Key Insights

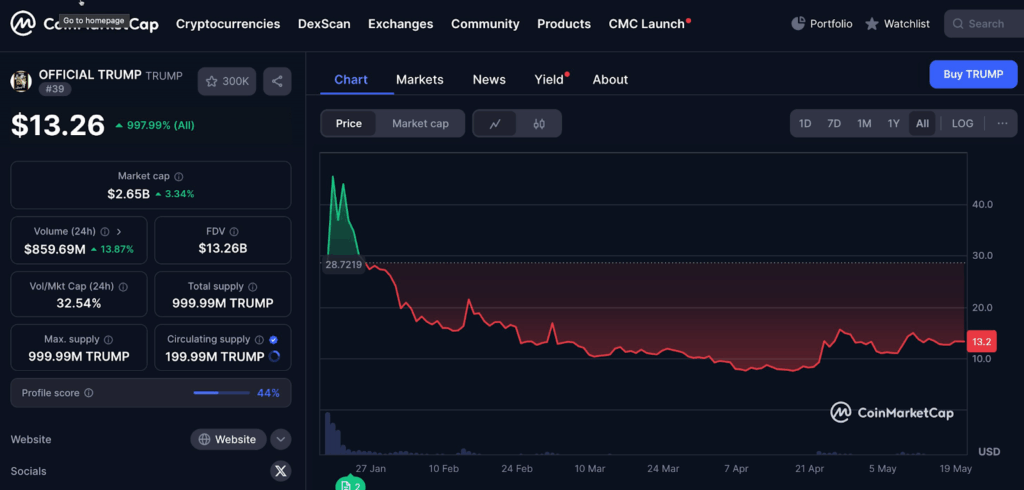

- Trump coin price surged 997.99% YTD, peaking at $28.72 before retracing to $13.26.

- Only 199.99M TRUMP tokens circulate out of a 999.99M max supply.

- Per blockchain analysis, 19 of the top 25 TRUMP wallets are controlled by non-U.S. holders.

TRUMP coin has quickly become one of the most talked-about digital assets in 2025. With political relevance and strong trading interest, it surged by over 997% this year. Despite a decline from its early peak of $28.72, many investors are watching closely. As the market stabilizes, the question remains—can TRUMP coin reach $20 again before the end of 2025?

Current Market Trends and Price Behavior

TRUMP coin is currently priced around $13.26. It reached a high of $28.72, followed by a sharp correction. The coin’s market cap now stands at $2.65 billion, and its 24-hour trading volume is $859.69 million, indicating steady interest from traders.

The price pattern over the past few weeks shows lower volatility than its initial launch. The chart shows attempts to recover, although the trend has remained chiefly flat with minor upward moves. Analysts are closely watching the $11.50–$12.00 range, which has acted as a support zone.

Source: CoinMarketCap

TRUMP coin has seen some price rebounds near this level. If buying volume increases, this support could push the coin toward a $16.00–$18.00 zone in the coming weeks. If momentum holds, it may retest the $20 mark later this year.

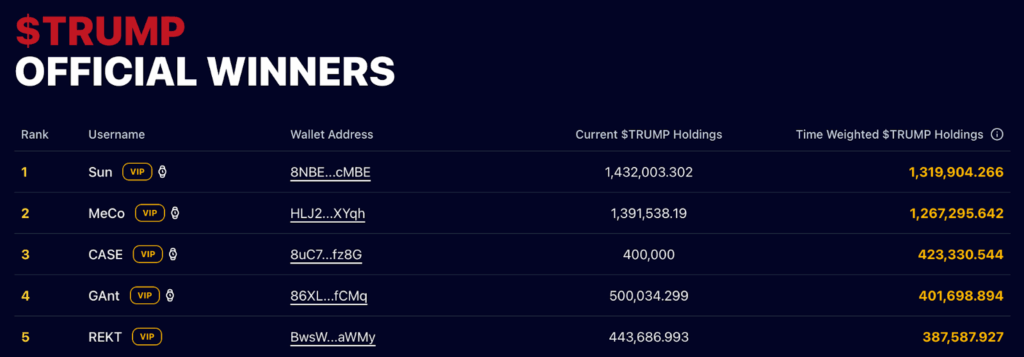

Whale Holdings and Leaderboard Activity

The official TRUMP coin leaderboard lists the top holders, many of whom hold large amounts of tokens. The top wallet, “Sun,” holds over 1.4 million TRUMP coins. Other notable wallets include “MeCo,” with 1.39 million, and “Woo,” with 1 million tokens.

All top holders on the leaderboard have VIP badges, which come with benefits such as invitations to exclusive events. One such event is a gala dinner scheduled for May 22 in Washington, D.C., where the top 220 holders are expected.

Reports suggest that many of these wallets are linked to non-U.S. entities. Inca Digital’s research shows that at least 19 of the top 25 wallets are likely controlled by individuals outside the U.S. Exchange data, particularly from platforms like Binance, confirmed this.

Trading Patterns and Liquidation Risks

CoinGlass data shows frequent long and short liquidations for the TRUMP coin. Major liquidation events occurred around April 23 and May 11. During these times, fast market swings affected both bullish and bearish traders.

The pattern of long liquidations following price drops suggests that some traders are using high leverage. This increases the risk of sudden sell-offs when prices fall. At the same time, the occasional short squeezes point to unexpected price increases that caught short sellers off guard.

The market’s reaction to recent price levels shows caution. Traders are watching key levels for signs of a bounce. Many are waiting for confirmation of a trend before making large entries.

Forecast: Can Trump Coin Price Revisit $20 by Year-End?

Whether the Trump coin price can revisit $20 by late 2025 will depend on a few factors: market sentiment, supply growth, political catalysts, and whale activity.

A push above $16 would be technically significant and could pave the way for a rally toward $20. For now, $12 has acted as a strong base. However, broader crypto market trends and macroeconomic shifts will likely influence price movement in the months ahead.

Exchange volume remains elevated, and non-U.S. wallet activity signals sustained interest. Should sentiment improve, TRUMP could retest $20 before the end of the year—especially if political developments spark renewed momentum.