Key Insights:

- Amid the ongoing crypto crash, Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have taken a particularly hard hit.

- 151,480 traders were liquidated in the past 24 hours, with total liquidations amounting to $500.40 million.

The ongoing crypto crash is wiping out millions of dollars’ worth of traders’ positions daily due to the escalating geopolitical tensions between Israel and Iran. Amid the crash, major assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have taken a particularly hard hit, sparking panic among investors and traders.

Top Cryptocurrencies Plunges

Bitcoin and Ethereum, the world’s two largest cryptocurrencies, fell sharply from $107,761 to $103,368 and from $2,618 to $2,453, dropping nearly 4% and 7%, respectively, in the past 24 hours.

Similarly, Solana followed suit, tumbling by 7% from $154 to $145, while other altcoins like Cardano, Dogecoin, XRP, and Hyperliquid experienced even steeper losses.

This notable market sell-off is the steepest crypto crash of 2025 and is now raising concerns about a prolonged downturn.

Key Factors Behind the Crypto Crash

The potential reasons behind the crypto crash are the ongoing tensions between Israel and Iran over nuclear power status and the liquidation of millions of dollars worth of crypto assets.

The crypto crash began on June 13, 2025, when Israel launched airstrikes on Iran’s nuclear sites, military installations, and residential areas. During the attack, several of Iran’s military leaders and top nuclear scientists were killed, and both a the nuclear facility and a the uranium conversion facility were destroyed. Since then, the crypto market has been crashing every single day.

According to the on-chain analytics firm Coinglass, 151,480 traders were liquidated in the past 24 hours, with total liquidations amounting to $500.40 million. The largest single liquidation order occurred on OKX — BTC-USDT-SWAP — valued at $4.16 million.

Of this substantial liquidation, the majority came from the long side. Coinglass revealed that $421.65 million worth of long positions were liquidated, while short positions saw $80.57 million in liquidations.

The crash has sent shockwaves through the crypto community, with fear and uncertainty dominating investor sentiment. Social media platforms were flooded with concerns over another potential bear market phase.

On-Chain Metrics Reflect Investors Rising Interest

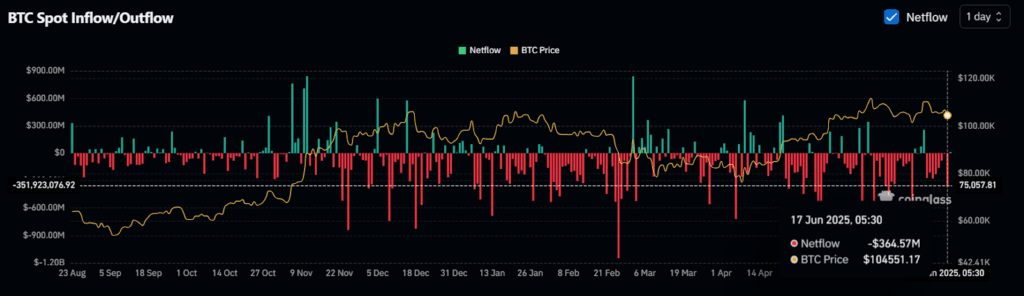

Despite the notable price crash in the crypto market, exchanges across the cryptocurrency landscape have been witnessing significant outflows, as reported by the on-chain analytics tool Coinglass.

Data from spot inflow/outflow reveals that exchanges saw a substantial outflow of $364.57 million worth of BTC in the past 24 hours. This is the highest recorded outflow since June 6, 2025, indicating potential accumulation by investors and long-term holders. Such accumulation could help reduce selling pressure and limit further downside momentum.

Meanwhile, this outflow was not limited to BTC but was also observed in ETH, SOL, and other cryptocurrencies. This suggests that investors and long-term holders are potentially seizing the dip as an opportunity to add more to their holdings, setting a perfect example of the “Buy-the-Dip” strategy.

What’s Next for the Market?

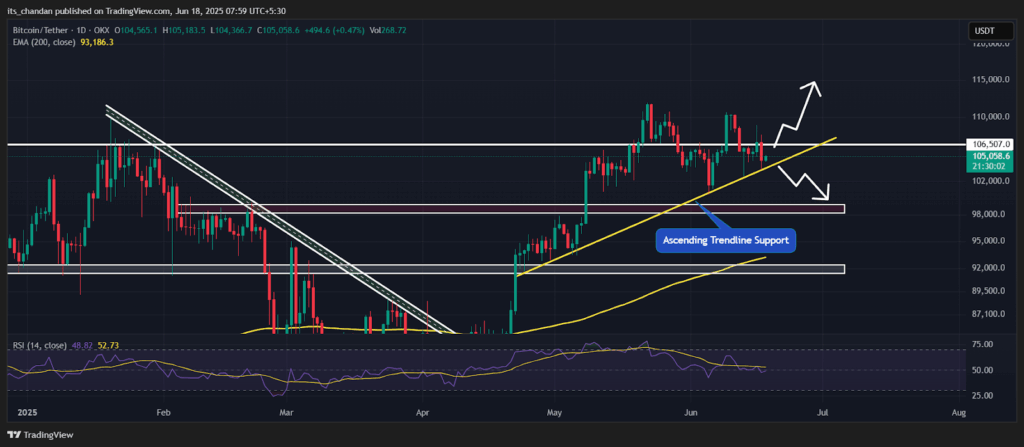

Expert technical analysis reveals that Bitcoin is still in its prolonged consolidation zone between $104,300 and $107,000. Additionally, on the daily time frame, BTC remains in an uptrend and has been consistently taking support from an ascending trendline. Currently, the price is sitting at this key trendline support level.

Historically, since late April 2025, whenever the asset’s price reached this trendline support, it has typically experienced upward momentum. However, the price is currently moving sideways due to the ongoing conflict.

Based on recent price action, if BTC fails to hold this support and breaks below it, there is a strong possibility of downside momentum, with the price potentially falling below $100,000, a move that could trigger a broader crypto crash.

BTC’s Relative Strength Index (RSI) stands at 48, indicating a neutral sentiment in the market, neither oversold nor overbought, suggesting a balanced price action currently.