Key Insights:

- Bitcoin and Ethereum ETFs collectively recorded over $1 billion in daily inflows last week.

- This is the highest combined total in five months, in a show of increasing investor interest.

- BlackRock’s iShares Bitcoin Trust (IBIT) led Bitcoin ETF inflows with $877 million in a single day.

The cryptocurrency market is heating up once again, and exchange-traded funds (or ETFs) are taking all the action.

By the close of last week, Bitcoin and Ethereum ETFs collectively recorded more than $1 billion in daily inflows. This stands as the highest combined total in five months and shows that investors are ramping up their appetites for crypto-backed investment products.

Here’s a breakdown of the drivers behind this influx and what it means for the crypto market as a whole.

Bitcoin ETFs Drive the Majority of Inflows

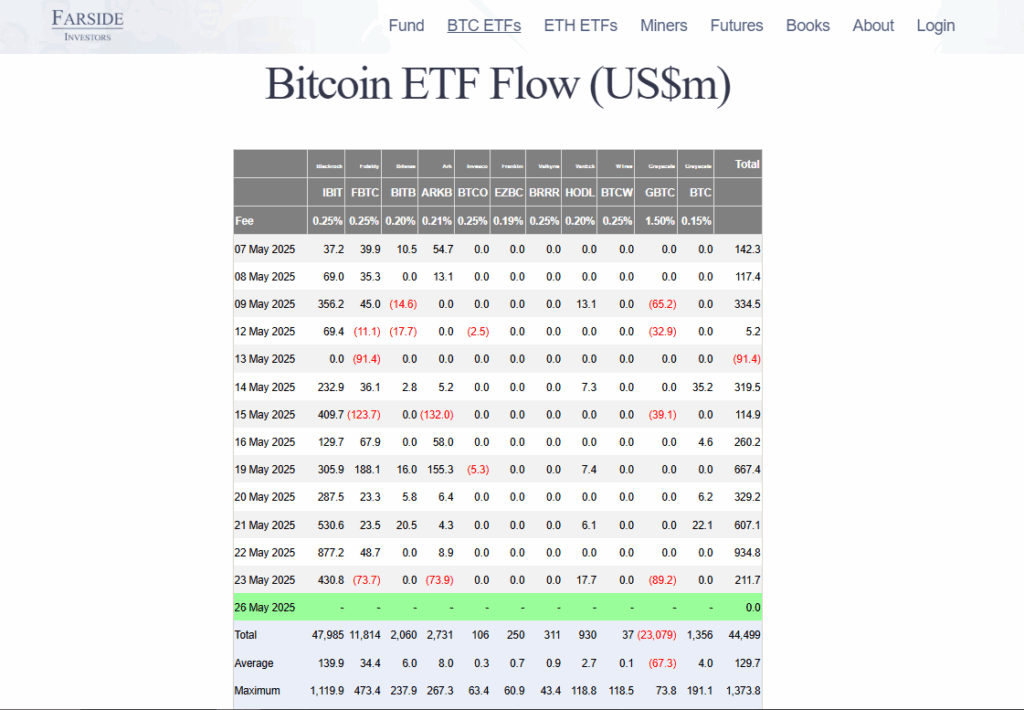

BlackRock’s iShares Bitcoin Trust (IBIT) led the pack over the last week, with a staggering $877 million in a single day. According to data from Farside Investors, this is the fund’s third-largest daily inflow since its launch.

In total, Bitcoin ETFs saw an impressive $935 million on Thursday, which stands as the lion’s share of the day’s activity.

Further down the rabbit hole, IBIT added over $1.9 billion just in the first four days of the previous week. This stands as the third time in a month that it has crossed the billion-dollar inflow mark on the weekly timeframe.

This comes after a previous record of $2.4 billion and $1 billion during the weeks of 28 April and 5 May, respectively.

It should be noted that since its launch in January 2024, IBIT has amassed nearly $41 billion in total inflows. This dwarfs its closest competitor (Fidelity’s FBTC) by a wide margin, considering how Fidelity’s offering has only taken in about a quarter of that.

Ethereum ETFs Also Gaining Ground

While Bitcoin continues to hold investor attention, Ethereum is quietly building its speed.

The Ethereum-based products pulled in over $110 million on Thursday of last week, with the Grayscale Ethereum Trust (ETHE) and Fidelity Ethereum Trust (FETH) leading the way with more than $40 million in inflows.

Ethereum’s price performance has also improved, even though it initially lagged behind Bitcoin.

Ethereum is currently up by around 46% in the past month in terms of price, and is now trading somewhere around $2,565 after dipping slightly at the end of the week.

According to analysts, the sluggish performance of the Ethereum ETF market might have been due to Ethereum’s intraday 3.5% drop on Thursday.

According to Bloomberg ETF analyst James Seyffart,

Despite this, BlackRock’s iShares Ethereum Trust (ETHA) has been a major performer and has pulled in over $4.3 billion in net inflows (more than double its nearest competitor).

Overall, the eight Ethereum ETFs currently on the market have seen more than $2.7 billion in net inflows this year, though Grayscale’s ETHE has posted $4.3 billion in outflows due to its higher fees.

Record-Breaking Year for Crypto ETPs

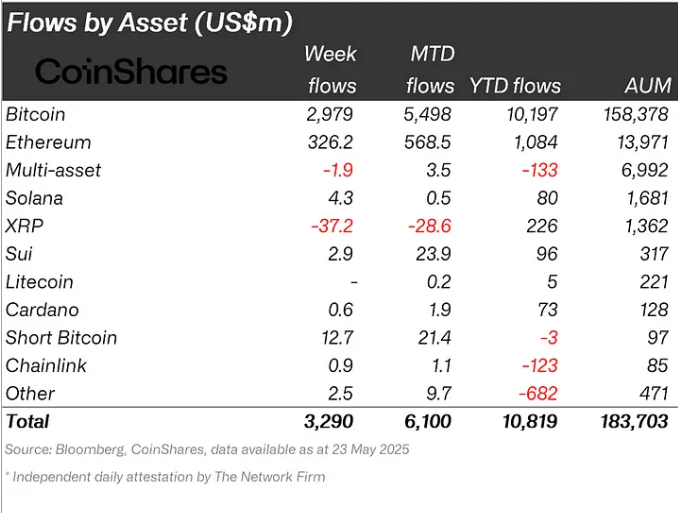

Zooming out, 2025 is is more and more becoming an increasingly encouraging year for crypto investment products. According to CoinShares in a recent report, worldwide crypto exchange-traded products (ETPs) saw $3.3 billion in inflows in the week ending May 24.

This brings the year-to-date total to a record-breaking $10.8 billion.

James Butterfill, head of research at CoinShares pointed towards the macroeconomic backdrop as a driver of this trend, saying

According to this report, Bitcoin ETPs alone brought in $2.9 billion during the week. This made up about 25% of total inflows for the year.

Interestingly, even short-BTC products saw fresh interest, with $12.7 million in inflows, in their highest since December of last year.

Ethereum ETPs are also performing well, with $326 million in weekly inflows. On the other hand, XRP-focused products saw a steep $37.2 million in outflows.

Overall, with Bitcoin attempting to flip $110,000 into support, the interest in crypto ETFs and ETPs is not likely to fade anytime soon. If the current trend continues, we could see this year go down as a major year for crypto adoption in worldwide investment.