Key Insights:

- Whale buys 30,000 ETH at $2,513, now up $1.52M as ETH nears 2W Gaussian Channel reclaim.

- ETH inflows spike above 200K as long-term holders accumulate ahead of a potential breakout.

- Ethereum smart contract deployments hit 250K/day, the highest since 2021 bull market.

Ethereum may be preparing for a major move as it approaches a key technical level. A whale’s $75.39M ETH buy at $2,513 aligns with the asset’s attempt to reclaim the 2-week Gaussian Channel.

This comes as on-chain inflows hit multi-month highs and contract deployment surges past 250K daily, showing renewed confidence in the network.

Whale Accumulation Aligns with Key Technical Reclaim

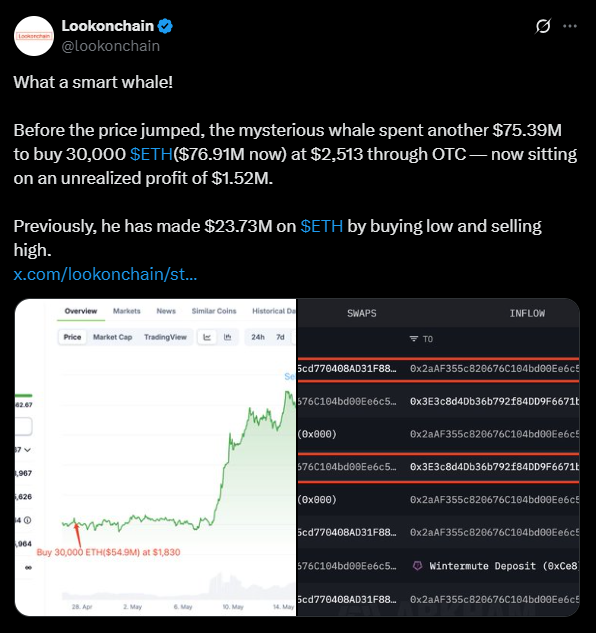

An Ethereum whale has just purchased 30,000 ETH in an over-the-counter deal for $2,513 which cost about $75.39 million.

At of writing, ETH is valued at $2,690.37, so the whale is sitting on an unrealized profit of about $1.52 million. Earlier, the same wallet managed to make $23.73 million by smartly buying and selling Ethereum as the market fluctuated.

This move reflects that the investor believes Ethereum will rise in price and is in line with a key pattern appearing on the charts.

At this time, Ethereum is approaching the upper limit of the 2-week Gaussian Channel, which has often marked major rallies in the past.

In the past, this structure has helped the market take off during bullish times. In 2020, once ETH went above this zone, its price rose from around $300 to more than $4,000.

The same thing happened in 2024 when Ethereum jumped from $2,400 to over $4,100 after reaching that level again. As we move into mid-2025, Ethereum is again trying to reclaim this level.

If the asset keeps moving forward and breaks out above this channel, it may revisit the $4,000 level in the coming months.

On-Chain Inflows and Dollar Weakness Add to Bullish Case

Additionally, the strong behaviour seen on the Ethereum blockchain further supports its technical structure. Inflows of ETH into accumulation wallets have surged to over 200,000 ETH, a level that was only seen during the lowest points of previous markets.

These purchases are not like regular retail buys but instead come from wallets connected to long-term investors. When we see such inflows, it means investors are choosing to invest for the long term instead of trading quickly.

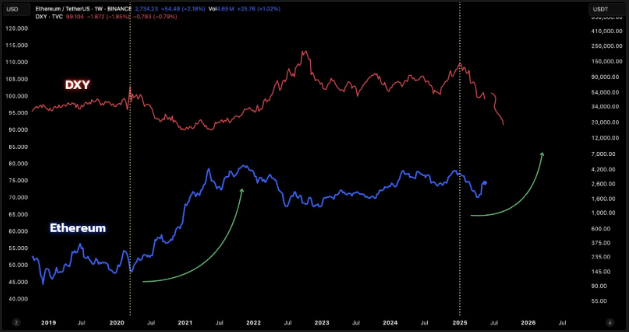

On the macro side, Ethereum seems to be going up when the U.S. Dollar Index (DXY) falls, a pattern that has been important in previous cycles.

In both 2020 and 2022, the DXY reached its highest point while ETH was at its lowest, and this was followed by significant increases in ETH’s price.

In 2025, the DXY has fallen again, yet Ethereum is making a new low on its weekly chart, which could indicate a coming uptrend. If the link is confirmed, ETH could be getting ready for a major rise as the dollar remains weak.

Builder Activity Returns to 2021 Bull Run Levels

Even though price and big economic news are in focus, Ethereum’s network is also showing strong signs of life.

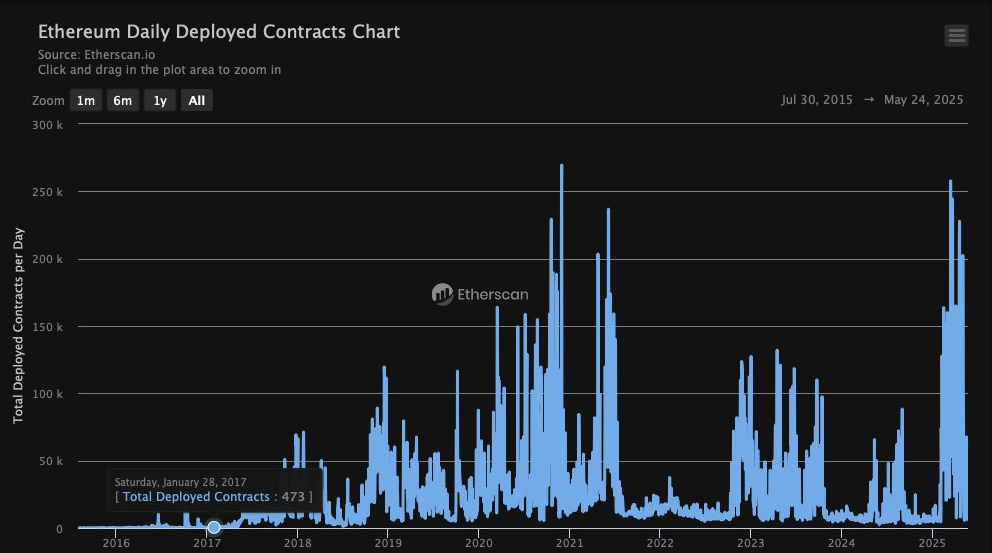

The number of daily smart contract deployments by developers increased in May 2025. Over 250,000 contracts were deployed on multiple days during the month, according to Etherscan.

This is the highest level of activity by on-chain developers since the bull market in 2021. When the number of blockchain deployments increases, we tend to see more dApps, new protocols and useful innovations.

More builders are joining Ethereum because they have greater confidence in its future as a platform for innovation and decentralized finance.

As Ethereum leads the way as the top smart contract blockchain, the rise in development could lead to more financial instruments, NFT platforms, staking services and other features that help the network’s economy grow.

Even though the price doesn’t rise right away, this growth supports the value of Ethereum. All these factors, including whale buying, technical reclaim, higher inflows and positive macro trends, make this burst of development activity another sign that Ethereum could perform well as we approach late 2025.