Key Insights:

- The XRP has experienced a robust bounce off the support area of $1.85 and 1.90 in favor of the rally up to 2.18 upon the increase of its volume.

- Upbit exchange was an attraction in South Korea with a 24hr trading volume of $20.96 billion, where XRP contributed 15.96% to the total KRW trading going on in the exchange.

- XRP retail was also bullish in sentiment as was institutional.

Upbit exchange was a prime attraction point in South Korea with a staggering 24-hour trading volume of $20.96 billion.

XRP news noted Ripple’s XRP contributed 15.96% to the total KRW trading going on in Upbit exchange.

XRP News on Price Analysis

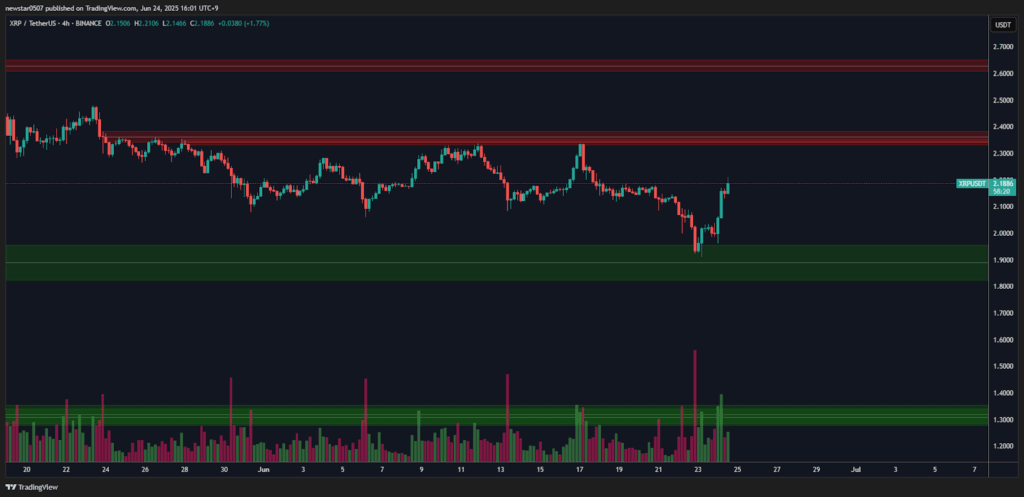

Technically, XRP experienced a robust bounce off the support area of $1.85 and $1.90 in favor of the rally up to $2.18 upon the increase of its volume. The price regained the $2.00 psychological level and proved the upward pace.

According to the chart, the first resistance and big sell wall was pegged at $2.40 after which a bigger sell wall was found in the region of $$2.60.

Should XRP manage to break above the resistance at $2.40 with powerful volume, then it may jump in price to approach the resistance area at $2.60 soon enough.

A break above $2.60 would then create space to $2.70 and above. Failure to break and hold over $2.40 may however result in its rejection and a pull-back.

Under this condition, XRP may have its second glance at the price of $2.00 and drop into the region of support at $1.90.

Another breakdown may take the route back to the earlier area of accumulation plains around $1.70-$1.85.

An increase of volume in the recent up-trend justified the existing bullish price effect; however, more pressure in the price zone well beyond the $2.40 would be substantial to verify it.

As long as XRP was hovering above the 2.00 mark, this trend was in a bullish mood and the support flow was ever increasing.

XRP News: Could Korean Demand Bring Interest On XRP?

The surge in Upbit caused XRP as a trading pair to be the most dominant one at the top exchange in Korea, which served as a symbol of increased investor appetite and new strength among the tokens.

That was a huge portion of market activity, which suggested intense retail, and even institutional involvement.

Flare-up in the Korean demand may bring subsequent interest in XRP globally, which may move XRP to critical resistance levels when other volumes warrant.

Nevertheless, a temporary decline may ensue in case buying pressure expires or in the event there is a wider change of mood in the markets.

South Korea has always dictated altcoin rallies and the ruling of XRP in the South Korean currency (KRW) further supplements its status of a speculative and strategic asset.

Provided this tendency continues, XRP may become the primary driver of the next Altcoin rally that should be region-based, and the volatility will likely stay high in the near future.

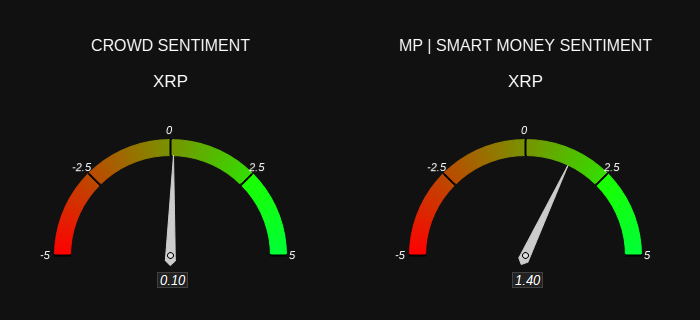

XRP Crowd Vs Smart Money Sentiment

Meanwhile, XRP retail was also bullish in sentiment as was institutional. Crowd sentiment was at 0.10, indicating just positive, whereas the sentiment of smart money was much higher at 1.40. This meant recognizable institutional optimism.

The split indicated that although interest levels were generally mild in retail investors, professional investors had been turning more upbeat.

Such sentiment compatibility corresponded to further encouragement of rising prices. Had retail sentiment become better, then a more intense rally would have ensued due to wider participation.

But in case the sentiment behind smart money was not so hot, the momentum could have been weak even though the people were optimistic.

Its two-bears reading indicated a positive posture, and it could be that smart money was expecting the market to behave well or be well-founded.

The presence of accumulation behavior in XRP was alluded to by the current positioning, particularly before possible breakout regions were to be seen.