Key Insights:

- Dogecoin remains steady at $0.18 while market signals point to a possible major breakout.

- Technical charts show an inverse head and shoulders pattern, suggesting a bullish reversal.

- DOGE has moved above the 50-period moving average, indicating growing support at current levels.

Dogecoin (DOGE) price has remained rangebound at nearly $0.18, but recent market activity signals a potential major price breakout.

Accumulation by large holders and technical indicators suggest a bullish shift is brewing. A short squeeze scenario could unfold if key resistance levels break soon.

Dogecoin Shows Bullish Patterns Amid Whale Accumulation

Dogecoin’s price continues to consolidate at $0.18, forming a base that could support a sharp upward movement.

Technical indicators show that during its steady trading pattern, a strong pattern formation developed in the previous several months.

The 8-hour time frame shows an upside-down head-and-shoulders formation, predicting an upward price movement.

A standard technical signal developed when the price reached $0.1305 and its shoulders raised diagonally upward, thus shaping an ideal pattern for eventual upward movement.

The price has successfully surpassed its 50-period moving average, which strengthens support for its present position. The price level combination enhances the possibility that traders will reach the $0.2087 zone.

A price exceeding $0.2087 could lead to $0.2420 as the March 2 peak. The upcoming resistance area will be the $0.2087 area as the next obstacle before reaching greater targets.

The price momentum will grow stronger when trading volumes rise during an upward breakout at $0.21.

Analyst Predicts Dogecoin Surge to $1.1

A market analyst has identified a megaphone pattern on the weekly Dogecoin chart since October 2023.

Regular decreases in highs within this pattern lead to higher resistance boundaries that signal high market volatility and possible price breakouts. A significant resistance level exists near $0.50, which defines the top part of this chart structure.

Since the beginning of 2022, the price has followed a consolidation stage accompanied by renewed purchasing momentum.

The initial price surge for Dogecoin was initiated in October 2022 and reached its apex during April 2024 with an increase of 290%.

The second price increase was initiated in September 2024 before reaching its peak point in December of the same year.

According to the same analysis, DOGE will likely escalate to $1.1 after September 2025. The predicted long-term target for this analysis relies on the megaphone pattern achieving an upward resolution with strong momentum properties.

The mental target of $1 functions simultaneously as a historical landmark and a previous challenge area.

Whale Buying Activity Strengthens Bullish Sentiment

Large-scale holders have continued accumulating Dogecoin over the past two months, fueling speculation of an upcoming breakout.

On May 1, blockchain data revealed a purchase of 100 million DOGE within seven days. At current levels, that amount equals over $18 million.

Since March 7, whale investors have demonstrated substantial growth in their Dogecoin holdings, which started this wider purchase pattern.

Wallets holding between 1 million and 10 million DOGE rose from 10.3 billion to 10.59 billion, marking an addition of 290 million DOGE in less than two months.

Large marketplace stakeholders show their market confidence through their holding decisions of coins in long-term investments.

Market movements with strong effects tend to happen after this behavior, particularly during retail demand growth.

The continuous accumulation of DOGE could reduce total supply levels, directly leading to a short squeeze effect.

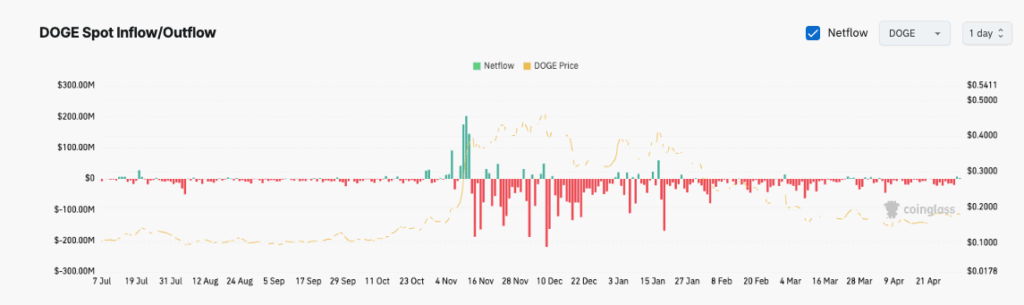

Exchange Netflows Suggest Holders Are Taking DOGE Off Platforms

CoinGlass data indicates continuous exchange outflows surpassing inflows since the beginning of November 2024.

External wallet transfers from exchanges imply that traders move cryptocurrency into secure wallets for long-term storage. According to this recent trend, the market-wide selling pressure is shrinking.

Before November 2024, DOGE experienced balanced netflows with low fluctuations between exchange inflows and outflows.

During the initial part of November, exchange activity demonstrated substantial growth, reaching $200 Million in total inflows.

Exchanges faced heavy selling activity, creating this dramatic influx of cryptocurrencies in early November 2024.

The market has experienced negative netflows since the $200 million peak because it has shown over $50 million daily outflows from April 2025 onward. Exchanges experience constrained supply during this time period because market participants react to this situation by preparing for upcoming substantial price adjustments. The diminished supply of DOGE tokens on exchange markets may lead to a price increase whenever demand temporarily increases.

Short sellers could face liquidation if DOGE breaks past $0.2087 and holds above $0.21. The spike in rapid price movement would start when short sellers rush to cover their positions while the price advances toward $0.2420, potentially exceeding it. When this situation occurs, momentum tends to quicken its pace within several days.