Key Insights:

- TRUMP coin price consolidates between $9.20 and $12.50, forming an accumulation zone after a downtrend.

- RSI is indicating weakening bearish momentum and a possible rebound from support.

- MACD flattening shows a lack of dominant trend, signalling potential for breakout volatility.

TRUMP coin price continues to trade within a narrow range following a multi-week decline from March highs near $20.00. Recent technical charts show stabilisation, with traders keen on support zones of around $9.00 to determine short-term direction.

TRUMP Coin Price Action Forms Base Around $9.20–$12.50

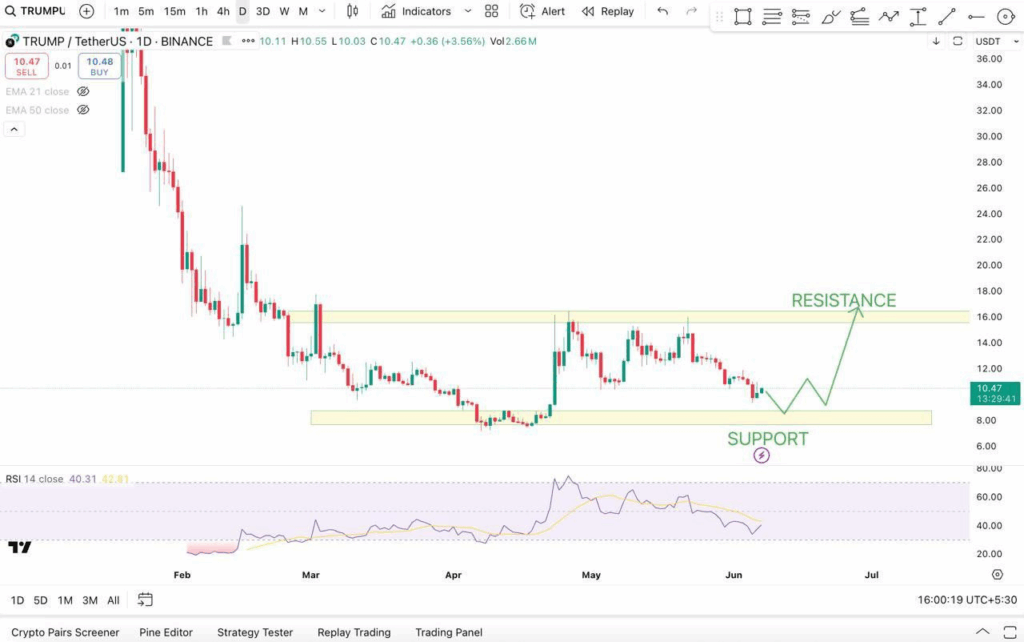

Analyst JamesBitunix’s chart identified a defined accumulation TRUMP coin range between $9.20 and $12.50, developed after a prolonged downtrend.

This rectangular formation reflects a period of TRUMP coin price compression, where selling pressure has diminished and demand is stabilizing. The range acts as a consolidation zone, often observed before breakout movements in trending assets.

The chart suggests a breakout strategy is unfolding, with an entry zone just above the accumulation box. The projected upside indicates TRUMP coin could reach $21.70 if momentum holds. A stop-loss near $9.20 helps maintain a favorable risk-reward balance.

Early May’s bullish candlesticks reinforce the possibility of TRUMP coin breaking out of consolidation, provided current levels remain intact.

TRUMP Coin Support Sees Repeated Buying Activity

Another crypto analyst, AkaBull, illustrates a wider consolidation zone for Trump coin, with firm support observed around the $8.00–$9.00 region and resistance capped near $16.00. Recent TRUMP price trend has returned to the lower boundary of this structure, where a potential double-bottom formation is developing.

This repeated defence of the same Trump coin price floor suggests sustained interest from buyers at these levels.

Moreover, the Relative Strength Index (RSI) supports this outlook. Currently positioned just above 40, the RSI indicated a weakening bearish momentum. The recent flat direction of the indicator is often linked with the possible trend reversals, in particular, when they match the apparent candlestick support formations.

A rebound off this level may bring Trump coin back towards the $16.00 resistance, assuming buying strength continues and short-term momentum changes.

Short-Term Indicators Show Weak Momentum

Additionally, in the short term, Trump coin price has shown an unstable trend characterized by extreme fluctuations and periods of correction. Earlier, the asset approached $20.00 at the beginning of March.

Following that, Trump coin entered a prolonged decline, and the occasional recoveries have failed to maintain positions above the $16.00 mark. Most recently, TRUMP price has stabilized around $10.50 after a failed breakout earlier in May.

In addition, the indecision in the market is also emphasised by momentum indicators. The MACD lines are near the zero line, and the difference between the MACD and signal lines is small, which shows that there is little directional momentum.

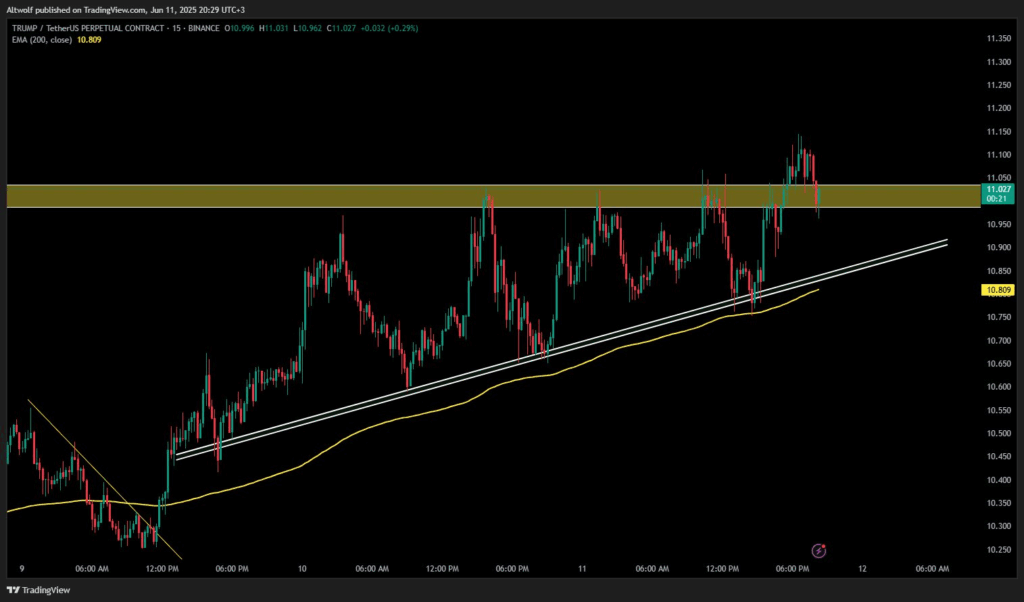

TRUMP Coin Price Eyes Next Rally if 200EMA Holds

Analyst AltwolfCrypto’s TRUMP/USDT 15-minute chart shows the meme coin trading within a critical structure. Trump coin price action is currently testing the 200-EMA support around the $10.809 level after facing rejection from a resistance zone near $11.05–$11.10. The support has so far acted as a launchpad for prior rallies, but a failure to hold here could confirm a short-term bearish trend.

Further, the analyst noted that the structure remains bullish only if the 200EMA holds. TRUMP coin price has been holding a solid trendline support that is rising, as marked by two rising white trendlines that meet at the 200EMA.

The convergence signals one of the principal inflection points of TRUMP price next significant move. In case the coin rebounds off this area, then it may revisit the new highs and even make a breakout to new short-term objectives.

At the time of writing, TRUMP coin trades at $10.42 and has a market capitalization of $2.1 billion. According to CoinMarketCap statistics, the asset has experienced a 24-hour trading volume of $369.35 million, with recent price changes affecting the Trump price.