Key Insights:

- XLM crypto price is forming a five-wave impulse from $0.23, targeting a macro top near $6.50.

- The 0.786 Fibonacci level and falling wedge pattern suggest a breakout may lead to $0.4584–$0.6719.

- Support at $0.20 remains intact; invalidation only occurs with a weekly close below this demand zone.

Stellar (XLM) crypto price showed preliminary indicators of recovery in the short-term, mid-term, and long-term timeframes. Technical analysts highlighted a bullish formation in momentum as well as structure.

Meanwhile, XLM crypto price movement has placed the altcoin near several high-confluence support zones. Further, the analysts suggested that the trend could develop into a broader reversal phase if key levels hold and volume supports follow.

XLM Crypto Price Build Long-Term Structure Toward $6.50

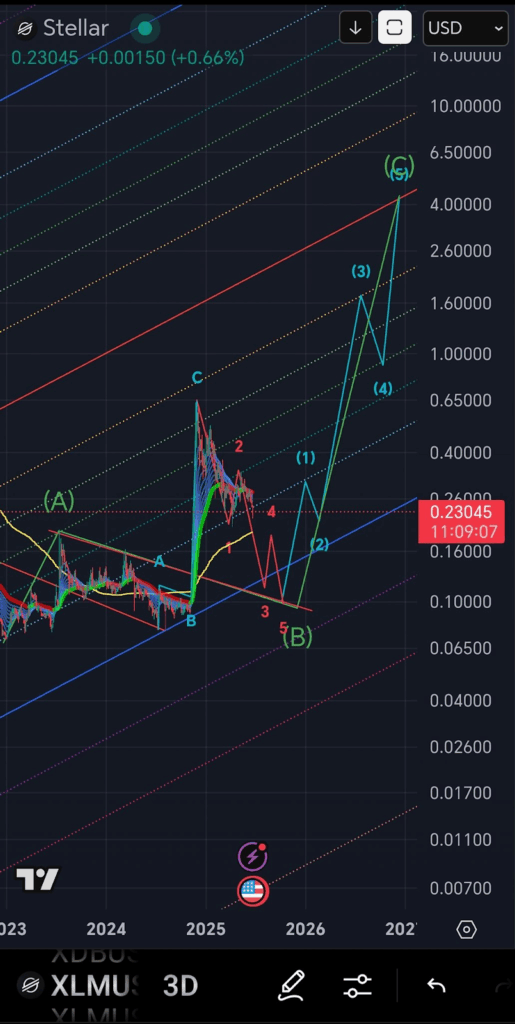

According to analyst CaptToblerone, XLM crypto price has completed a corrective ABC pattern on the 3-day chart. The conclusion of wave (B) near the $0.16–$0.18 support level signaled the start of a new five-wave impulse.

Wave (1) is developing, and wave (2) is also expected to retrace into the blue trendline. This has in the past served as a point of support and justifies its application in the current installation.

Furthermore, Fibonacci and regression channels drawn by the analyst indicated the structure of a breakout with points of resistance at $0.65, $1.60, and $4.20. An upper target of the wave formation is calculated to reach the mark of $6.50, where wave (5) of the multi-year bullish trend will be found.

More so, it indicated the potential for an over 2,700% increase in Stellar crypto price relative to positioning in the event that Elliott Wave roadmap plays out as projected. The pattern comprises structural wave transitions and high-precision regression tools.

Analysts Point Out Base as XLM Crypto Price Holds Support

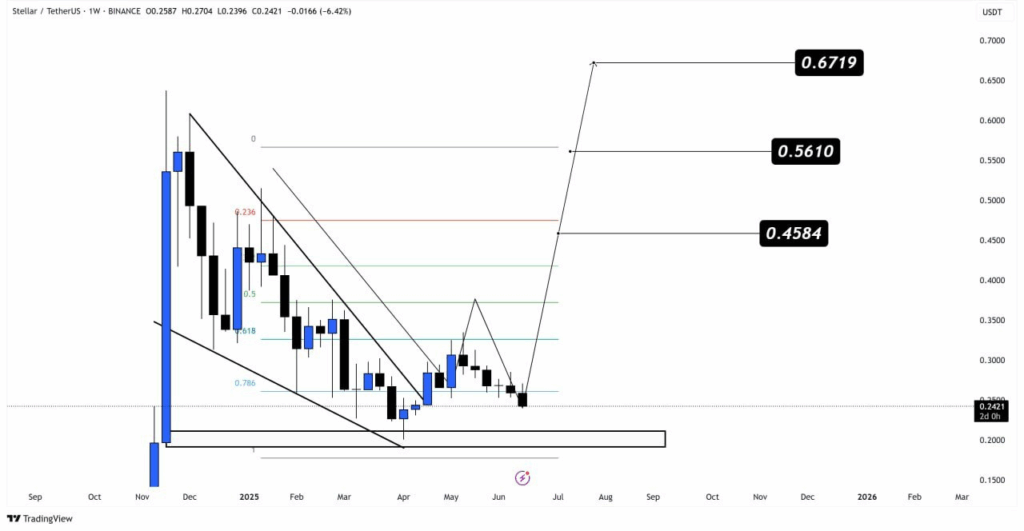

Additionally, analyst VipRoseTr made a weekly analysis, which revealed a descending wedge profile. XLM crypto price recently touched the score of 0.786 Fibonacci, which is considered an important confluence point that leads to trending reversals.

Subsequently, XLM crypto price has held above a clearly defined demand zone around $0.20, suggesting that downside pressure may be weakening. A sustained weekly close above the wedge resistance could confirm the bullish reversal setup.

According to the analyst, projected Fibonacci-based targets include $0.4584, $0.5610, and $0.6719. Each of these aligns with historical resistance points from previous consolidation cycles in Stellar coin trading history.

Besides, the falling wedge is considered valid unless XLM crypto price closes below $0.20 on the weekly chart. As long as demand zone remains intact, the analyst pointed to medium-term upside continuation.

XLM Crypto Price Signal Bullish Momentum Continuation

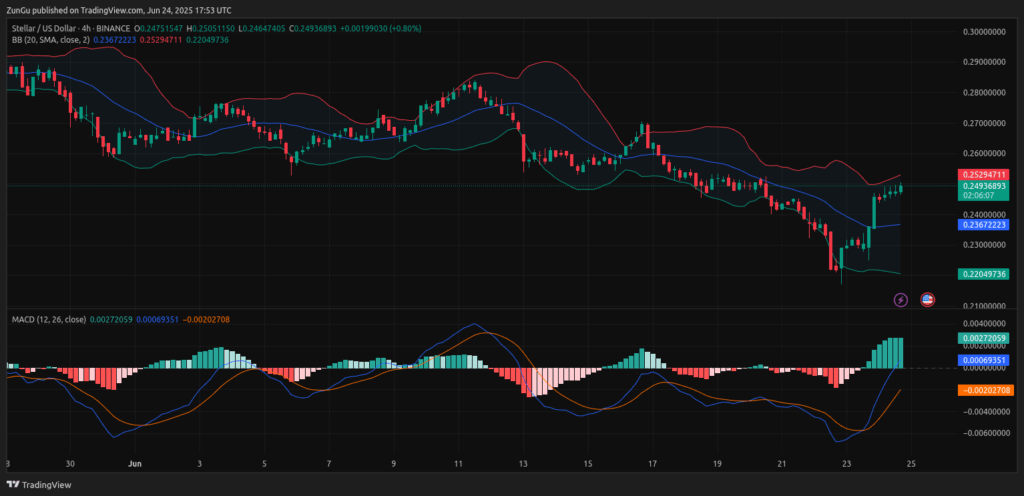

Moreover, the most recent analysis identified a bullish MACD crossover, whereby the MACD line (0.0027) moved above the signal line (0.00003). The growing histogram portrayed the growth of purchasing momentum in the short term.

In addition to that, this crossover follows XLM crypto price surge from $0.22 to around $0.2479. Also, technical formation confirmed that short-term market sentiment is shifting toward bullish control.

On the other hand, XLM crypto price broke above the mid-band of the Bollinger Bands at $0.2365. While pressing against the upper band at $0.2522.

Consequently, this push into the upper volatility channel suggested overextension but also indicated trend continuation if the resistance is broken. Immediate resistance remained at $0.2522, with extension expected near $0.26.

Therefore, if a pullback takes place, support will emerge around $0.2365 and $0.2280. This short-term structure contributes to the broader bullish case for Stellar crypto price.

While risk remained in the event of invalidation at key support zones, structural signals favor a medium to long-term bullish phase for XLM crypto price prediction. Stellar coin investors face a high-confluence technical setup supported by multiple indicators.

Additionally, Stellar crypto price is currently trading around $0.24. When placed within the broader market structure, XLM stands out among the altcoins, showing early reversal strength.