Key Insights:

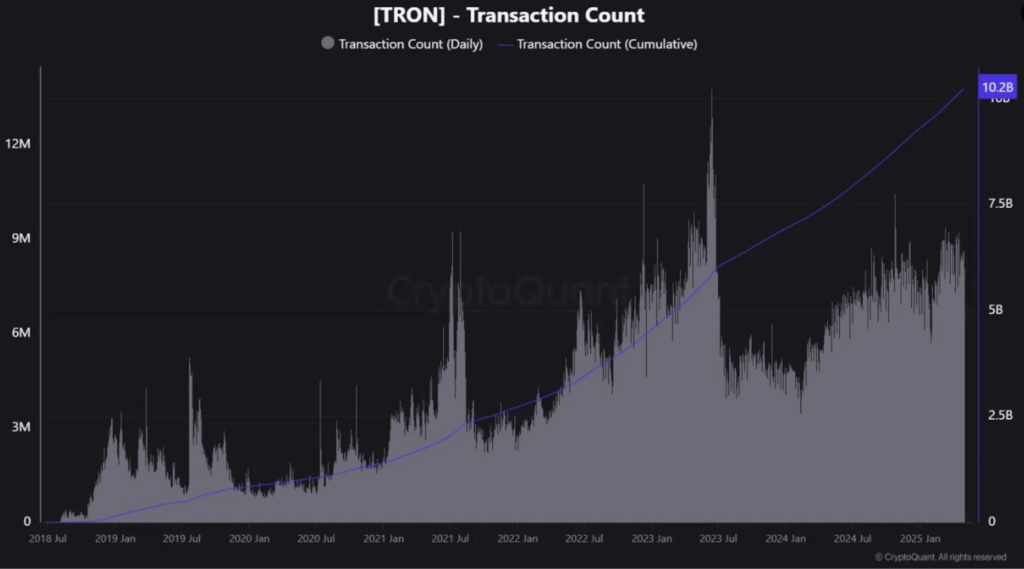

- TRON surpasses 10.2B transactions with 8.4M daily average, ranking among top active chains.

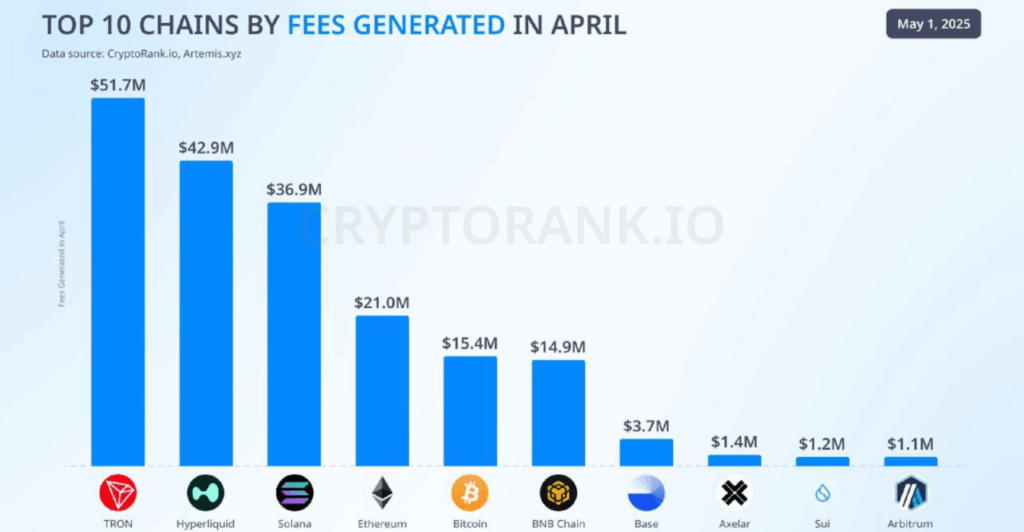

- April fee revenue hits $51.7M, outpacing Ethereum, Solana, and Bitcoin.

- TRX price eyes 14% breakout from triangle pattern as MACD signals build.

TRON (TRX) has passed a new usage milestone with 10.2 billion total transactions and nearly 8.4 million daily.

CryptoQuant says that this makes TRON one of the most active blockchain networks in the world.

Data shows that in 2021 and 2023, previous bull markets were followed by transaction spikes. But usage has continued to grow steadily even beyond those peaks.

Although volume patterns can change in the short term, the long-term growth of TRON’s network activity indicates that it is still a relevant network. It is especially true as on-chain demand stays constant.

TRON Leads All Chains in April Fee Generation

According to CryptoRank data, TRON was able to generate $51.7 Million in on-chain fees during April 2025.

This put it ahead of other major blockchains such as Ethereum ($21.0M), Solana ($36.9M), and Bitcoin ($15.4M).

The chart also reveals that TRON had a higher market usage than newer platforms like Base and Sui.

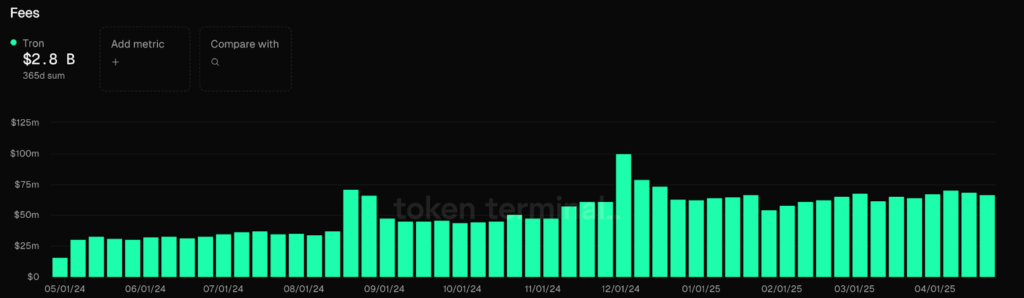

The earnings are part of a broader trend of fee growth that has been seen over the past year.

According to Token Terminal data, TRON raked in about $2.8 Billion in total fees over the past 365 days and has been earning between $50 Million and $100 Million per month.

In September and December 2024, fee volumes spiked in the month to $60 Million and $75 Million, respectively.

Often, high demand for block space and active user interaction are correlated with fee generation.

However, TRON’s fees are relatively low per transaction, though high fees on some chains are due to congestion.

Therefore, the high total is not due to fewer high-cost operations but to a large number of active users.

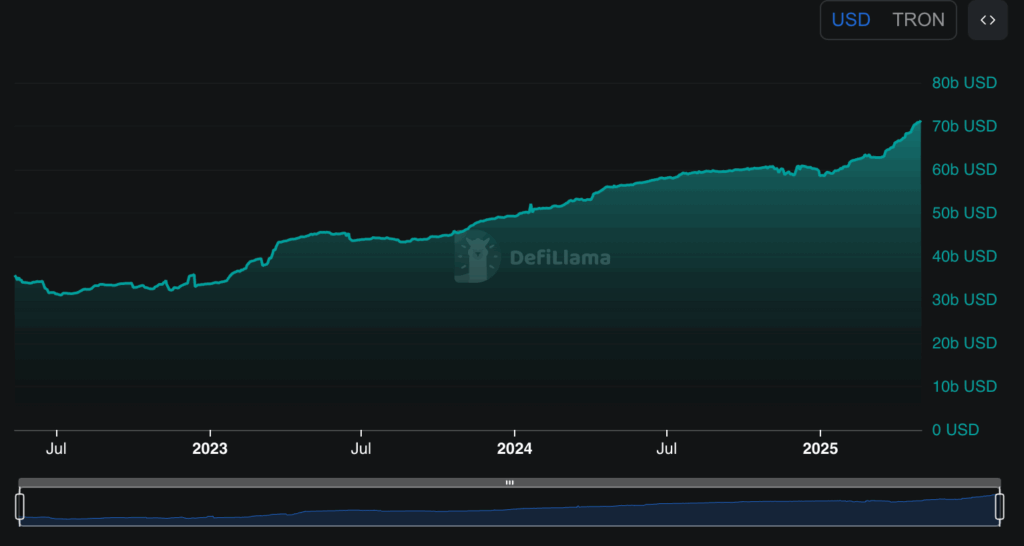

Stablecoin Growth on TRON Passes $70 Billion

Moreover, DeFiLlama data shows that TRON’s total value of stablecoins is now over $70 Billion, a new all-time high.

Since early 2023, the network has been gradually and steadily growing from around $30 Billion. The count of stablecoins rising has made TRON a preferred chain for cross border transfers and on chain settlements.

This expansion is used for network usage and transaction growth. Frequent, low-cost transactions are driven by stablecoins, particularly in areas where traditional banking is not readily available.

This helps keep TRON as one of the top chains for Tether (USDT) circulation, and therefore high transaction count and fee revenue.

It also provides liquidity for DeFi and decentralised apps and the growing stablecoin base. Because TRON’s network fees are stable and predictable, users can opt for TRON over alternatives such as Ethereum, whose gas costs can be volatile.

TRX Price Charts Suggest a Breakout Setup

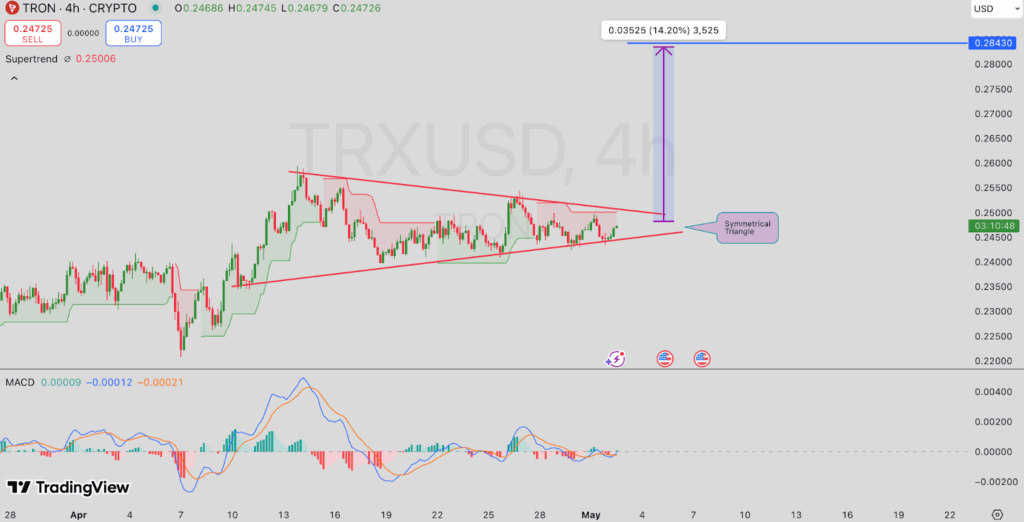

On the TRX/USDT 4-hour chart, a symmetrical triangle pattern indicates a possible price breakout building.

Price is now approaching the upper boundary near $0.25, which has been formed over the past three weeks. According to the projected move, the price could rise by 14.20% to a target near $0.284.

The signal and MACD lines are converging, according to MACD readings, which typically precedes a larger price move.

At the moment, the price of TRON is $0.247, which is below the potential breakout point. When combined with strong transaction growth and network demand, this price setup may lead to a rally.

Nevertheless, a failed breakout could pull the price back towards $0.230, the triangle’s lower trendline.

According to all current metrics, TRON is keeping strong user engagement. Record-high transactions, rising fee income and increasing stablecoin usage indicate continued demand.

Unlike some chains that spike during short-lived hype cycles, TRON’s growth trend has been gradual and steady since 2021.

With the market becoming more active in 2025, TRON’s consistent performance and usage metrics could help it survive and compete with newer layer-1s and existing platforms.

However, it will be up to technical follow-through and the broader market conditions to determine whether TRX can turn this into a sustained price rally.