Key Insights:

- BlackRock stock could see a price surge of over 8% to 10% if it breaks out of prolonged consolidation and the key resistance level.

- Given the current market sentiment, it appears that BlackRock is on a buying spree.

For over a month, BlackRock stock (BLK) has been moving sideways and consolidating within a tight range. This ongoing consolidation appears to be potentially driven by geopolitical tensions between Israel and Iran, as well as recent tariff policies.

Market Sentiment and Price Momentum

These developments not only impact overall market sentiment but also negatively affect the entire financial market, including crypto, stocks, and commodities. Amid this, BlackRock stock (BLK) showed little reaction, instead consolidating and remaining sideways.

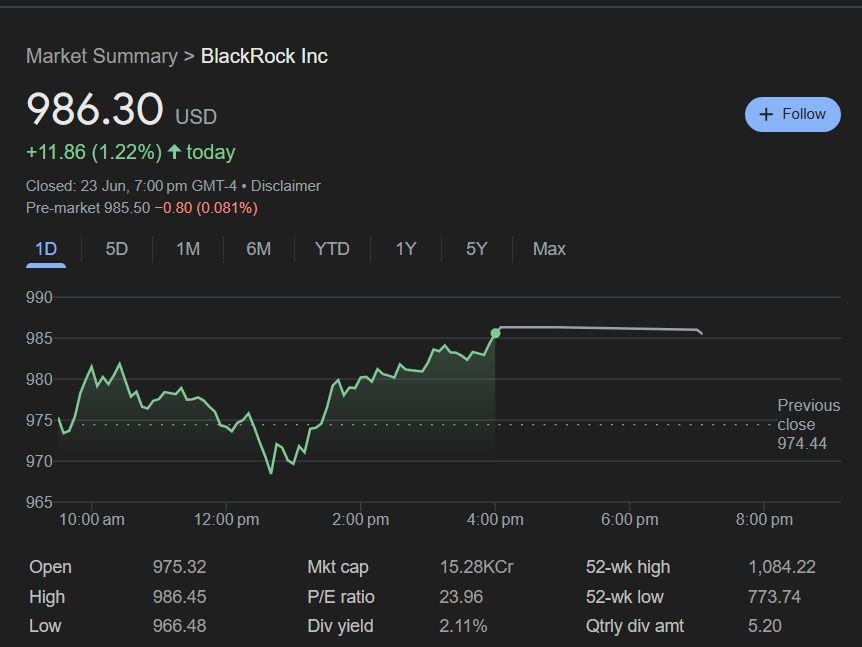

At press time, BlackRock stock (BLK) was trading near $986 and had registered a modest price surge of 1.22%. Meanwhile, the asset recorded a 0.51% gain over the past month and 23.45% over the past year.

Given the current market sentiment, it appears that BlackRock is taking advantage of the market structure and significantly buying the dip.

BlackRock’s Deepening Interest in Crypto

Recently, several posts on X (formerly Twitter) by experts and on-chain analytics firms have surfaced, suggesting that BlackRock is significantly accumulating Bitcoin (BTC) and Ethereum (ETH) as their prices have dropped significantly from all-time high levels

A well-followed crypto analyst shared a post on X stating that BlackRock has purchased a substantial $750 million worth of Ethereum (ETH) so far in June 2025. This significant purchase by an industry giant suggests that the current market structure might present an ideal buying opportunity.

Meanwhile, a local news outlet shared a report noting that, with continuous Bitcoin accumulation, BlackRock now holds a substantial 3% of all Bitcoin, making it the largest institutional Bitcoin holder.

Looking at BlackRock’s actions in the crypto landscape, it appears they are buying as much Bitcoin and Ethereum as possible, something only a firm like BlackRock can afford to do.

Additionally, rumors have surfaced that BlackRock is pressuring the United States Securities and Exchange Commission (SEC) to approve XRP spot ETFs before July 2025.

BlackRock (BLK) Price Action and Key Technical Analysis

According to expert technical analysis, BlackRock stock (BLK) has been consolidating in a tight range for the past one and a half months near the key resistance level of $1,000. The daily chart reveals that the asset has a strong history of price reversals from this level.

As per the daily chart, since February 2025, BlackRock stock has experienced more than five price reversals from this resistance level.

Blackrock Stock Price Prediction

Based on recent price action and historical patterns, if BLK breaks out of the prolonged consolidation and the resistance level, and closes a daily candle above $1,006, it could pave the way for further upside momentum.

If this happens, there is a strong possibility that BlackRock stock could see a price surge of over 8% to 10%, potentially reaching the $1,100 to $1,110 levels in the coming days.

Technical Analysis: EMA and RSI Insights

At press time, BLK’s Relative Strength Index (RSI) stands at 61, indicating moderate bullish momentum and suggesting that the stock is approaching overbought territory but still has room for further upside.

Meanwhile, the asset price is trading above the 200 Exponential Moving Average (EMA) on the daily time frame, indicating a strong long-term bullish trend and reinforcing investor confidence in continued upward momentum.

“When combining all these factors — from rising interest among analysts to the company’s strong confidence in crypto — it appears that BlackRock stock could break out of the prolonged consolidation it has been experiencing over the past few months.