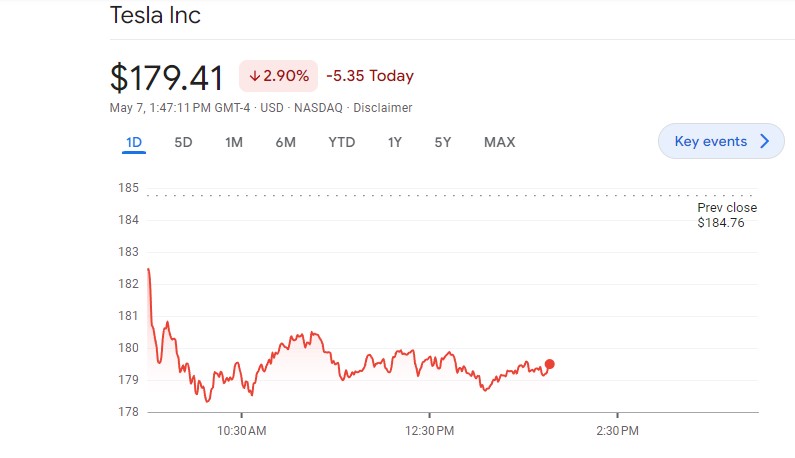

Tesla’s shares have dropped by 26% this year, closing at $184.76 on Monday. This drop comes as the company faces more competition, lower demand for its electric cars, and fewer deliveries in the first quarter.

CEO Elon Musk has been talking a lot about Tesla’s future in self-driving cars rather than just its cars. He told investors last month that those who doubt Tesla’s ability to make self-driving cars shouldn’t invest in the company. Tesla has been working on self-driving technology for years but hasn’t released it yet.

Denholm joined Tesla’s board when she was part of the audit committee. She became chair in 2018 after an agreement with the SEC related to Musk’s tweets about taking Tesla private. Musk had to step down as chair temporarily.

Before Tesla, Denholm worked in executive roles at Sun Microsystems and in finance roles at Toyota in Australia, and accounting firm Arthur Andersen. She’s currently part of several committees at Tesla.

Denholm, who didn’t comment on this, is involved in a lawsuit called Tornetta vs. Musk, which was decided in January. The judge ruled that Tesla’s 2018 CEO pay plan, which was the largest in public corporate history, should be rescinded.

Denholm’s recent stock sales come at a tough time for Tesla, with a lot of restructuring and layoffs happening. Demand for Tesla’s cars went down in the first quarter, and the company’s revenue dropped by 9%.

Musk said in April that Tesla was cutting more than 10% of its global staff. He called it a “pruning exercise” and said the company wasn’t giving up anything important.

Denholm and Musk are trying to get shareholders to vote with them on some proposals. One big proposal is to give Musk back his compensation package, which was canceled by a court earlier this year. This package could be worth billions of dollars in Tesla shares to Musk.

One of Tesla’s biggest individual retail shareholders, tech billionaire Leo Koguan, has told investors to vote against this plan. He recently wrote, “Don’t be a sucker, just vote NO.”