Key Insights:

- SEI crypto surges 47.73% from $0.185 as breakout confirms second leg of rally since May.

- Donald Trump tweet fuels $10 speculation, driving viral community engagement.

- $2.7M net inflow in 24h ranks SEI among the top 3 chains, showing organic network growth.

Sei Crypto Breaks Out With 47% Rally From Support

Sei crypto has surged over 47% following a breakout from consolidation, marking its strongest rally in months. This was followed by SEI retesting important levels that caused a break of a potential descending trendline, and the result was renewed bullishness.

Analyst World Of Charts found that this had been setting up since early-May and was done with a high-risk/reward ratio, yielding a 45%+ profit off the breakout base.

SEI crypto experienced a 0.0892 USDT value gain above its $0.185 base over a 12H Binance chart, an equivalent in power to its earlier 56.64% rally observed during the earlier day of April.

The pattern suggests consistent behavior in SEI’s upward moves after accumulation phases. The price is trading above $0.265, and short-term resistance is around $0.30 and $0.35.

The price action combined with volume spikes and the clearance of the trendlines indicates the possibility of subsequent upside. Support is currently at about $0.22, which is an area of earlier rejections that then turned to support.

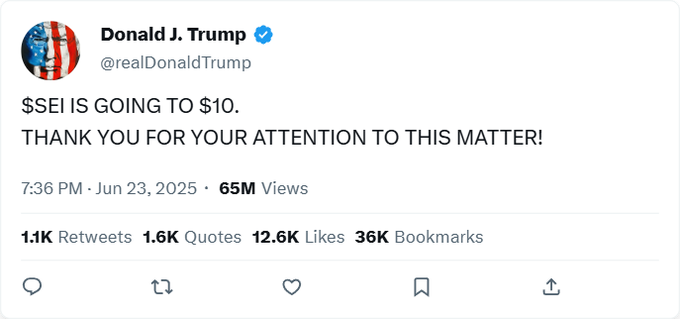

10 Projection Goes Viral Amid Community Speculation

Market speculation further increased when a viral tweet by U.S. President Donald Trump said, SEI will go to $10. The tweet received more than 65 million views and 12,600 likes. Though perhaps speculative, and most certainly rhetorical, the message appealed to many retail traders.

The post is not available on X, also, Trump has been regularly active on Truth Social, instead of X. Whether Trump actually made that post remains unconfirmed.

Sei supporters, such as Ryuzaki SEI, responded to this call and created temporary hype. There is no technical argument that could justify a $10 valuation at this point, however, these viral moments tend to affect liquidity and sentiment.

As is evident with what has happened with other assets historically, community-driven force can sometimes temporarily push prices above fair value. But institutional traders, on average, do not trade entirely on social signals.

The laying price of under $0.30 means that the $10 target is very much aspirational, but the wave of social interest is helping support growing volumes and market interest.

Daily Chart Indicates Bullish Trend Shift

The broader technical picture for Sei crypto shows signs of a long-term reversal. In chart analysis, Crypto Yoddha revealed a breakout of descending triangle formation in the daily scale.

This structure had restrained SEI gain since March however, recent movement of prices breached the upper resistance.

A series of higher lows, as well as the formation of a bullish channel, was evident on the chart. Provided that the price is above the breakout area, then analysts expect additional increases towards the $ 0.50 area.

The earlier bearish trend marked late 2024 has now been broken, and the new arrangement indicates a potential medium-term range of approximately $0.75 to $1.10.

Not only was the breakout formed with an increasing volume, but the trader’s interest in the new direction of the trend was confirmed too. A retest area would be down to the $0.21-$0.22, and a bounce might indicate a continuation.

$2.7M Net Inflow Underscores Growing Network Activity

On-chain data supports the recent price strength. According to Artemis metrics shared by Alex Kosa, Sei crypto recorded a net inflow of $2.7 million over a 24-hour period. The network ranked third after Ethereum and Base among the best chains.

Having inflows of $3.1 million compared to outflows of just $367K, SEI performed better than networks like Arbitrum, StarkNet, and Bitcoin. Netflow value is the actual use of a network or consistent demand instead of short-term speculation.

According to analysts, such inflows show a growing confidence in the builders and consumers. An increase in netflow is also likely to sustain price growth because it depicts real liquidity and utilization on-chain.

The data highlighted Sei crypto growing role within the DeFi and Layer 1 ecosystem, as developers and users shift activity toward more scalable platforms.