Key Insights:

- Solana dipped over 18% after rejecting from key resistance near $180, forming a cup-and-handle failure pattern.

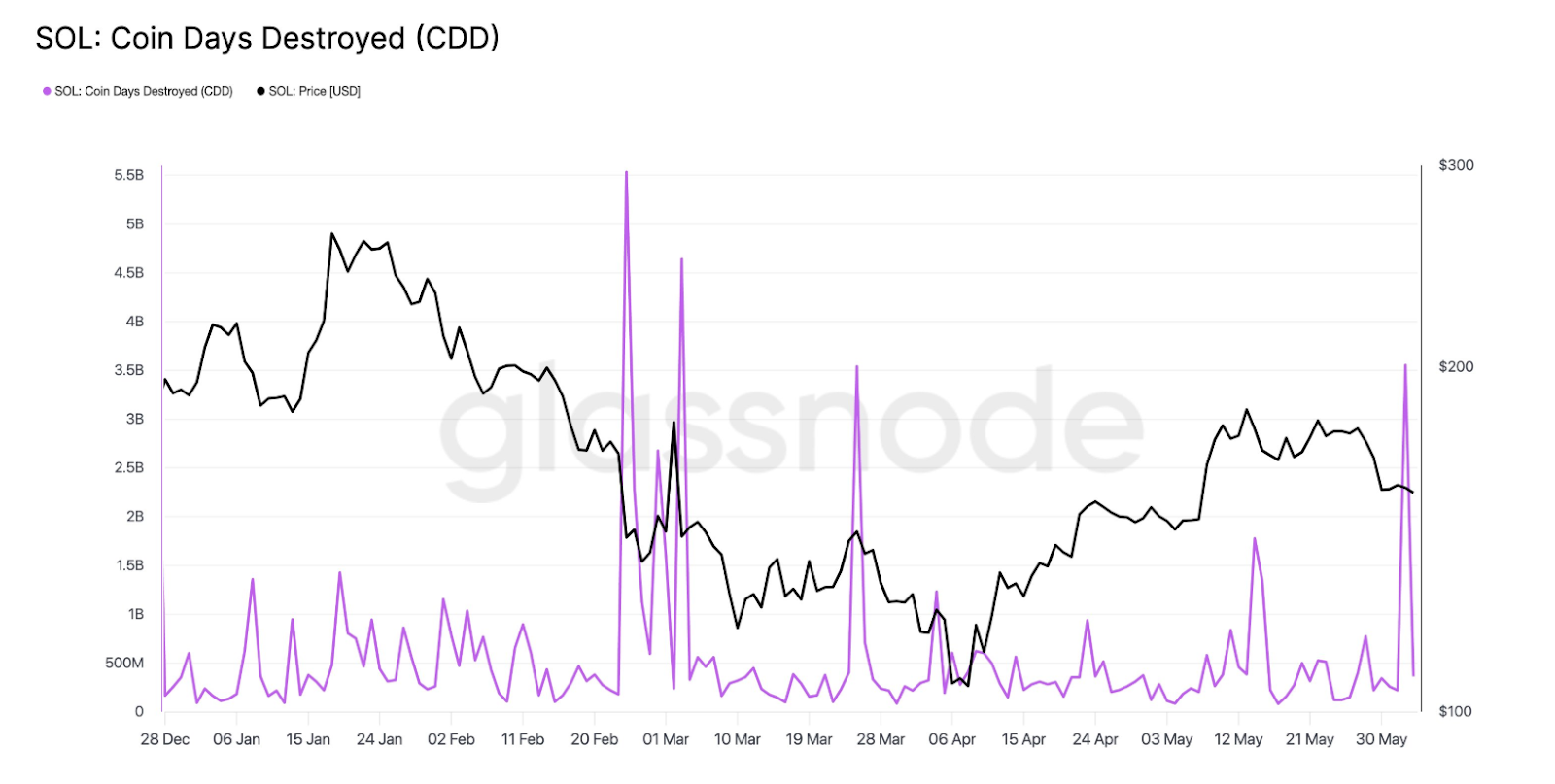

- Whale sold over 44K SOL post-staking rewards as Coin Days Destroyed spiked to its third-highest YTD level.

- Daily active users and network speed remain elevated, supporting the bullish outlook despite short-term correction.

After being rejected from a key resistance level near $180, Solana has dropped 18.6% to around $140.

Despite the pullback, key on-chain data such as whale movements and Coin Days Destroyed are showing healthy market activity.

Combined with strong fundamentals and high user engagement, these indicators suggest a possible bullish reversal if key support levels hold.

Solana Rejected at Key Resistance, Triggers Short-Term Decline

According to Lookonchain, whale ZkSjmB recently unstaked and sold 44,539 SOL worth $6.8 million on Binance. The wallet had acquired the position a month earlier, buying 44,116 SOL for $6.15 million at an average price of $139.4 per token.

As a result, the asset dropped 7.40% intraday, falling below the $140 level. The move reflects opportunistic profit-taking and short-term caution, despite Solana’s strong long-term fundamentals.

The price rejection of Solana recently happened at a major resistance zone around $180, which completed a cup and handle pattern before reversal.

However, from a technical structure perspective, the bias is short-term bearish, and $134–$145 is a key support range. The price is consolidating in this critical zone, which was a springboard for the previous rally.

RSI and MACD are heading into oversold territory, which could result in a technical rebound in the short term. If the retest and bounce from current levels are successful, the next upside target is projected to be near $170.

However, sentiment has not turned negative. As long as support holds, a reversal remains possible. This correction comes on the back of a sustained uptrend, and similar patterns in past cycles have often continued upward. As a result, this looks like a healthy retracement and not a broader downtrend.

Whale Selling and Dormant Coin Movements Raise Eyebrows

Blockchain data confirms that whale activity increased recently. One major holder unstaked and sold over 44,500 SOL worth $6.8 million.

This wallet had staked SOL a month ago, accumulating 422 SOL in rewards before exiting the position with an estimated $649,000 profit.

Although this selling pressure contributed to the price pullback, it did not spark broader market panic.

Coin Days Destroyed (CDD) for SOL also spiked to 3.55 billion, which is the third-highest spike of the year. Such a rise in CDD suggests movement from long-dormant wallets, which is usually a sign of a change in conviction or profit-taking.

This metric has spiked in the past, and those spikes have correlated with trend shifts, so it’s a key signal to watch in the coming days. Most importantly, the on-chain movement does not point to mass exits or changes in holder behaviour.

In fact, the data indicates that the tokens are being redistributed rather than major liquidation events during a price pause.

Network Activity and Developer Metrics Reinforce Strength

The recent correction hasn’t changed Solana’s fundamentals. It still averages 1,000 transactions per second (TPS). This throughput beats many competitors and is able to keep up with growing demand from DeFi, NFT, and gaming applications on the network.

Solana has an advantage in a high-speed environment during periods of peak on-chain activity. The number of daily active users has been steadily growing and now stands at 4.4 million, which indicates a more engaged user base that is interacting with decentralized applications on a daily basis.

With increased participation comes an increase in the network’s Total Value Locked (TVL), which has risen to $8.37 billion from $6.09 billion in mid-April. With this 37% increase, capital inflows are renewed, and ecosystem activity is expanding.

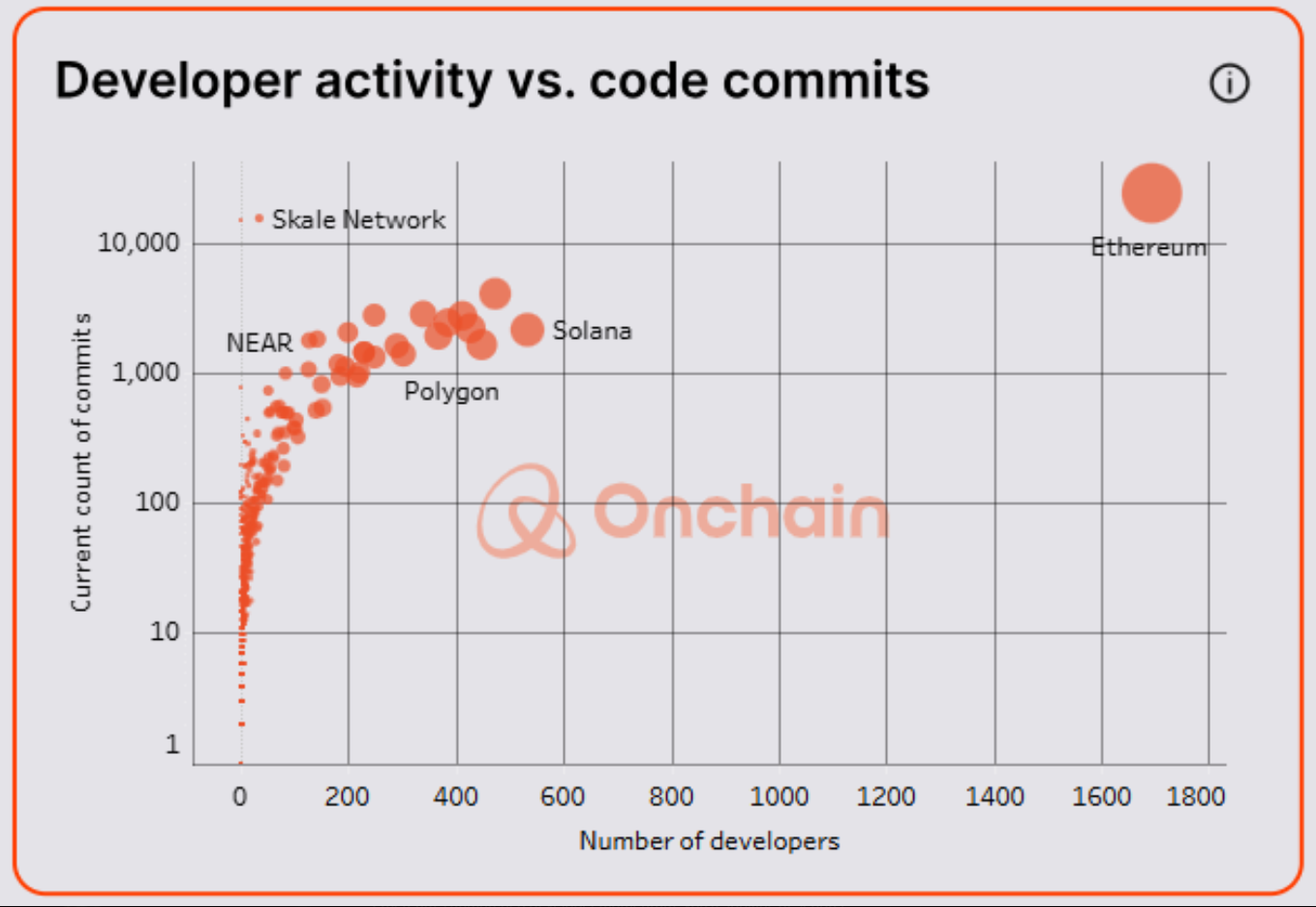

Also, over 500 monthly active contributors make Solana one of the top chains in developer activity. It ranks second only to Ethereum in code commits and development engagement, which is a strong signal of long-term confidence in the network’s scalability and utility.

At the same time, the 0.87 long/short ratio suggests short-term trader caution, but such positioning is often followed by price rebounds when fundamentals remain sound.