Key Insights:

- Crypto analyst Michael van de Poppe believes that an altcoin season is on its way.

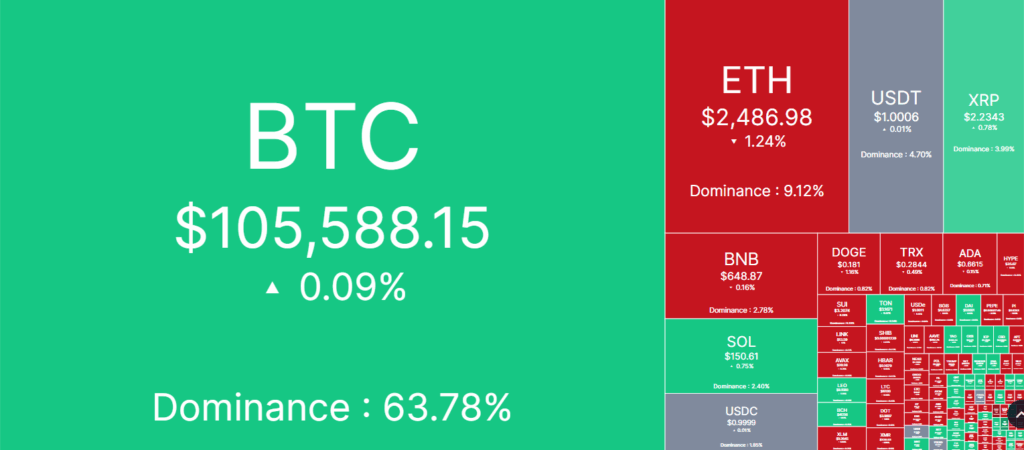

- Bitcoin’s current dominance is a major indicator for an incoming capital rotation into altcoins.

- Altcoins have seen some prolonged underperformance since late 2021, with many losing up to 90% of their value.

After spending the last few years underperforming compared to Bitcoin, the altcoin market might finally be near a turning point.

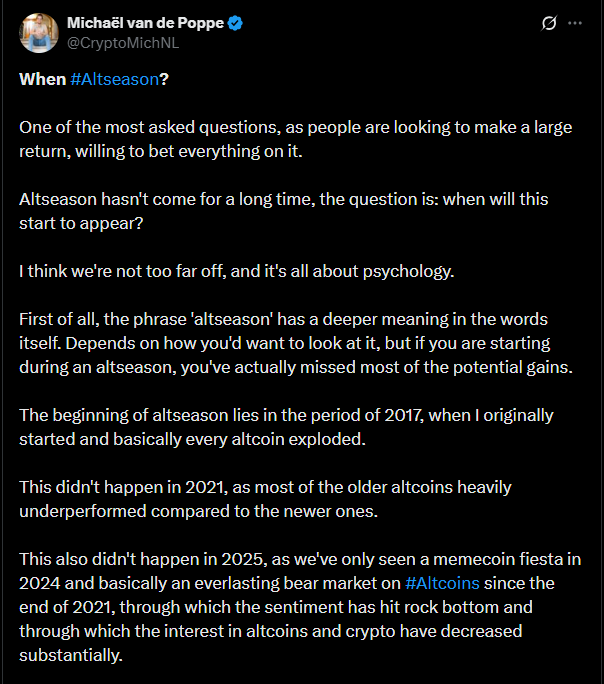

According to renowned crypto analyst Michael van de Poppe, an altcoin season could be just around the corner. While Bitcoin continues to take over headlines and market share, Van de Poppe believes the current outlook is a major accumulation opportunity for altcoins. Here’s a breakdown of his reasoning and what investors should be watching for.

Bitcoin’s Dominance is a Signal, Not a Barrier

Bitcoin currently holds more than 64% of the total crypto market cap, according to CoinMarketCap. This level of dominance shows that capital is flowing mostly into BT, while the rest of the market, especially altcoins takes a back seat.

However, Van de Poppe argues that this isn’t necessarily a bad thing. In fact, it could be a precursor to an altcoin season.

Historically, once Bitcoin reaches a local top and investors start to take profits, the next logical step is a rotation into altcoins. Traders tend to start looking for better risk-reward ratios and higher potential returns.

Altcoins tend to offer just that, especially when they are still trading far below previous all-time highs compared to Bitcoin

Altcoins Have Been in a Prolonged Cooldown

While Bitcoin has been rallying and reaching new highs almost every few months, altcoins have largely remained stagnant or in slow decline. Since the late stages of the 2021 bull market, many of these assets have lost as much as 90% of their value.

Even as Bitcoin has pushed past the $100,000 mark, many well-known altcoins like Ethereum, Litecoin and EOS have failed to keep pace. This underperformance doesn’t show poor fundamentals or a lack of development as anyone would think at first glance.

Instead, it shows a wider market pattern where Bitcoin is leading the charge, and altcoins are following with some lag. Van de Poppe believes that we are in the final stages of that lag, and the altcoin accumulation phase may soon give way to a full-blown rally.

Macroeconomic Forces Are Still in Play

Another reason for the delay in altcoin momentum is the general macroeconomic backdrop. Investors across worldwide markets are still dealing with fears over central bank policy, persistent inflation and the looming threat of a recession that shakes the world. These factors are making risk assets, including most cryptocurrencies less attractive in the short term.

Van de Poppe notes that while Bitcoin and gold have both benefited from this uncertainty, altcoins are often seen as more speculative.

As a result, while Bitcoin and Gold make headlines, the altcoins have been left behind as investors scramble for safer stores of value. Van de Poppe also pointed out that gold recently reached a new all-time high, which supports the idea that institutional investors are playing it safe.

Once market confidence improves, though, those same investors may begin rotating into altcoins especially if they’re hunting for yield or growth.

Where Are We in the Market Cycle?

The crypto community is still divided so far. Some believe we’re still in a bear market, while others argue that the next bull run has already begun. Van de Poppe is more on the latter side, and believes that now is the time for forward-thinking investors to start building positions in altcoins.

“Retail isn’t paying attention right now,” he says. “And that’s exactly when smart money starts buying.”

He explains that altcoin rallies often begin quietly, without much media attention. Early gains are typically taken advantage of by experienced traders and institutions that recognize the signs before the crowd catches on.

By the time the average investor hears the words “altcoin season,” many of the best opportunities have already passed. With all of this said, if the cycle repeats as it has before, the rotation into altcoins could start in the coming months.