Key Insights:

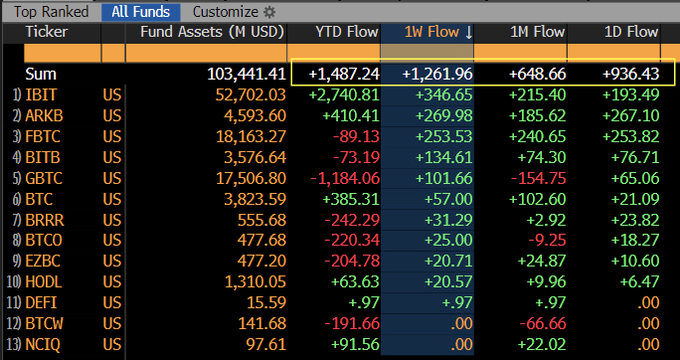

- Spot Bitcoin ETFs in the United States recorded $1.2 billion in net inflows this week.

- Total assets under management in these ETFs reached $103.4 billion.

- Bitcoin’s price rose above $93,000, hitting $93,712 for the first time since early March.

Spot Bitcoin ETFs listed in the United States recorded significant net inflows this week, totaling $1.2 Billion.

These new market operations increased the value of managed assets in these products to $103.4 Billion. The rising institutional demand resulted in Bitcoin breaking past $93,000 in value.

Almost $1 Billion of new capital flooded ETFs throughout Tuesday, marking the main period of rising interest.

The market activity peaked when Bitcoin crossed $93,712, marking its highest value since March. Different funds receive institutional capital indices that indicate widespread involvement in the sector.

The rising level of futures activity matched the incoming spot flows because institutional traders continue to use leverage in their cryptocurrency trades.

Glassnode recorded rising open interest amounting to $2.4 Billion in only 36 hours.

Market analysts believe that retail investor involvement will catalyze the continued success of the current price rise.

BlackRock IBIT Leads Bitcoin ETF Inflow Surge

The iShares Bitcoin Trust by BlackRock brought in $346.6 Million as spot ETF inflows during the previous seven days.

IBIT exhibited continued leadership by collecting $2.7 Billion in year-to-date funding sources.

Both other ETFs gained but did not achieve the level of performance shown by IBIT during this period.

During the year, ARKB secured $269.98 million weekly inflows, which accumulated to $410.41 Million.

The BTC-focused funds operated by Grayscale experienced slower growth since they collected $385.31 Million as year-to-date net inflows.

Since January, GBTC has experienced capital loss because investors withdrew $1.18 Billion.

GBTC losses failed to affect the ETF market because ten out of eleven funds experienced rising demand.

The distribution of funds showed positive improvement due to institutional investors who began or increased their investment operations.

To continue growing upward, attracting buyers beyond institutional entities and their resources will be necessary.

Bitcoin Demand Surges Amid ETF Momentum

Bitcoin investment products observed the highest demand among all digital assets by attracting the most capital inflow in the recent reporting period.

Digital asset products distributed by CoinShares have recently experienced strong overall demand, yet Bitcoin has collected most of the interest.

The investment pattern aligns with developments regarding ETF investments observed recently in the U.S. market.

Short Bitcoin products maintained poor performance this week by generating $1.2 Million in withdrawals and accumulating total withdrawals of $36 Million within seven weeks.

These outflows exceeding 40% constitute the total managed assets of that category. The negative stance toward short positions continues to exist, strengthening the bullish market outlook.

Rising open interest in futures distorts the balance between leverage and spot buying transactions.

Long-term support for Bitcoin will depend on retail market activity because analysts predict that volatility requires retail users to stabilize prices.

Prices may experience stress because existing demand from all customer sectors is required to maintain stability.

Ethereum Products Face Pressure While XRP Attracts Capital

Ethereum-focused investment products recorded a negative weekly flow of $26.7 Million, and the negative trend has persisted for eight straight weeks.

The total money flowing out of Ethereum investment products has reached $772 Million this time, even though it is the second-biggest cryptocurrency after Bitcoin.

The use of capital resources towards Ethereum remains restricted, even though the ecosystem holds its strength.

Year-to-date inflows for Ethereum total $215 Million, the highest amount among most altcoins during this period.

The market maintains a pessimistic outlook because recent flow data shows no significant turnaround.

Investors watch closely to see if capital will come back to Ethereum, considering the market dynamics and rising competition.

XRP investment products attracted $37.7 Million in new capital recently while accumulating $214 Million since the start of the year.

XRP’s market performance followed a different path from that of the other altcoins, which continued to lose market value.

The increasing institutional interest in XRP signals that institutions now specifically follow macroeconomic events and legal updates about the cryptocurrency.

Geopolitical Shifts Support Bitcoin Growth

surpassed the $93,000 mark primarily based on institutional demand, but future price stability depends on retail market investment.

Experts believe that leverage trading cannot keep the market uptrend going forever unless the spot markets see significant retail investment.

Stabilizing prices through retail involvement would decrease the magnitude of market corrections.

The sentiment has been influenced by geopolitical developments and macroeconomic events throughout the recent period.

Officials gave signs they would reduce the tension between the U.S. and China regarding trade policies while maintaining stability at the Federal Reserve leadership.

These developments helped improve risk appetite and created a favorable backdrop for Bitcoin ETF flows.