Key Insights:

- Solana’s Total Value Locked (TVL) has surged by 54% in six weeks to $9.44 billion.

- Solana’s memecoin sector has increased by nearly 70% in less than two months.

- Technically, Solana is showing bullish chart patterns and a break above the $180-$200 resistance zone could lead to a new high of $295.

Solana has been drawing more and more attention from analysts so far, after launching a powerful rally from April 7 to May 26. The cryptocurrency has risen from a low of $95 to highs near $180, and is now sitting on one of the most important resistances on its charts.

While the cryptocurrency is currently attempting to break through $180, a combination of bullish technical patterns and on-chain activity could be major pointers towards a rally to the $300 mark and possibly even higher.

TVL Climbs 54% in Just Six Weeks

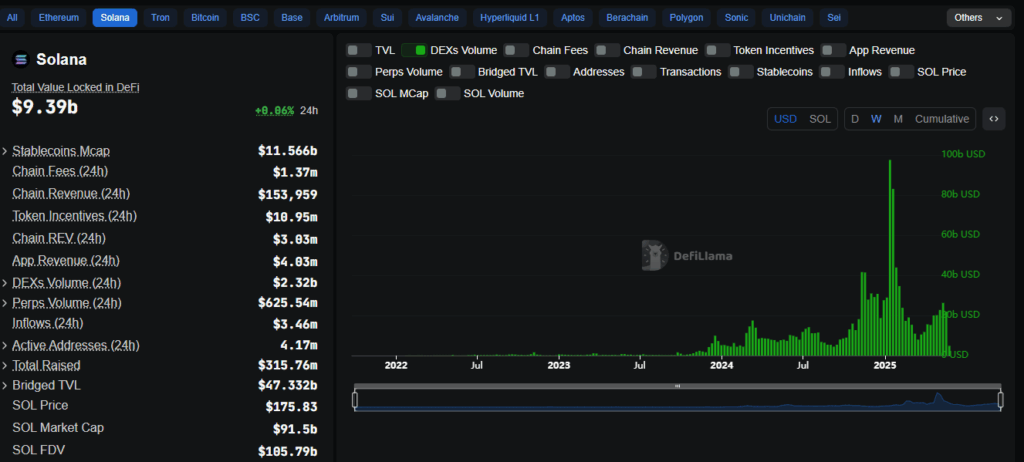

One of the clearest signs of Solana’s recent strength is its Total Value Locked (TVL).

According to data from DefiLlama, Solana’s TVL has jumped by 54% since 7 April.

Moreover, this metric hit $9.44 billion on May 26, up from $6.12 billion. This shows that the trend is no ordinary rebound. Instead, it is a show of confidence in Solana’s future.

DefiLlama also shows that some of the biggest Dapps driving this trend include Raydium, which saw a 52% spike in TVL alongside others like Jupiter DEX, Jito and Kamino Lending which grew by 12%, 25% and 11% respectively. This puts Solana second only to Ethereum in terms of TVL among layer-1 blockchains.

Impressively, it has even beaten Ethereum’s layer-2 networks, like Arbitrum, Optimism, and Base. It also ranks ahead of BNB Chain, which benefits from deep integration with Binance itself.

Memecoins Fuel the Hype

Solana’s recent strength isn’t limited to DeFi. Its memecoin sector has exploded too, and has pushed the collective market cap of Solana-based memecoins from $8 billion on April 8 to nearly $14 billion by May 26. This stands at a near-70% increase in less than two months.

Trading volume on Solana’s decentralized exchanges has also surged, and has been driven largely by memecoin activity. As traders flock to Solana-based tokens like WIF, BOME, and SLERF, the underlying demand for SOL has strengthened, since users must hold and spend SOL to participate.

While many of these tokens have seen pullbacks on weekly or monthly charts, they are still strongly above their earlier lows, in a show of even more market confidence.

Bullish Chart Patterns

So what about the charts? From a technical perspective, SOL is flashing several bullish signals that could support this rally. So far, according to the charts, Solana’s price has climbed from a $95 bottom and is now pressing against a resistance zone between $180 and $200. This said, if a break above this zone occurs, the next level is around $252, which clearly opens the door to further upside.

A move beyond that could bring SOL to its all-time high of around $295, which stands as a 66% increase from current levels. More on the bullish case, the RSI has also climbed from less than 40/100 in March to 53 in late May.

More on this, the daily chart is forming a classic bull flag, within which a breakout above the $180 resistance could push SOL first toward $200, then possibly to $220 and $260, if momentum continues.

Still, analysts continue to watch trading volumes on Solana, considering how this metric has declined during the current consolidation phase. Investors must note that without a strong uptick in volume, any breakout attempt might fall flat.

Will $260 or $450 Be Next?

Several respected analysts believe SOL is on the verge of a major upswing. However, most agree that this will only happen if it can convincingly break above the $180 resistance zone.

Robert Mercer pointed out a “price fractal” that is very similar to Solana’s October 2024 breakout. If history repeats itself, a breakout now could send SOL soaring toward $260.

Javon Marks thinks the same, and pointed towards another pattern from last year. According to the analyst, if this pattern plays out again, Solana could rally to as high as $450.