Key Insights:

- US Securities and Exchange Commission (SEC) is expected to approve multiple crypto ETFs, including altcoins, by late 2025.

- Over $1 billion in crypto ETF liquidations occurred as Bitcoin fell below $99K during weekend selloff

- Ethereum ETFs saw sustained inflows in June, while Bitcoin ETF activity remained volatile.

Crypto ETFs in the United States have shifted decisively, and analysts have increased the chances of their approval to a significant percentage. This coincides with indications of positive interactions between SEC and major asset managers, making it more certain that large volumes of digital asset ETFs will be approved.

In addition, the developments follow surging demand for existing products such as Bitcoin ETFs and coincide with geopolitical concerns that have pressured the crypto market.

Analysts Raise Approval Odds for Major Altcoin Crypto ETFs

According to Bloomberg ETF analysts Eric Balchunas and James Seyffart, the U.S. SEC has shown positive engagement on pending crypto ETF applications. As a result, the analysts placed approval odds for several products at up to 95%.

Moreover, this expectation covers spot crypto ETFs for Solana (SOL), Litecoin (LTC), XRP, and Dogecoin (DOGE). The analysts suggest the SEC is likely to classify these assets as commodities, which would place them outside its securities jurisdiction.

While the analysts anticipate further progress, they noted that approvals may not materialise before October 2025. Seyffart stated that the timeline could stretch beyond this date, depending on procedural steps.

Crypto ETFs Regulatory Status and Application Tracker

A tracking table of current filings revealed extensive activity by large firms, including Grayscale, Bitwise, and Canary. These asset managers have filed S-1 and 19b-4 forms on different crypto ETFs that would cover altcoins such as Polkadot, HBAR, and Avalanche.

Further, the SEC has acknowledged most filings, setting final decision deadlines between October and December 2025. Approval probabilities for these assets range from 90% to 95%, according to analysts. The basket or index product, which would package several digital assets into one fund, has a projected approval likelihood of 95%.

However, certain assets are subject to regulatory uncertainty. SUI has a 60% probability of approval with no clear classification as a security or a commodity. Tron (TRX) currency has no tie-in odds, and the decision is still pending until 2026, with SEC yet to provide guidance.

Bitcoin and Ethereum Crypto ETF Momentum and Market Volatility

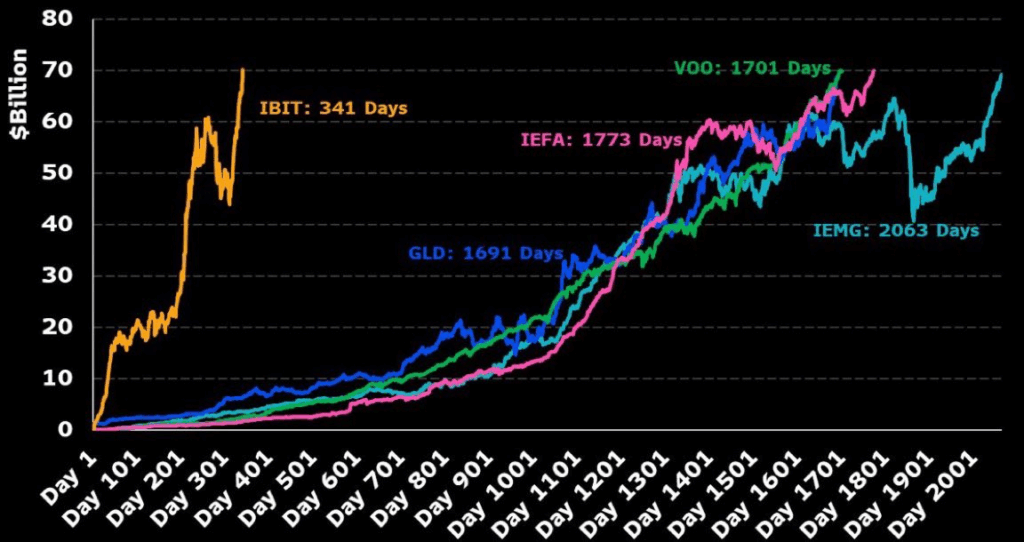

BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed $70 billion in assets under management within 341 days. IBIT is now the fastest-growing ETF in U.S. history, with 31 consecutive days of net inflows. By contrast, traditional ETFs like GLD and VOO took over 1,600 days to reach similar milestones. IBIT’s rise highlights institutional demand for regulated bitcoin exposure.

Meanwhile, Ethereum ETFs show slower progress. Glassnode data revealed that most ETH crypto ETF holders remained underwater as of May 2025. Although inflows rose on June 10–11, price gains were modest. Broader crypto market volatility also spiked as Bitcoin fell below $99,000 amid geopolitical tensions.

According to CoinGlass report, over $1 billion in liquidations, with institutional ETF inflows slowed sharply heading into the weekend.

Crypto ETF Speculation Signals Altcoin Rotation

With increasing optimism about a potential XRP crypto ETF, analysts suggested the move may trigger more capital rotation into altcoins. An institutional endorsement would indicate that XRP and, by extension, the rest of the large-cap and mid-cap digital assets would have greater institutional legitimacy.

According to a report, this shift could mirror the capital flows seen after spot bitcoin ETF approvals earlier in the year.

One of the biggest winners of this narrative is Solana, which has recorded solid network performance and increased developer activity that has already gained new institutional interest.

Notably, crypto ETF market may soon no longer be limited to Bitcoin and Ethereum, should the current momentum with U.S regulators hold.