President Joe Biden is advancing his latest proposal for student loan forgiveness, aiming to fulfill a key campaign pledge and engage young voters ahead of the upcoming election. The Education Department has initiated the process for a new regulation to enact the cancellation plan announced by Biden last week.

This proposal, subject to a 30-day public comment period and further review, targets more than 25 million Americans with a focus on specific eligibility criteria.

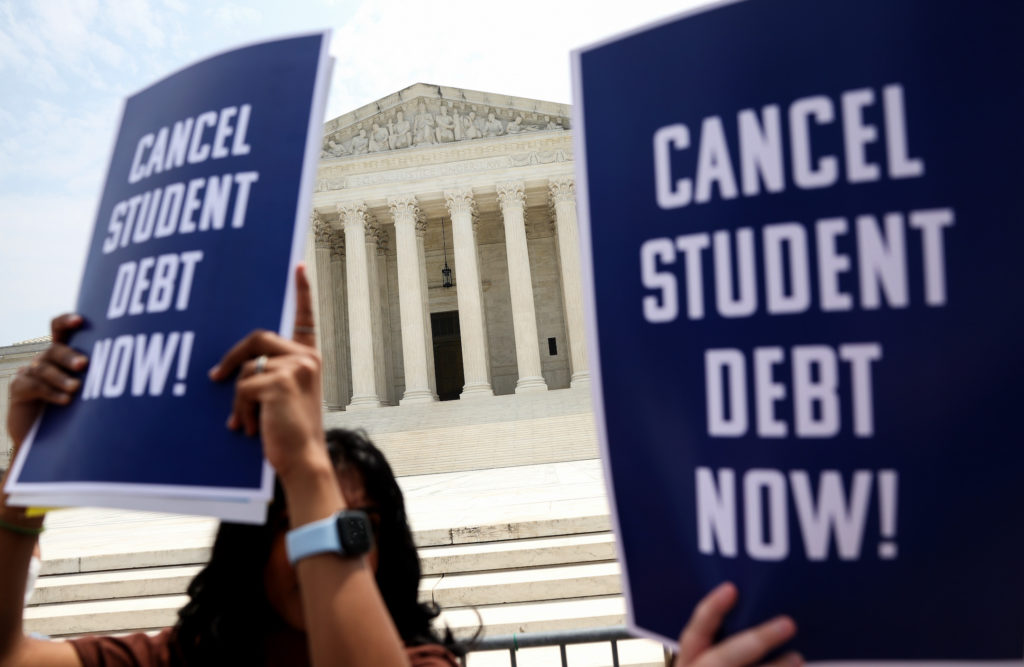

Unlike the previous plan struck down by the U.S. Supreme Court, this proposal adopts a different legal foundation and aims to address various categories of borrowers. While Biden has emphasized the transformative impact of the plan, conservative critics argue that it places an unjust burden on taxpayers who did not attend college and have threatened legal challenges.

The proposed regulation includes four eligibility categories outlined by Biden, with additional provisions addressing different forms of financial hardship set to be introduced later.

Notably, one category seeks to alleviate the burden of runaway interest by eliminating up to $20,000 for borrowers who owe more than their original loan amounts. Automatic cancellation of loans is also proposed for those with extended repayment periods or who attended programs with low financial returns.

Furthermore, the plan aims to streamline relief for borrowers eligible for existing federal forgiveness programs but has not applied due to complexity. The Education Department collaborated with various stakeholders, including students, college officials, and borrower advocates, during the formulation process.

While the rulemaking process typically spans several months, the Biden administration plans to implement certain aspects of the proposal as early as this fall.

However, Republican opposition remains steadfast, arguing against broad student loan forgiveness as an unfair bailout. Legal challenges and political debates surrounding the proposal are expected to continue in the coming months.