Highlights:

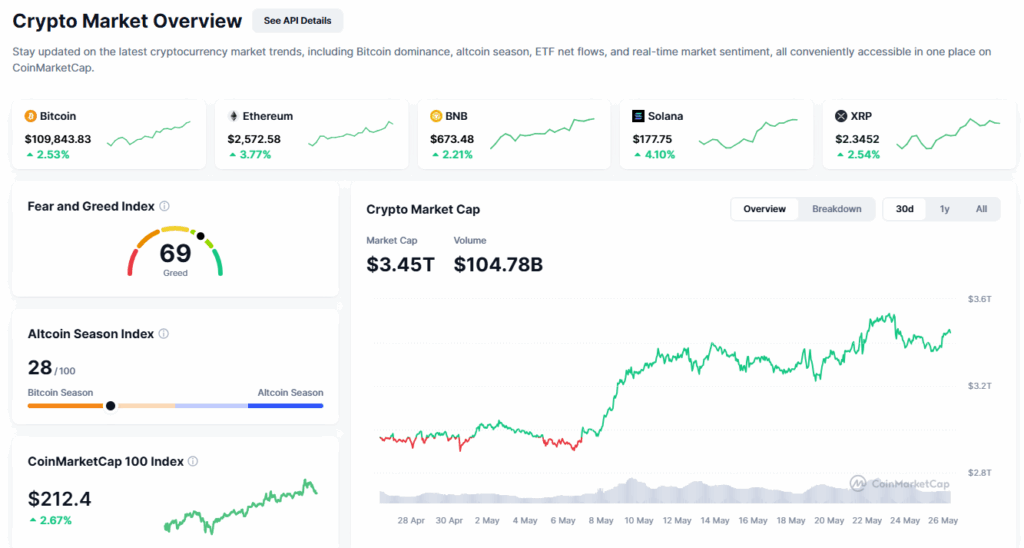

- The crypto market cap surged by $46 billion to $3.39 trillion, on the back of institutional confidence.

- Bitcoin is close to its all-time high, with analysts watching the $110,000 level for more bullish momentum.

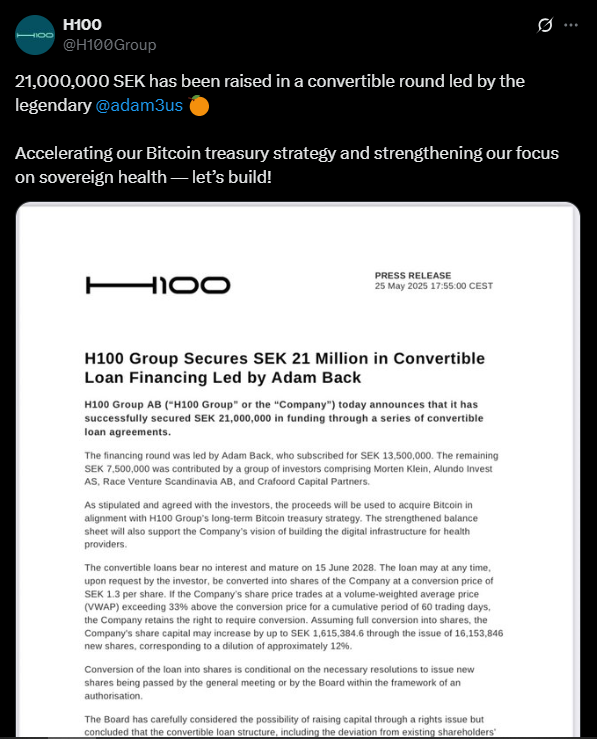

- Increasing institutional interest from Blockstream CEO Adam Back’s investment in H100 Group AB might have been a major driver of the rally.

The crypto market has seen a major boost in the last 24 hours, after adding $46 billion to reach a total market cap of $3.39 trillion.

Bitcoin continues to hover near its all-time high, while altcoins like Hyperliquid (HYPE) are rallying. However, what are some of the reasons behind this momentum? Here’s how a mix of institutional optimism and strategic investments are influencing today’s uptrend.

Market Cap Grows Despite Warning Signs

The total crypto market cap rose by $46 billion over the past day according to CoinMarketCap, in a show of increased confidence among investors. Even though the market saw a minor pullback last Friday, it has since rebounded strongly and is holding its ground above the $3.31 trillion support level.

According to analysts, if this level continues to hold, the market cap could push higher toward the $3.49 trillion mark. This kind of movement would further reinforce the ongoing bullish trend.

However, not everything shows that the ride will be smooth. There is always a possibility of a market slowdown or even a reversal in price direction.

If that plays out, we could see the market retrace toward $3.21 trillion, which might damage investor sentiment slightly. Bitcoin is currently trading at around $109,614, and is only about 2% away from its all-time high.

This said, for BTC to break out further, it must first flip $110,000 from resistance to support.

If this happens, the next target would be $112,000 or even higher. Overall, market watchers are optimistic but still wary of any unexpected price action. This is because a failure to reclaim and hold $110,000 could result in a downward move.

As such, Bitcoin could be on its way towards the next support zone around $106,265 if the bears somehow take over. So far, BTC’s resilience has been strong, and the current trend shows a bullish continuation.

Institutional Confidence Grows

Beyond price charts, one of the major reasons for the recent rally is the increasing institutional interest in Bitcoin. Just this week, Blockstream CEO Adam Back led a $2.2 million investment round for Swedish health tech firm H100 Group AB.

This move was set in motion to help the company buy more Bitcoin. Back personally contributed $1.4 million, while the remaining funds came from venture firms across Scandinavia.

Keep in mind that H100 had already purchased 4.39 BTC earlier in the week. This time, it now plans to buy an additional 20.18 BTC with the new funding.

Overall, its total holdings are expected to skyrocket to around 24.57 BTC. It is also worth noting that this makes H100 not only the first publicly traded company in Sweden to adopt a Bitcoin treasury strategy, but also one of the first in Europe.

Bitwise Predicts $420 Billion in Bitcoin Inflows by 2026

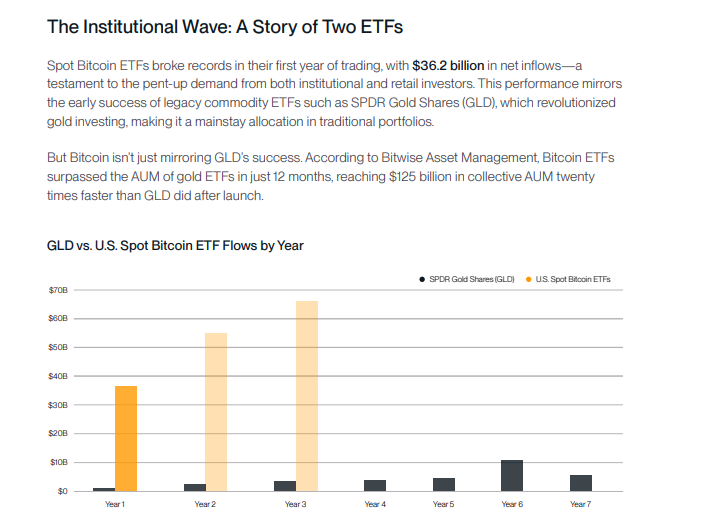

More on the bullishness, another factor driving the market comes from Bitwise.

According to the asset manager’s most recent report, Bitwise expects that Bitcoin could attract $120 billion in inflows by the end of the year. Moreover, it could see an additional $300 billion by 2026 from ETFs, corporations, and even governments.

Already, U.S.-based spot Bitcoin ETFs brought in $36.2 billion in net inflows in 2024. This brought the total AUM to around $125 billion in assets under management (more than that of the gold ETFs by a wide margin). At this pace, annual inflows could hit $100 billion by 2027 and set Bitcoin up as a true competitor to gold.

Bitcoin’s Expanding Role in Global Finance

As of now, nearly 1.7 million BTC, worth over $180 billion, are held by publicly traded companies and governments.

Among these, corporations account for around 1.15 million BTC ($125 billion) while sovereign nations hold 529,705 BTC (roughly $57.8 billion). Note that the United States leads the way with 207,189 BTC, followed by China. Overall, Bitcoin has had a great week in the last 7 days, and more bullishness is expected to follow.