- Solana Strategies now holds 420K SOL after investing $4.7M this week, fully exiting its Bitcoin position

- Upexi adds 77,879 locked SOL at $151.50, gaining $2.1M as current prices hover near $178

- Solana leads in active addresses and revenue while attracting major corporate treasury interest

Institutional backing for Solana (SOL) is growing stronger as major firms pour millions into the network, as market confidence rises. This week, SOL Strategies added 26,478 SOL to its treasury, bringing its total SOL holdings to 420,355 SOL, or nearly $100 million.

A wave of corporate investments followed, and Upexi was the next to follow with a discounted SOL purchase worth $11.8 million. Solana dominates usage metrics, and these moves signal that a new all-time high could be approaching this summer.

Firms Deepen SOL Exposure, Exit Bitcoin Positions

This week, SOL Strategies confirmed the acquisition of 26,478 SOL for $4.7 million, moving its treasury fully into Solana. All Bitcoin holdings have been exited, and the firm holds 420,355 SOL, worth roughly CAD $100 million. It is in alignment with its long-term strategy of validator growth and ecosystem participation.

Moreover, a U.S. based consumer product company, Upexi bought 77,879 locked SOL at $151.50 per token for a total of $11.8 million.

As of writing this, their total SOL holdings are 679,677, worth $121.2 million, and they are very bullish on Solana’s future.

Additionally, the DeFi Dev Corp invested more than 600,000 SOL (worth about $100 million) into its treasury diversification plan. As motivators, the company pointed to Solana’s scalability, cost efficiency, and growing DeFi and meme coin activity.

These large inflows reflect increasing institutional conviction that Solana will be a long term competitive chain.

On-Chain Growth Supports Bullish Price Structure

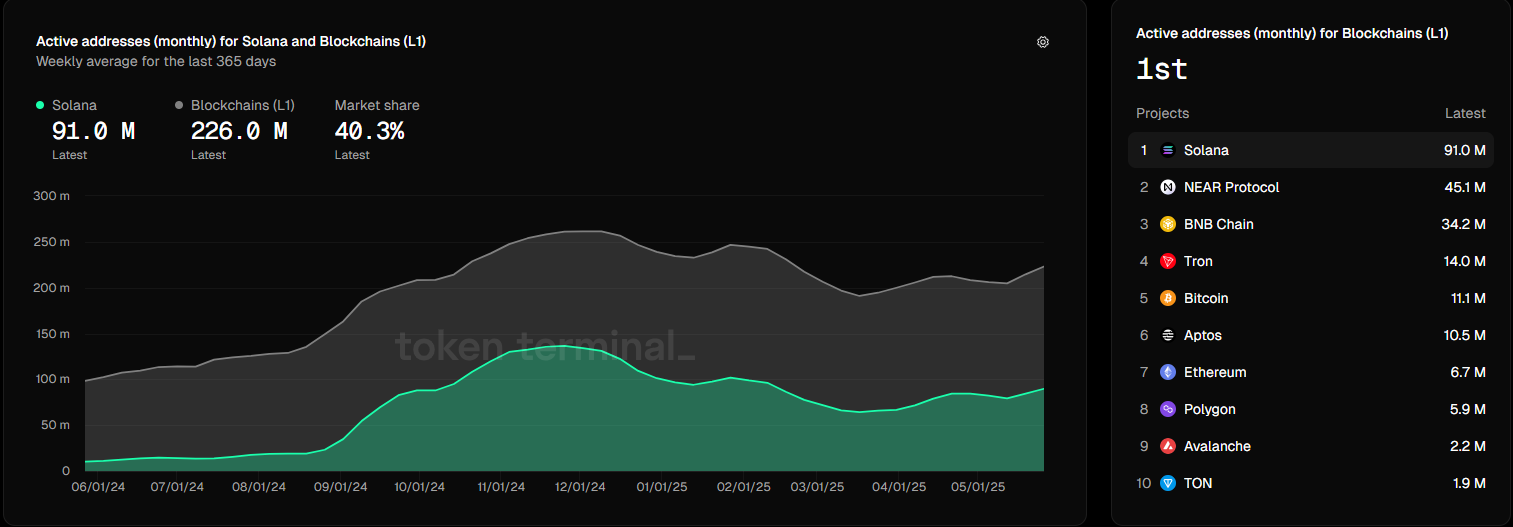

In the blockchain sector, Solana is still the leader in network activity with 91 million monthly active addresses.

While writing, it had a 40.3% market share of Layer 1 blockchains, more than double that of NEAR Protocol and far ahead of Ethereum’s 6.7 million active addresses. This growth has been steady for several months and is increasing real-world usage.

Revenue generated by Solana-based apps also paints a bullish picture. Meme coin platform Pump.fun, which runs on Solana, made $1.21 million in 24 hours, more than Ethereum’s $934,987.

Other Solana-based apps, such as Jupiter and Phantom, also made the top revenue generators, which helped bolster the sentiment for the network.

Some participants are rotating capital within the ecosystem, even as activity spikes. The latest in a series of over 3.49 million SOL moved, Pump.fun deposited 156,425 SOL worth $25.74 million to Kraken.

This includes the sale of 264,373 SOL for $41.6 million USDC at $158, which indicates both liquidity and demand are strong.

Price Chart Reflects Breakout Potential Ahead of Summer

In addition, Solana’s technical setup is also bullish and continues to show bullish continuation as the current price breaks above key resistance near $220.

With consistently higher highs and higher lows on the 3-day chart, Solana’s technical setup suggests a bullish breakout is possible. At press time, SOL was trading at around $155.3 and was heading towards key resistance at the $178–$180 zone.

A breach of this level with strong volume would see the next major resistance near $260, the last hurdle before a retest of the all-time high.

The volume data shows the growing interest, as accumulation patterns follow each correction. The buyers kept stepping in at support zones and turning the resistance into solid bases for the next leg up. Analysts say if buying pressure holds, the next breakout target could reach or exceed $300.

Higher user activity, greater on-chain revenue, and lower transaction fees are all indicators that Solana is gaining competitive strength against Ethereum.

Solana’s ability to handle up to 2,600 transactions per second was noted by DeFi Dev Corp in its recent interview, a key advantage over Ethereum’s more limited throughput. That comparison is sparking broader conversation about Solana’s long-term market share.