Key Insights:

- A whale transferred over 29 million XRP, worth approximately $63.81 million, to a Coinbase-linked wallet.

- The transaction occurred at 12:12 p.m. UTC and came ahead of Coinbase’s planned XRP futures launch next week.

- On-chain data suggested the transfer was an internal Coinbase movement for fund consolidation or liquidity management.

Recently, a significant XRP movement occurred as a whale shifted over 29 million XRP coins to a Coinbase wallet. The transfer occurred at 12:12 p.m. (UTC) and was valued at approximately $63.81 million.

This transaction aligns with Coinbase’s upcoming launch of XRP futures contracts. The launch is scheduled for next week.

XRP Whale Transfer Linked to Coinbase

The wallet transferred 29,532,534 XRP to a Coinbase-linked address. Each coin was valued at approximately $2.16 during the transaction.

Whale Alert first identified the sender account as an unknown entity. At the same time, on-chain analysis confirmed that the sender was an internal Coinbase operation. The sending address, activated on April 11, 2025, has received XRP from multiple sources.

Coinbase has used this address to collect XRP from several wallets for fund consolidation or liquidity management. After today’s large transfer, it holds only 10 XRP. The existence of this pattern confirms operational fund transfers instead of retail activities.

The destination address, linked to user withdrawals, quickly distributed nearly 28 million XRP across more than 100 transactions. This wallet currently holds 1.55 million XRP, valued at $3.34 million.

Ripple Wallet Moves 70 million XRP

On April 14, a separate XRP whale shifted 70 million XRP worth $150.36 million to an unidentified address. According to Bithomp records, the sender wallet, which Ripple controlled, became active in October 2023. It previously received 200 million XRP from Ripple on April 11, 2025.

The wallet continues to be active in Ripple-related transactions, which indicates that Ripple participates in broad liquidity management. Liquidity provisioning and institutional settlement seem to be the most probable applications for which the purpose of this XRP activity remains undefined.

Several experts believe Ripple uses this wallet to support ODL clients and create exchange-traded funds. The wallet has shown consistent activity with high-value XRP transfers, indicating its role in more extensive ecosystem operations.

Market liquidation events and market-making activities tend to trigger these movements. The April 14 fund transfer continues the documented practice of Ripple reallocating its funds.

A known community tracker reported the possibility that Ripple will utilize these funds for exchange liquidity arrangements and ETF backing.

Though speculative, these assumptions align with recent XRP product launches. Ripple’s participation in large-scale market events remains supported by its coordinated transfer actions.

XRP Liquidity Gains Momentum Ahead of Potential ETF Approval

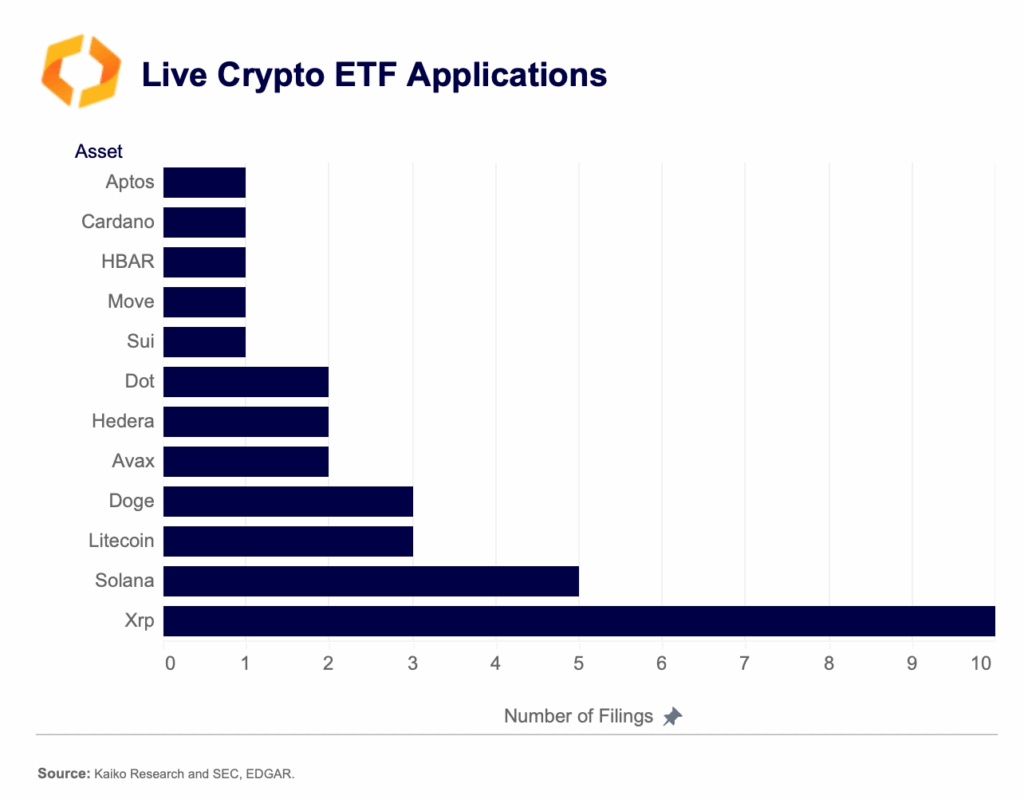

XRP’s liquidity has grown strongly over recent months, boosting its position in the broader crypto market. A Kaiko Indices report showed that XRP and Solana exhibit the deepest 1% market depth on verified platforms.

This highlighted their strong liquidity and trading activity. Since late 2024, XRP’s liquidity performance has surpassed Solana’s and doubled Cardano’s.

This improved liquidity has supported XRP’s ambitions for inclusion in a U.S. spot ETF. Teucrium’s 2x leveraged XRP ETF launch helped increase institutional exposure and daily trading volume.

Volume surpassing $5 million marked the newly launched fund as Teucrium’s biggest success during its inaugural day. Despite lacking a strong futures market like Bitcoin, XRP continues gaining ground in the U.S. spot trading sector.

The cryptocurrency achieved an all-time high share value since it survived the difficulties brought by the SEC’s legal actions. Multiple factors have generated rising expectations that future regulatory developments are imminent.

Once higher than XRP’s, Solana’s market dominance has dropped from 30% to 16% as XRP gains more ground. Meanwhile, XRP remains above the $2 mark and trades at $2.16, reflecting its resilience.

The coin demonstrated an 11.66% increase throughout the past week alongside a 31% price surge starting from April 7.