Key Insights:

- Whale wallets added 1.1M ETH in May, pushing balances above 17.5M amid rising price trends.

- Ethereum futures open interest hits record 7.1M ETH, equal to $19.1B in positions.

- Most ETH supply held near break-even, making price stability key for market sentiment

Large investors accumulated over 1 million ETH in May, boosting activity. Total whale holdings now exceed 17.5 million ETH. The rise in Ethereum prices above $2,600 aligns with this steady buying trend.

Meanwhile, futures open interest reached an all-time high of 7.1 million ETH or $19.1 billion. This demonstrates growing market participation and rising confidence in the ETH market.

Whales Accumulate Over 1M ETH as Open Interest Hits Record Levels

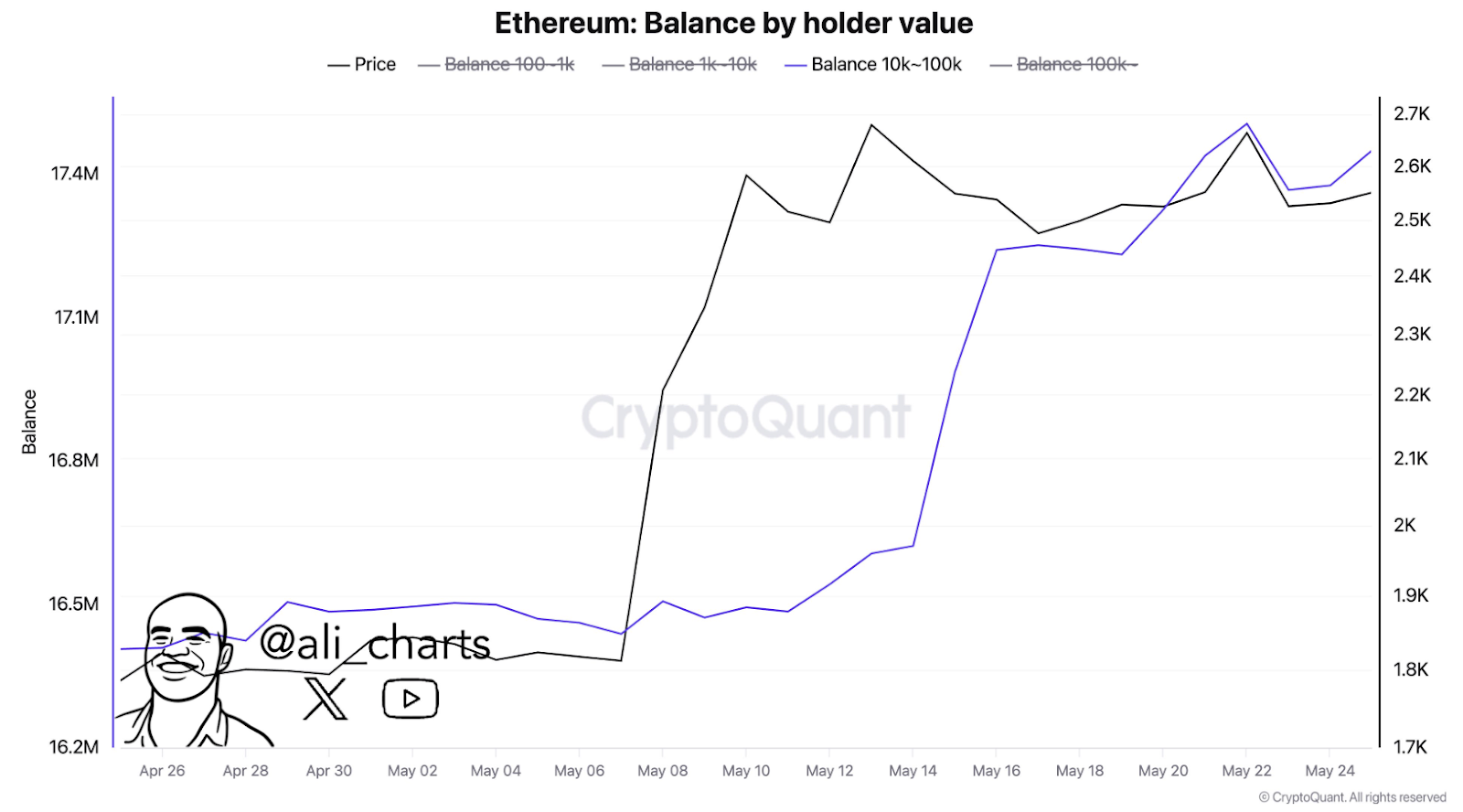

Over the past month, large Ethereum holders, or whales, have added more than 1.1 million ETH to their holdings.

CryptoQuant data shows wallets holding 10,000–100,000 ETH grew their balances. Since early May, holdings rose from 16.4 million to over 17.5 million ETH. The accumulation happened as the Ethereum price increased from below $2,000 to above $2,600.

The most notable rise occurred after May 10 as prices and whale holdings surged. This sharp increase signals strategic positioning by major investors. They may be preparing for potential market changes ahead.

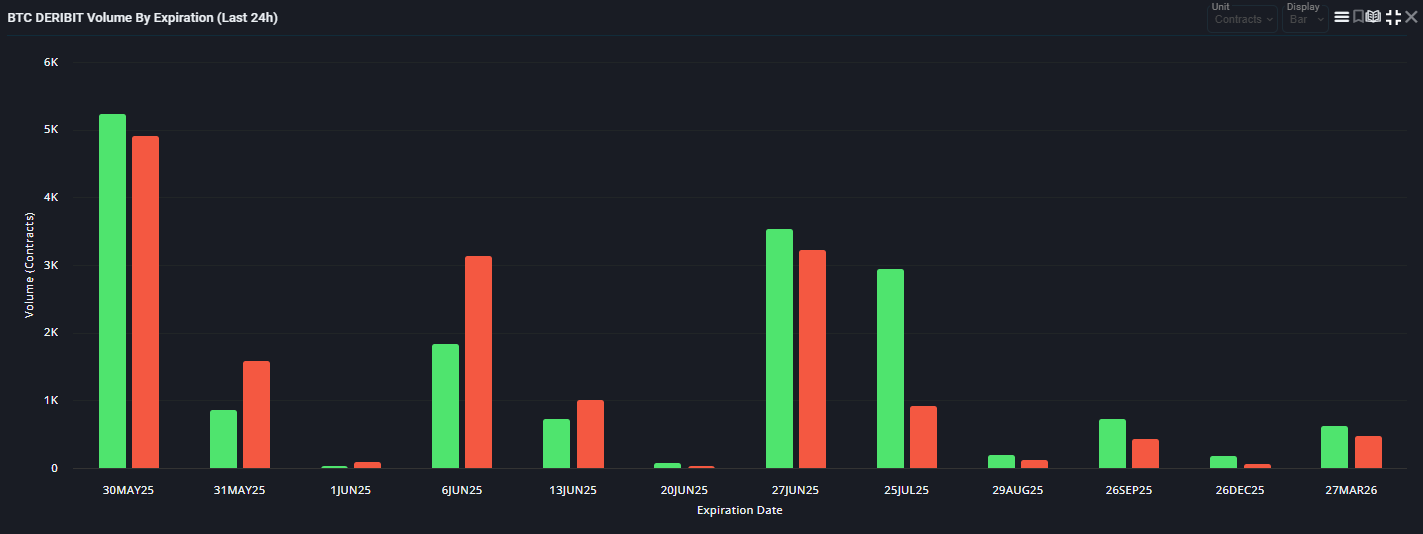

Large wallets kept buying, but smaller address groups (100–1,000 ETH or 1,000–10,000 ETH) remained stagnant. Meanwhile, open interest in Ethereum futures hit an all-time high of 7.1 million ETH or about $19.1 billion.

The market’s price recovery has coincided with this sharp increase in open interest. It has risen from around 4 million ETH in January 2024.

Open interest has risen, which could mean more traders are entering the derivatives market, perhaps anticipating higher volatility. Historical data show that previous peaks in open interest, such as in mid-2022, were followed by large price swings.

Future movements aren’t guaranteed, but market participation is rising. More active contracts often lead to stronger short-term price reactions.

ETH Market Still Fragile Despite Recent Gains

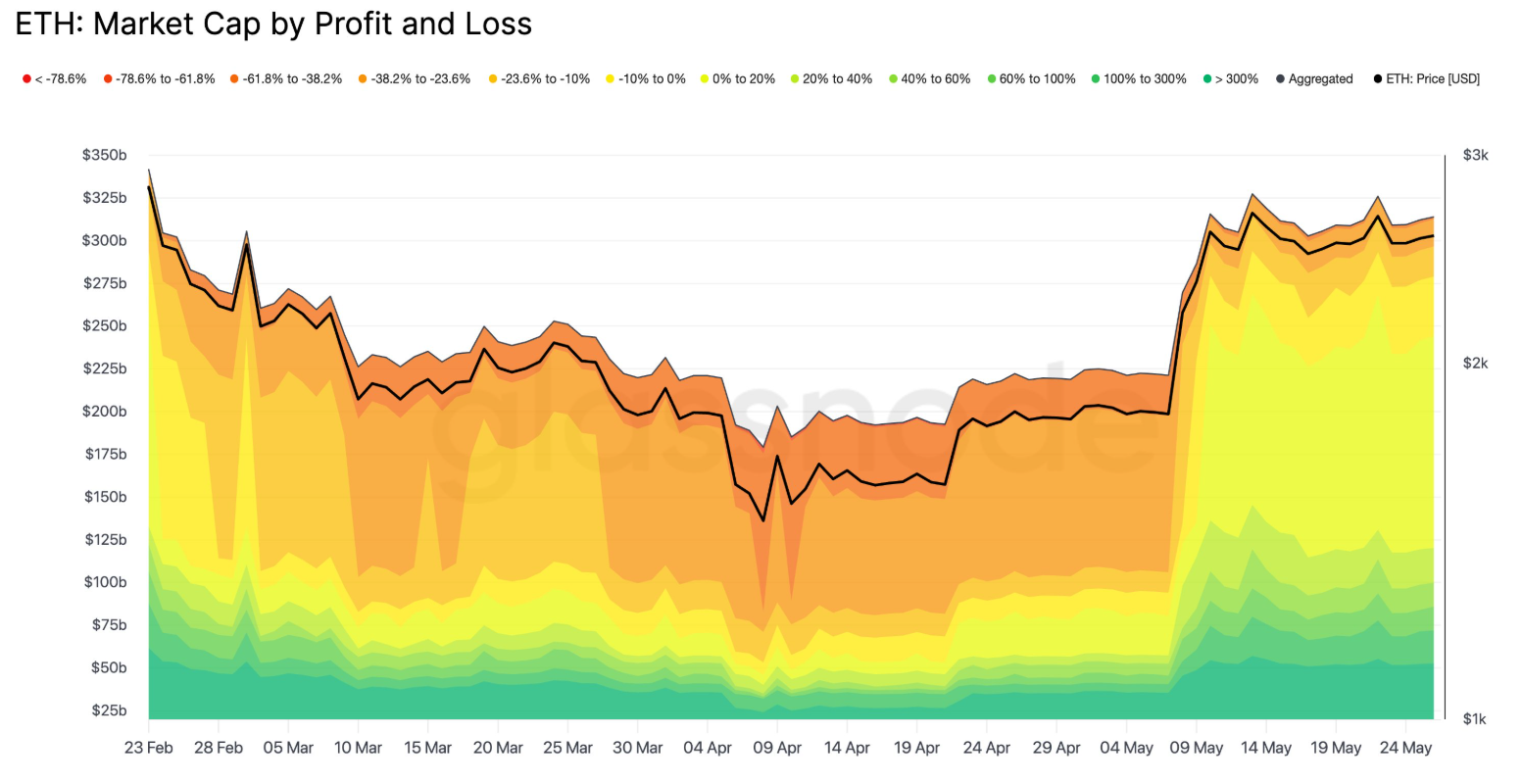

Glassnode data shows that most of Ethereum’s market cap is concentrated in certain wallets. Around $123 billion is held by wallets that bought between $2,300 and $2,500. This is important because it is a break-even zone for many holders.

If the price drops below $2,300, a big chunk of the supply will be in an unrealized loss again. This is shown in the market cap by profit and loss chart, as the biggest section is in the yellow band (0% – 20% gain). That means many holders are only slightly above their entry price.

ETH price shot up from late April to mid-May. It went from about $1400 to over $2600. Despite this price rise pushing many addresses into profit, the position remains vulnerable to downside moves.

Ethereum Enters Key Phase of Crypto Cycle

Looking at a chart of the usual flow of capital in crypto markets, Ethereum is in the second phase. Bitcoin usually rallies first, and this follows suit. Next, money flows into Ethereum, large-cap alts, and smaller tokens in what traders call ‘altseason.’

Meanwhile, Ethereum has now moved above the midline of its two-week Gaussian channel, a technical indicator used to find trends. This shift has caused long upward moves in past cycles.

Similar moves in 2020 and 2023 are marked on the chart, followed by wider market rallies. As of May 2025, Ethereum reclaimed the mid-band, and the price is now trading above $2,600.

After each of the market recoveries, there were higher highs within approximately 12–18 months. Using this pattern, Ethereum looks to be in the early stages of another potential trend, as whale buying increases and open interest rises.