- XRP open interest surged 25% to $4B, signaling strong market participation.

- XRP price hit $3 after crypto reserve news but corrected to $2.52 amid profit-taking.

- XRP futures and options activity soared, reflecting increased bullish sentiment.

XRP price recorded a net inflow of $94.87 for the day, which makes it the third highest net increase on daily record. The trading volume surpassed $4 billion, which created a new multi-month high of the XRP price. Chad Steingraber speaking in the same light also stressed this rise which supports the bullish trend.

These huge inflows, therefore, suggest growing interest from institutional investors. Such a surge points to the possibility of big investors manipulating the market to build a large position. XRP with a seemingly solid vertical movement in the price reflects the positivity that is being seen in the market recently.

Open Interest Soars 25%, Signaling Strong Market Activity

According to data from CoinGlass, OI skyrocketed by 25% in 24 hours to reach the $4 billion mark. This a clear indication that there is active trading happening with investors taking up more futures contracts boldly. The trading of options increased exponentially and the Open Interest grew by 910% reaching $3.22 million .

An up-tick in the open interest, paired with a higher price level, indicates that traders are becoming more bullish. Market participants continue to observe whether this is a trend that will continue or lead to higher volatility.

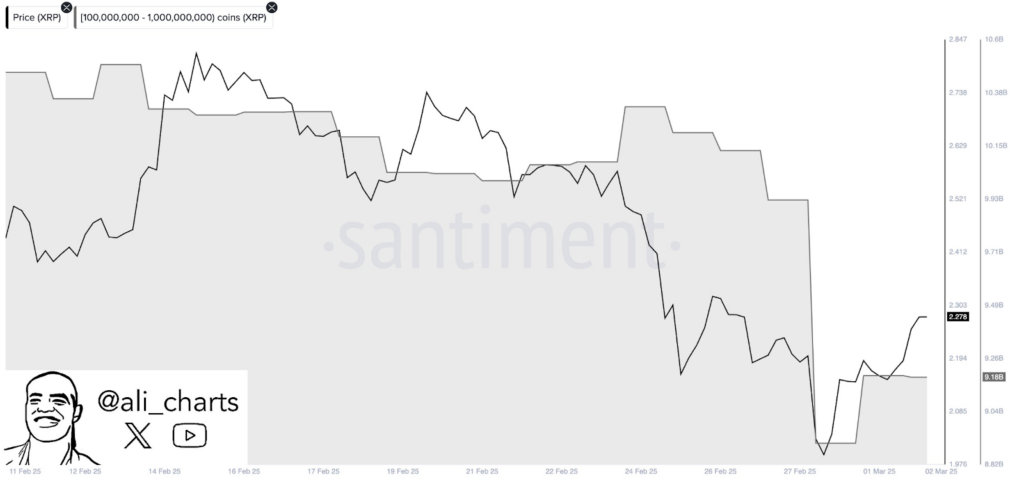

XRP Price Action: Sharp Rally and Profit-Taking

In early March, the price of XRP surged to $3.40 before starting to pull back. At the time of writing, XRP price traded at $2.0252, which is 7.94 % higher than it was at the start of the day. The asset reached its high in the last one day period at $2.2563 while its low was recorded to be at $2.0032.

The downward movement of the price could be attributed to profit taking following the sharp move up. However, the trading volume is still high and has only dropped to over $2.4 billion in the last 24 hours. From the weekly chart we can identify a parabolic movement accompanied by a correctional phase.

Moving Averages and Key Support Levels

The five-day moving average stands at $2.4592, while the ten-day moving average is at $2.5265. The thirty-day moving average remains lower at $1.5037, reflecting the recent uptrend. If XRP holds support at $2.00, buyers may regain control.

The relative strength index (RSI) shows overbought conditions, signaling a possible retracement. If selling pressure persists, XRP price may struggle to reclaim higher levels. Traders are watching for a consolidation phase before another potential breakout.

Additionally, XRP inclusion in a crypto strategic reserve fueled market optimism. The reserve also features Bitcoin, Ethereum, Cardano, and Solana. The announcement triggered an immediate rally, pushing XRP price from $2.17 to $3.02.

Uncertainty remains regarding the reserve’s size and purchase structure. Investors are also monitoring Ripple’s ongoing legal battle with the SEC. The outcome could impact long-term market sentiment and regulatory positioning.

Whale Accumulation and Price Outlook

As for whales, their activity does not slow down, and the number of large investors with large packs of XRP only increases. The crypto analyst Alien Martinez also revealed that whales have bought 270 million XRP over the weekend. This accumulation means that investors are becoming more optimistic even when there is volatility in the market.

However, to maintain an upward trend, XRP price needs to stay above $2.60. If the price rises above $3, there are expectations of a retest at $4.2 and $5. More declines in support could result in additional corrections.