Key Insights:

- ONDO leads the RWA sector in social engagement and chart strength.

- Triple-tap demand zone suggests a high-reward, low-risk trade setup.

- Total value locked and revenue metrics support bullish ONDO outlook.

Recent statistics revealed that ONDO crypto leads Real World Asset (RWA) project analyses in terms of social media activity.

By June 25, 2025, ONDO is deemed to have more than 4,090 posts and 433,000 interactions on various platforms translating to the highest social dominance score of 0.40 percent among all the RWA competitors. This beats the likes of SKY (0.30%), Zebec Network (0.30%), and ELYSIA (0.20%).

The supremacy of ONDO crypto is not just a weight loss issue on the exchange, rather, it evidences spiraling community activity when the token is recording some of the technical buy signals.

This retail interest and a healthy chart setup has brought ONDO Crypto in the limelight of the traders as well as the long term RWA followers.

Third Tap into Demand Zone Sparks Accumulation Setup for ONDO Crypto

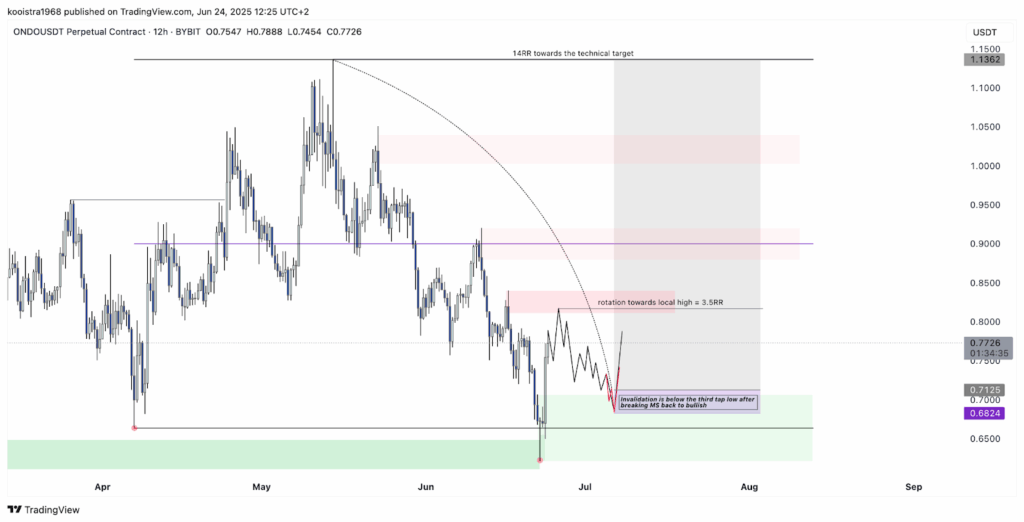

The 12-hour chart and 3-day chart give an impression of the current structure of the market of ONDO.

Price action on the 12-hour chart, put what looks like a textbook triple tap accumulation pattern evolving and the most recent move confirms the mitigation of an extreme demand developing in a higher time frame (HTF) market structure.

After the first and the second taps, the price fell again into the green area of demand making a third and clean base of support.

The area near the $0.68 to 0.71 still looks problematic as it is the level that indicates the invalidation of the currency.

This range of defense would be considered clean, and a gradual withdrawal capable of time-displacement between taps, would be a possible TCT Model 2 accumulation set up.

In case of confirmation of such a schematic, the technical target is close to $1.15, with a potential of about 14RR (risk-reward) motion.

Although the accumulation model might not be fully confirmed, there still is a statistical inclination towards the local high at the levels of around $0.90 to 0.95.

This in-between target is in line with the 3.5RR level which will enable booking profits partially with minimum downside exposure.

At this level a partial take of 25 percent provides a realized gain of +0.875 percent on a 1 percent risk trade. At the same time, it minimizes net exposure, resulting in a risk-off position in that you can break-even or make a nominal profit even in the case of price reversing.

This type of accuracy in entry minimizes emotional tension when making a trade and enables a trader to guard capital without removing him/herself of the possibility of additional gain should extension toward the technical level of the trade near the level of $1.15 follow through.

Higher Time Frame: ATH Break Could Lead to +200% Expansion on Ondo Crypto

In the 3-day chart, zooming out on ONDO crypto, its structure shows that the ongoing pullback exists within the context of a wider range created by the 2024 highs that followed in December around the 2.20 price.

Once the current range high at around $1.15 breaks and closes successfully, a previous advanced forex pattern, a level 2 Break of Structure (BOS), will be confirmed and a continuation of the rotation to new record highs will follow.

It is highlighted in the chart that it is necessary to check the change in the market structure at several levels.

The seller congestion at or around former highs might offer resistance, and should the current build up persist traders may see a subsequent ascension giving investors more than 200 per cent on current pricing of 0.77 dollars.

In addition to the technical and the sentiment, ONDO has the fundamentals working in its favor. As stated by DeFiLlama, the Total Value Locked (TVL) on the ONDO protocol demonstrates constant inflow and increased confidence in the protocol, and is at the level of 1.399 billion dollars at the time of writing. The rate of annualized revenue stands at 41.7 million whereas the fees have soared to 55.8 million. These figures have made it have a current market cap of 2.419 billion as well as a FDV of 7.657 billion.

A current price of $0.77 and the 24-hour trading volume of $125.66 million evoke the impression of a high level of liquidity and real-time demand, especially considering the growing TVL and the number of users of this token since the beginning of 2025.