Key Insights:

- VanEck has filed for a BNB ETF, making it the first proposed exchange-traded fund directly tied to Binance Coin.

- The filing has raised speculation that Binance founder Changpeng Zhao influenced the decision through his recent comments on crypto reserves.

- BNB’s price remains around $599.6 and is positioned within a volatile liquidation zone that may lead to rapid price swings.

Asset manager VanEck has filed for a BNB ETF, triggering market speculation and regulatory discussions. The filing happened simultaneously with Binance founder Changpeng Zhao’s recent discussion of national crypto reserves. Industry experts are investigating whether Zhao had a substantial impact on VanEck’s decision.

Eric Balchunas from Bloomberg’s ETF analytics team connected VanEck’s ETF application with Zhao’s statements. VanEck made this move based on Zhao’s advocacy to include BNB in sovereign digital asset reserves. Despite remaining speculative, the timing matches Zhao’s public appearances and bolsters this theory’s acceptance.

The filing about Binance Coin here captures broad market attention because it could represent the industry’s first Binance Coin melody-based ETF. The recent action by VanEck points toward institutional interest but raises important questions about the matter.

Market reactions toward Binance’s structure and regulatory troubles continue to affect perceptions of this development.

VanEck BNB ETF Sparks Influence Debate

The decision by VanEck to file for a Binance Coin ETF exchange-traded fund created intense conversation within digital asset platforms and traditional financial institutions. This filing occurred when Changpeng Zhao started integrating BNB into worldwide digital asset reserve programs. The connection between Zhao and traditional financial institutions has generated speculation about his unknown role in intervention.

At present, Zhao’s BNB adoption suggestion to governmental bodies has possibly led VanEck to position itself in emerging trends before they became popular. The strategic discussions influenced VanEck CEO Jan VanEck’s decision, per Balchunas. The action presents an important example of how structured entities shape unstructured financial resources.

Zhao’s lack of official documentation about his involvement increases the evidence supporting this theory. The focus shifts to how Binance conducts its relationships with global regulators and institutions.

According to the new filing, institutional investment vehicles showcase rising interest in digital currency options that go beyond Bitcoin and Ethereum.

Regulatory Concerns Challenge ETF Outlook

The BNB ETF filing has brought back into focus longstanding questions about Binance’s management structure and regulatory track record. Public skeptics point out Binance Coin’s substantial centralized management as a major factor limiting its eligibility to become a regulated ETF.

The filing has revived worries about Binance’s proper compliance after previous regulatory actions, together with current analysis of its regulatory track record.

Analysts in the market argue that launching a BNB exchange-traded fund would increase regulatory oversight constraints on Binance and its associated operations.

The new filing poses difficulties for U.S. regulatory bodies, which already demonstrate restrained support for crypto security products. Zhao’s involvement in sovereign reserve suggestions creates added regulatory uncertainty.

Critics define the ETF proposal as dangerous because it creates an excessive connection between exchanges and financial products subject to regulation.

Experts warn that exposing classic market systems to vulnerabilities in the crypto revolution could result from this development.

Holding an approval for the ETF represents a crucial step forward in bringing alternative digital assets into mainstream markets.

Potential BNB Price Movements Show Mixed Signals

BNB’s price stagnates around $599.6 despite growing expectations about potential exchange-traded funds (ETFs). The token’s current elevated price point exists alongside fluctuating market sentiments because traders are spread between long and short positions according to derivative market indicators.

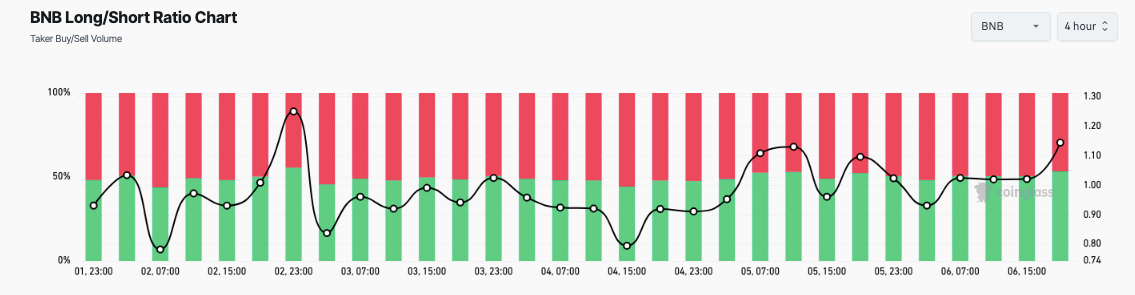

Data shows the long/short ratio crossing above 1.1, demonstrating growing long position engagement despite short dominance on the market.

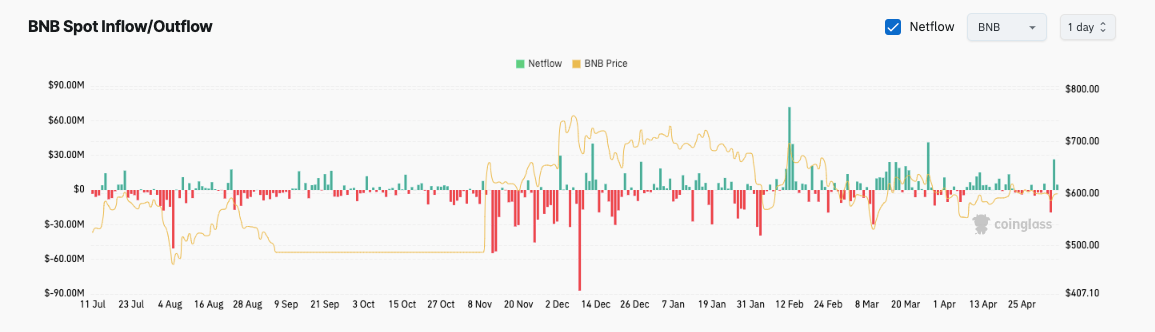

BNB tokens continue to show accumulated demand in spot market exchange transactions since they remain in net draw.

Multiple Spot Inflow/Outflow data months showed red bars indicating low token exchange inflows. ETF developments encourage market participants to move BNB off of exchanges through sustained withdrawals.

Technical examination of exchange transaction data confirms intense market engagement near price points $570 and $630 because they act as significant buying and selling pressure areas.

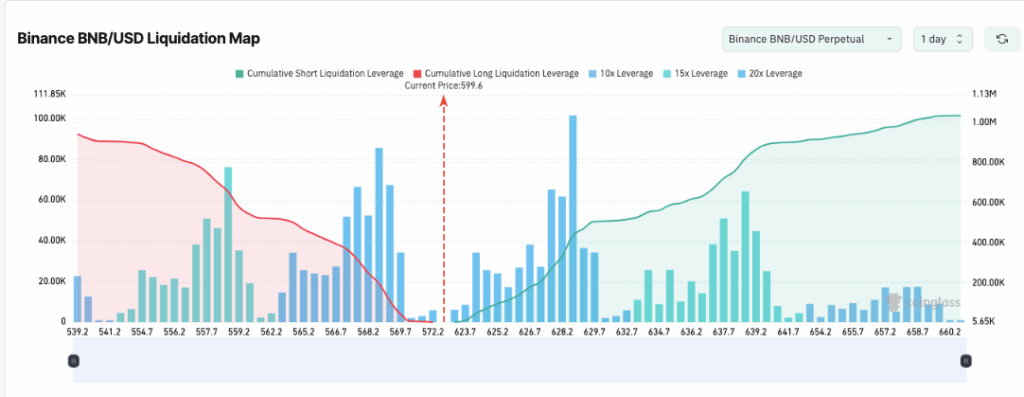

Highly leveraged traders face major liquidation risks when operating near the marked BNB/USD thresholds on the liquidation risk map. When prices cross either zone it triggers major liquidations and high short-term market turbulence.

Liquidation Map Highlights BNB Danger Zones

The BNB/USD liquidation map shows distinct price areas that could trigger sudden forced liquidations of positions.

Short position liquidations concentrate beneath $570, and long position risks exist above $630, creating a restricted zone of elevated risk.

If prices drive outside either boundary point, the futures market will experience a cascade of events.

The risk levels extend from $565 up to $575, and $625 through $640 become more hazardous when employing leveraged positions at 10x and 15x.

If these levels are crossed, the price levels host substantial open interest that will generate excessive market volatility. The increased leverage pressure produces conditions that could trigger sudden price movement.