Key Insights:

- Meme coin rallies in 2025 mirror the early stages of past crypto bubbles.

- Ethereum gas fees and wallet activity signal rising retail speculation.

- Institutions are avoiding meme coins, focusing on BTC and ETH exposure.

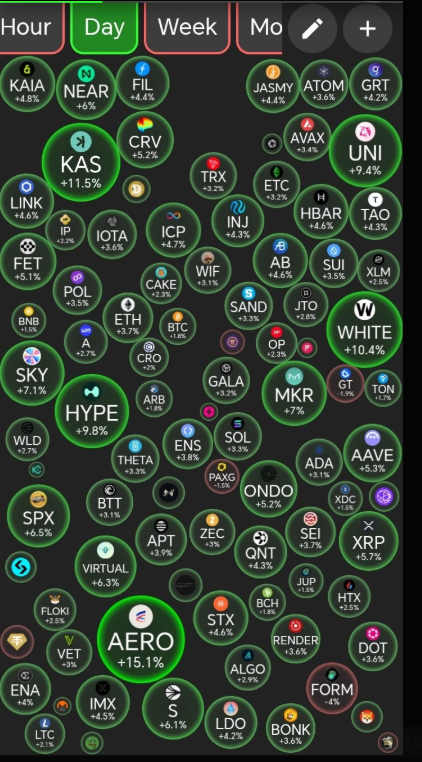

Signs of speculative cycles have resurfaced across the cryptocurrency sector in mid-2025, reigniting debates over potential crypto bubbles. Since March, meme coins and micro-cap tokens have outpaced major assets like Bitcoin and Ethereum.

Crypto Bubbles: Are Meme Coins Fueling Another Speculative Cycle?

Historically, crypto bubbles have been driven by narratives that attract massive public attention. In 2025, meme coins have again taken center stage.

Tokens like $LILPEPE, $ZYNK, and $BLOON have gone viral within hours of presale launches. Their marketing strategies often include celebrity endorsements, gamified airdrops, and aggressive referral systems.

Notably, $LILPEPE presale recently crossed $9 million in funding within 72 hours, driven largely by retail investors on social media. However, blockchain analysts caution that many of these projects recycle old tokenomics with updated branding.

According to DeFiLlama, over 30 new tokens launched in June alone have seen price surges of over 500%, despite no product or team transparency.

In addition, this behavior draws comparisons to ICOs of 2017 and the GameStop-style frenzy of 2021. In both cases, initial buyers saw fast gains, but prices later collapsed when liquidity dried up.

The Financial Times published a warning noting the “illusion of infinite upside” that fuels buying during these cycles.

Retail Mania Returns as Altcoin Market Soars

More so, CoinGecko’s data showed dozens of tokens with less than $10 million market caps rallying over 1,000% within days. Retail traders, many new to the market, are pouring funds into meme-themed assets that often lack utility or backing.

Furthermore, analysts point to surging daily volumes on decentralized exchanges as further evidence. Platforms like Uniswap and PancakeSwap have seen a 45% increase in meme coin trades over the past two months.

TikTok, Reddit, and X (formerly Twitter) are flooded with posts touting “100x gems” and speculative price targets. Analysts are drawing parallels to the irrational exuberance seen in 2017’s ICO boom and the meme coin rally of early 2021.

The rapid rise in token prices with minimal fundamentals has led experts to raise concerns. They argue that history shows such rallies often end with sharp corrections, leaving late entrants exposed to losses.

Speculative Patterns Mirror Past Crypto Bubbles

Moreover, the structure of recent rallies resembles previous crypto bubbles. In both 2017 and 2021, surges began with established coins like Bitcoin, followed by explosive gains in altcoins and meme coins. By the time low-cap tokens dominate headlines, market cycles often enter unsustainable phases.

Historical data from Glassnode and CoinMetrics reveal that in late stages of crypto bubbles, wallet activity and gas fees spike dramatically.

These patterns have now emerged again. Ethereum gas fees hit their highest level in nine months in early June. Blockchain activity across networks like Solana and Base also reached yearly peaks.

Besides, veteran trader Peter Brandt posted a chart on June 14, comparing Bitcoin’s current structure to November 2021. He asked: “November 2021 all over again?”, suggesting a potential market top.

Institutional Activity Diverges from Retail Frenzy

While retail investors continue to chase meme coin rallies, institutional players appear more cautious in 2025. Fund inflows have favored Bitcoin and Ethereum, with CoinShares reporting over $1.9 billion in digital asset inflows last week, 80% of which went to BTC and ETH. Grayscale and Fidelity have also expanded ETF product offerings tied only to top-tier crypto assets.

Meanwhile, centralized exchanges like Binance and Coinbase have increased warnings about high-risk assets.

Coinbase even delisted five meme coins in June, citing a lack of due diligence compliance. Regulators have also responded, with the SEC sending inquiries to several meme coin developers for possible securities violations.