In the realm of midday trading, several companies are making significant moves, drawing attention from investors. Here’s a rundown of the notable developments:

Norwegian Cruise Line: The cruise ship operator saw a remarkable 18% surge following robust forward guidance. Norwegian Cruise Line anticipates a profit of 12 cents per share for the current quarter, surpassing analysts’ consensus estimate of a 20 cents per share loss, as reported by FactSet.

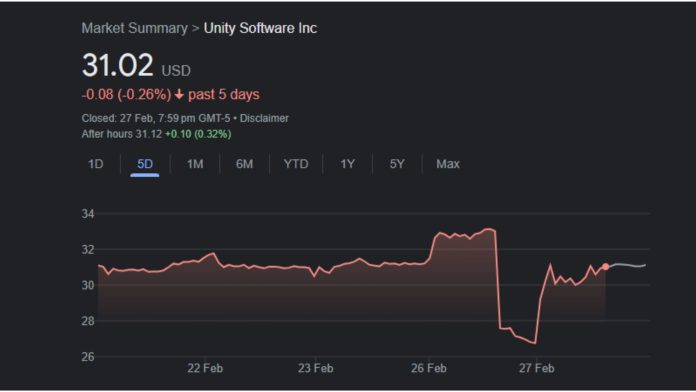

Unity Software: On the flip side, video game developer Unity Software experienced a dip of about 9% due to disappointing EBITDA guidance. The company expects adjusted EBITDA to range between $45 million and $50 million, falling short of the $113 million anticipated by analysts polled by FactSet.

Viking Therapeutics: In the biotech sector, Viking Therapeutics soared over 90% after achieving primary and secondary endpoints in its Phase 2 GLP-1 study. The company reported successful weight loss outcomes in patients receiving the VK2735 treatment.

Hess Corporation: Meanwhile, oil and gas explorer Hess Corporation faced a 3% decline after Chevron issued a warning regarding a dispute involving Exxon Mobil and China’s National Offshore Oil Corp. (Cnooc) over Guyana’s offshore oil assets. This dispute threatens Chevron’s planned purchase of Hess. Chevron also slipped 2%.

Workday: Shares of Workday slipped 3% despite posting quarterly results that beat expectations. The company reported earnings of $1.57 per share, surpassing the anticipated $1.47 per share, according to LSEG (formerly Refinitiv). Workday’s revenue of $1.92 billion aligned with analysts’ expectations, and the company reiterated its guidance for fiscal 2025.

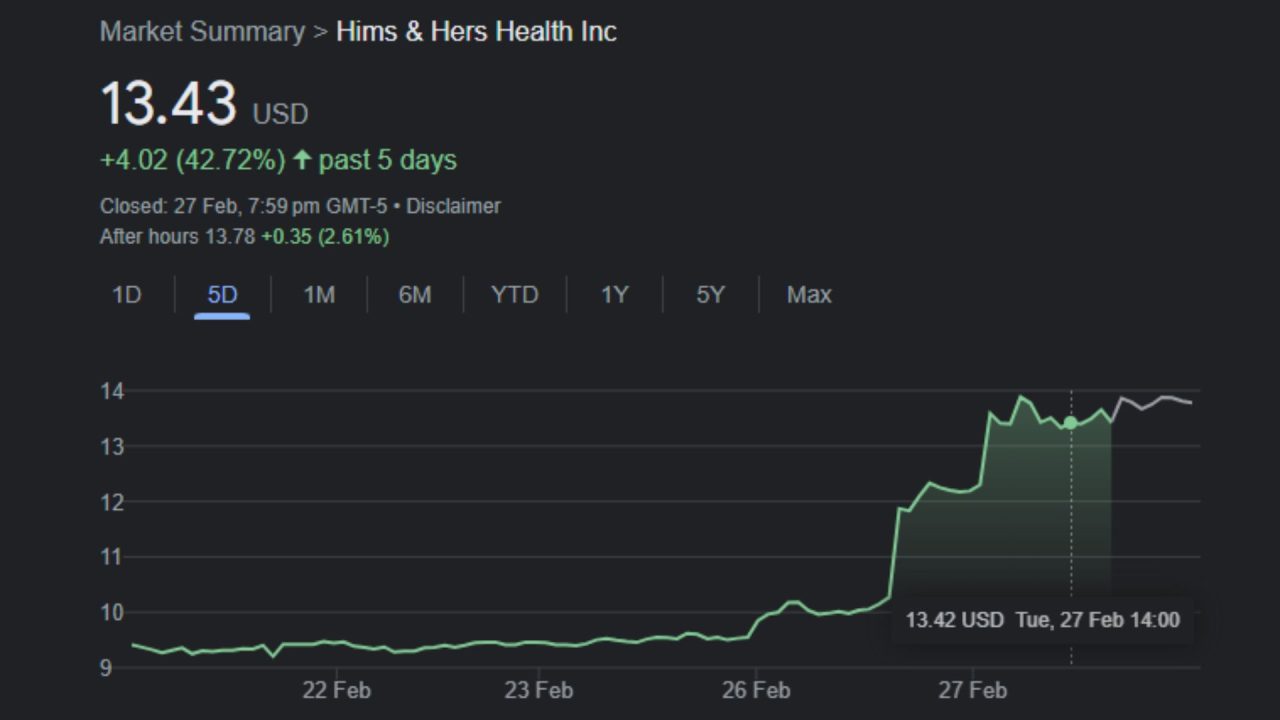

Hims & Hers: The health platform witnessed a remarkable surge of over 33% on the back of better-than-expected earnings and forward financial guidance. Hims & Hers reported earnings of 1 cent per share on $247 million in revenue for the fourth quarter, exceeding analysts’ expectations of a loss of 2 cents on $246 million in revenue, as per LSEG. Additionally, the company shared revenue and adjusted EBITDA guidance that surpassed analyst forecasts.

Macy’s: Despite mixed quarterly results and a decline in same-store sales growth, Macy’s saw a 3% increase following cost-cutting initiatives aimed at repelling activist investors. The company plans to close approximately 150 department stores while expanding better-performing chains.

Lowe’s: Shares of home improvement retailer Lowe’s climbed nearly 3% to a 52-week high after reporting better-than-expected earnings. The company’s earnings per share of $1.77 in the latest quarter surpassed estimates of $1.68, according to LSEG. Additionally, Lowe’s revenue exceeded expectations.

Zoom Video: Zoom Video witnessed a nearly 5% increase after surpassing Wall Street’s expectations in its fiscal fourth-quarter results. The company reported an adjusted per-share profit of $1.22 on $1.15 billion in revenue.

Cava: The restaurant chain rallied 6% one day after reporting earnings and revenue that exceeded analyst estimates. Cava’s fourth-quarter revenue of $175.5 million was 52% higher than the previous year and above the expected $174.3 million, according to FactSet. Additionally, Cava provided full-year EBITDA guidance that surpassed estimates.

Roku: Roku experienced a slight dip of more than 1% after Wells Fargo downgraded it to underweight from equal weight, expressing concerns about Walmart’s Vizio acquisition potentially hindering growth.

Sprouts Farmers Market: Shares of Sprouts Farmers Market gained 2% after Bank of America Securities double upgraded the supermarket chain to buy from underperform. The bank cited Sprouts’ differentiated assortment of goods as a driver of sales and raised its price target on the stock to $70 from $30.

Duolingo: Shares of language learning company Duolingo rose more than 6% following Seaport Research Partners’ initiation of research coverage with a buy rating. Duolingo is scheduled to release its fourth-quarter results on Wednesday.

CarGurus: CarGurus saw a decline of over 7% due to weak financial guidance for the current quarter. Although the online car-selling platform exceeded Wall Street’s fourth-quarter expectations, it fell short of revenue and earnings forecasts for the first quarter.

AutoZone: AutoZone witnessed an almost 6% increase after surpassing Wall Street’s fiscal second-quarter expectations on both the top and bottom lines. The company reported earnings of $28.89 per share on $3.85 billion in revenue.

Coinbase: Coinbase shares rose approximately 3% as cryptocurrency prices surged, propelling Bitcoin above $57,000. This uptick also benefited other crypto-connected stocks, with CleanSpark gaining 2.7% and Microstrategy surging more than 9% following its acquisition of another 3,000 bitcoins.