Key Insights:

- The total crypto market cap has dropped by $7 billion, which shows a current period of stagnation and indecisiveness.

- Bitcoin is clinging to support above $105,000, with $106,265 acting as immediate resistance.

- Analyst Dave the Wave predicts a possible Bitcoin correction to $96,000. This could be a healthy consolidation before a rally to $160,000.

The crypto market is in the middle of another uncertain stretch. The market cap dropped by $7 billion in the past 24 hours. Bitcoin is clinging to support just above $105,000, and this sideways price action is leaving traders cautious.

While some analysts predict incoming bullish momentum, others warn that a deeper correction could be inbound.

Crypto Market Cap Sheds $7 Billion

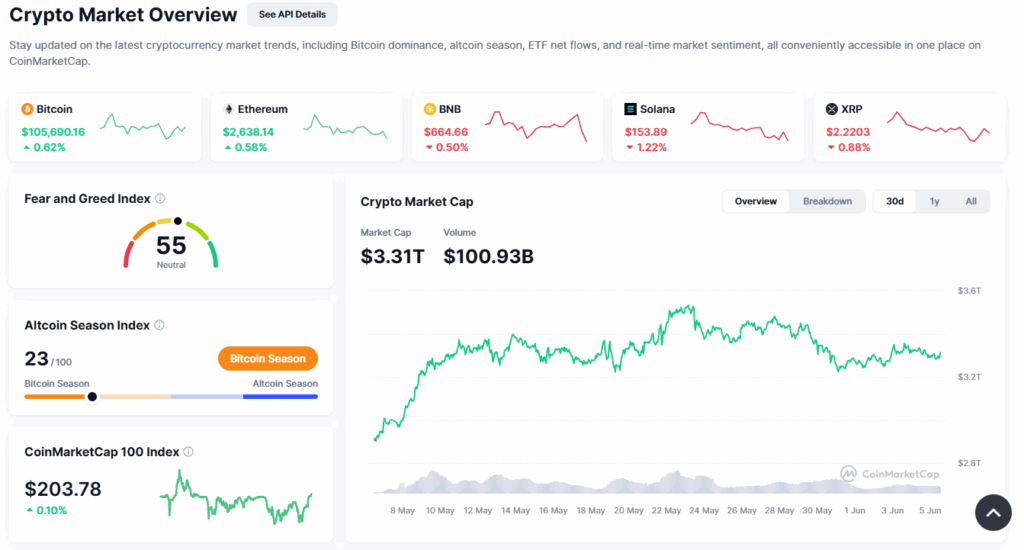

The total crypto market cap now sits at roughly $3.31 trillion, down from $3.38 trillion earlier this week. While this $13 billion dip may not seem much in isolation, it shows how stagnant the market has been over the last few days.

The market is now trapped between $3.21 trillion and $3.31 trillion. This consolidation phase shows no immediate signs of resolution. Also, both bulls and bears are holding back while waiting for a clear signal before getting in on the action.

This indecisiveness often signals the market is gearing up for a big move. It could rise if buyers gain confidence or fall if sellers take control.

Bitcoin Holds Above $105,000, But for How Long?

Bitcoin is priced around $105,023, holding a narrow lead above its recent support. The good news for BTC bulls is that the asset’s bullish momentum hasn’t entirely faded. The cryptocurrency has managed to avoid falling back into a downward spiral, at least for now.

So far, the resistance level to watch out for is the $106,265 zone. A move above this level could unlock a path toward $108,000 there. If Bitcoin holds its momentum, it may lift the broader market from its downturn.

This could reignite investor optimism and drive new interest. A sustained rally might bring fresh energy to the crypto space.

However, on the flip side, if Bitcoin fails to gather momentum, a pullback to $102,734 will become likely. Falling below that level would weaken the current bullish case and could be the start of a more general correction.

A Correction Coming?

Not everyone is convinced that Bitcoin will continue climbing without a hitch. One popular analyst, Dave the Wave, who accurately predicted the 2021 market cycle, is now sounding the alarm on an incoming correction.

According to Dave, Bitcoin could soon drop to around $96,000, near the 0.382 Fibonacci retracement level. Dave believes that such a correction wouldn’t necessarily spell doom.

He believes a dip to that level could set the stage for a powerful rally to $160,000 in the long term. He argues this would be a healthy consolidation phase before the next major breakout.

Market Sentiment In Wait-and-See Mode

Across the board, market sentiment seems to be on the cautious side. Many investors are sitting on the sidelines, waiting for clear signals or technical confirmations before entering new positions.

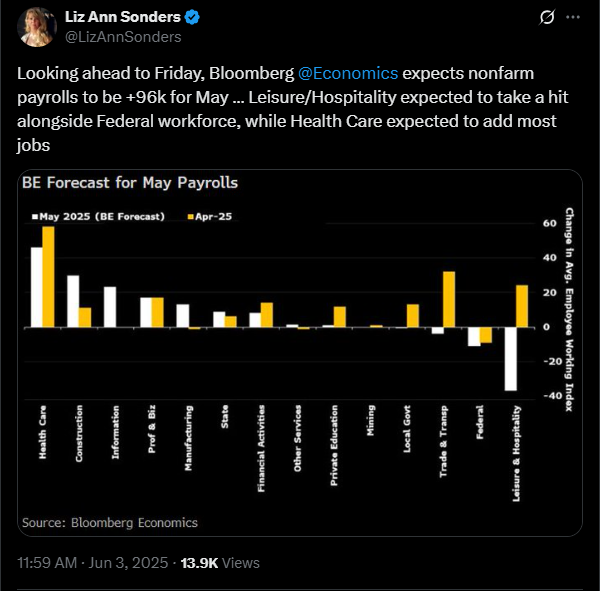

For example, upcoming U.S. employment data, especially the non-farm payroll (NFP) numbers, could inject volatility into the market.

A stronger-than-expected report would likely reinforce the Federal Reserve’s stance of keeping interest rates high. This might damage appetite for risk assets like crypto.

On the other hand, weaker job data could strengthen hopes for rate cuts later in the year and provide a fresh boost to crypto prices. The crypto market is in a holding pattern in the short term.

The total market cap remains within a narrow band, and Bitcoin continues to flirt with the $105,000 level. While short-term uncertainty may feel frustrating, it often serves as the groundwork for future gains.