Key Insights:

- Whale wallets scooped 800 million DOGE between April 12 and April 14.

- DOGE formed the inverse head and shoulders pattern with its neckline at $0.170.

- The Long/short ratio rebounded, showing rising bullish sentiment in derivatives.

Over 800 million DOGE was accumulated by large Dogecoin holders in the last two days, rekindling market interest.

On the other hand, an inverse head and shoulders pattern has formed on the chart with the $0.170 level as a key resistance for a potential breakout.

Whale Accumulation Grows as Dogecoin Price Recovers

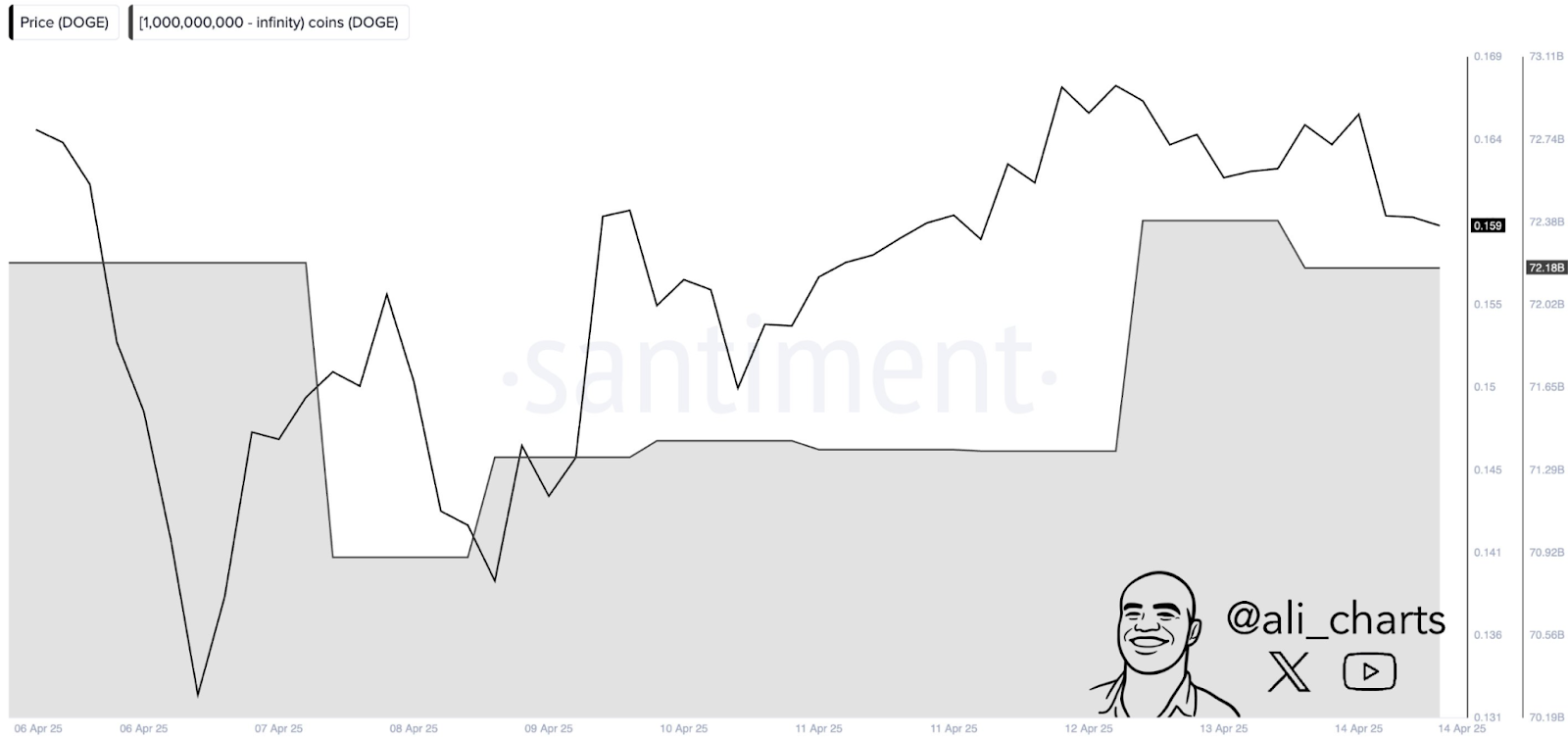

Data from Santiment shows that large Dogecoin holders have been increasing their holdings in the past 48 hours.

Between April 12 and April 14, the wallets holding more than 1 billion DOGE coins acquired over 800 million DOGE.

The action occurred amid a short-term price recovery when Dogecoin was trading around $0.145 and $0.165.

As seen on the Santiment chart, the total holdings of these major wallets jumped from around 71.38 billion DOGE on April 11 to 72.18 billion DOGE on April 14.

This increase is due to a 1.12% increase in whale-held supply, as prices have also increased during this period.

Prices were low near $0.131 on April 6 but started recovering steadily from April 8.

Inverse Head and Shoulders Pattern Forms on 4-Hour Chart

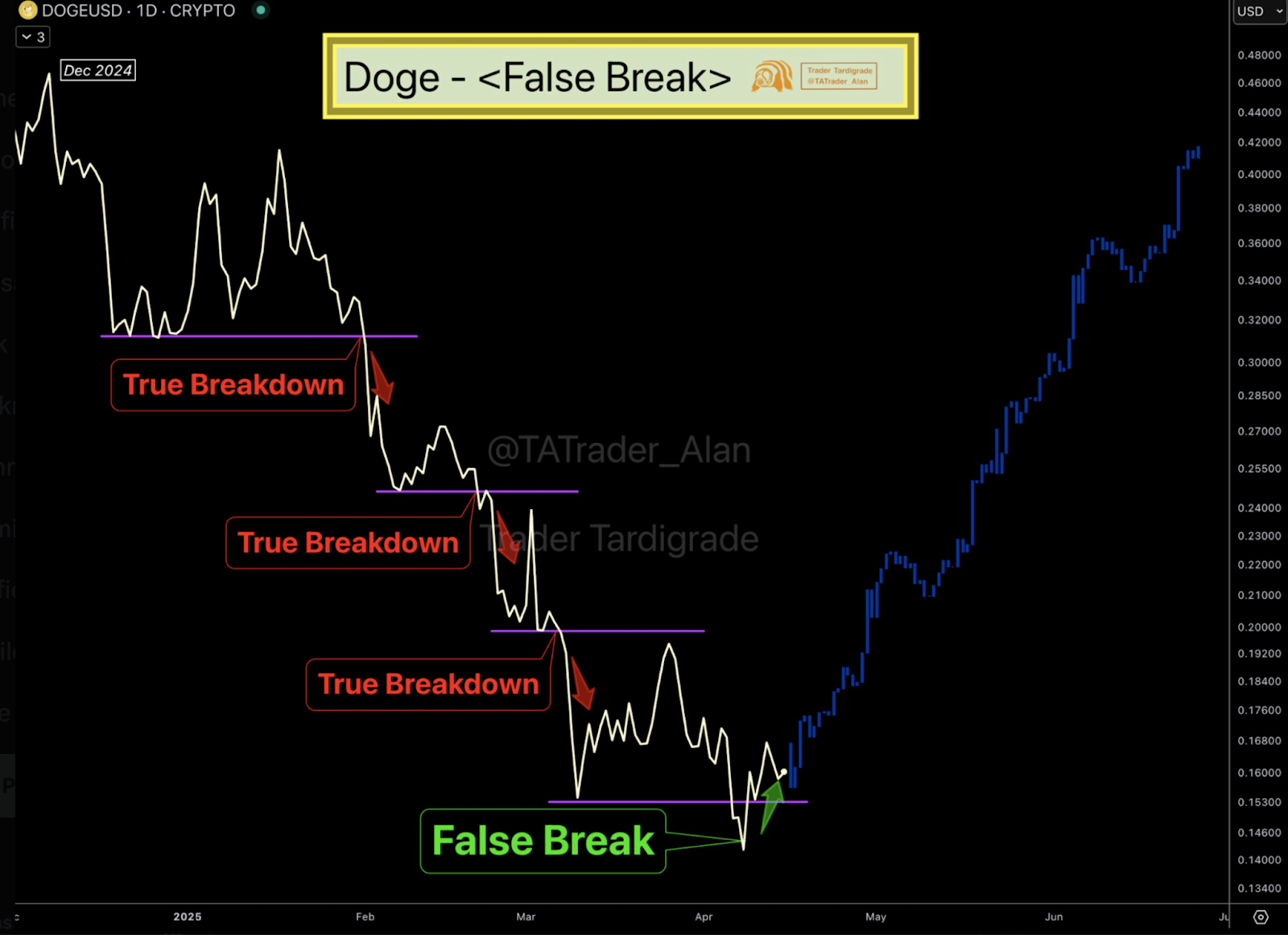

Meanwhile, as per Trader Tardigrade’s technical analysis, Dogecoin was forming an inverse Head and Shoulders (iH&S) pattern.

This is a setup that has shown up on the 4-hour chart, consisting of three main lows, two higher lows (shoulders), and one lower low (head).

When confirmed, this type of pattern can indicate a trend reversal.

On April 7, the head was formed near $0.127, while two shoulders were formed on April 4 near $0.156 and on April 15 near the price area.

The neckline was a resistance line at around $0.170.

A bullish breakout from this pattern may be confirmed if the price closes above this level with strong trading volume.

Conversely, a false breakdown earlier this month was also mentioned by the trader. DOGE dropped below key support around $0.145 but recovered quickly.

After the recovery, the price traded consistently above that support, which TATrader_Alan said is a classic false break. “A new DOGE bull run could start from this false break,” he added.

Long/Short Ratio Shows Slow Shift in Market Sentiment

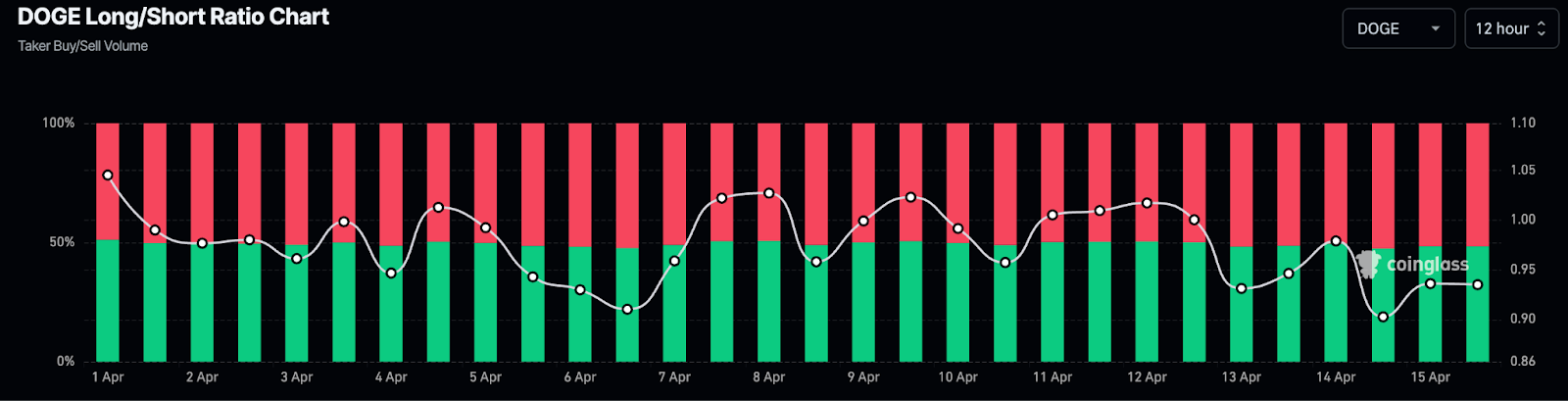

CoinGlass provides more data on market positioning. The DOGE long/short ratio, which measures the ratio of taker buy and sell volume, fell from above 1.05 on April 1 to below 0.92 on April 6.

Such a drop implies that more traders were opening short positions, anticipating the price to drop.

But, from April 7 to April 11, the ratio started to rise again. By April 15, it had reached about 0.95, which indicates a rise in long-interest.

This upward movement, however, while it is still below 1.0, is a trend towards more balanced trading.

Sometimes, periods in which shorts are dominant and then longs increase can cause a change in price momentum.

If Dogecoin manages to break the $0.170 level, it could set off stop losses on short positions and cause a rapid rise in prices.

The Market is Focused on $0.170 Price Level

The $0.170 resistance level is at the center of DOGE’s price action. This level is the neckline of the H&S pattern and is also a psychological level in the market.

The trend is still uncertain as the pattern has not been confirmed without a close above this level.

Whale buying, early technical setup, and changing sentiment create a confluence of factors that could lead to more price activity.

However, traders may be cautious without a breakout. Any further upside will depend on volume and confirmation.