Key Insights:

- The $0.497 zone is emerging as a key support. A successful bounce from this level could lead to a 30% rally toward $0.65.

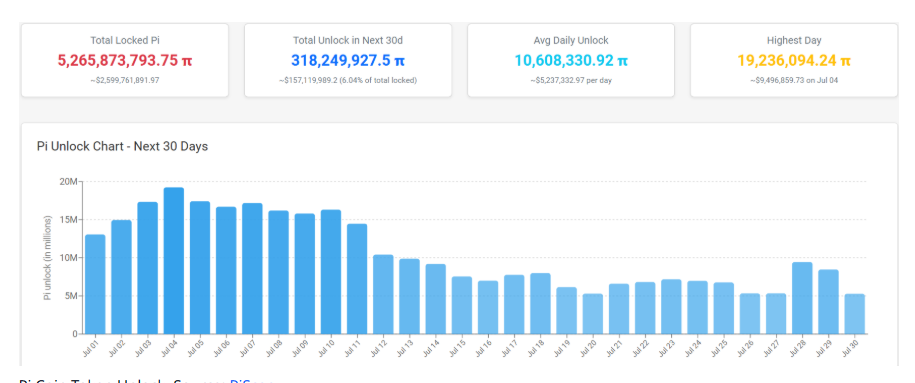

- 318 million Pi tokens worth $160 million are set to unlock gradually, which could increase selling pressure.

Amid the ongoing bearish market sentiment, Pi crypto value continues its downward streak, forming red candles each day since June 26, 2025. Despite the overall bearish outlook, the current price action of Pi Coin appears bullish and suggests potential upside momentum in the coming days.

Experts’ Bullish Outlook and Bold Predictions

This bullish outlook has also been acknowledged by experts and analysts on X (formerly Twitter). In the past 24 hours, several optimistic views and bold predictions have surfaced, gaining significant attention from crypto enthusiasts.

In a post, a crypto expert shared that Pi is forming a textbook-style inverse cup and handle pattern on the 4-hour timeframe, indicating a bearish continuation. The post further added, “Now trading below the 50MA, momentum favors sellers. Break of $0.5 = gateway to $0.30 lows. The trend is weak. Structure is bearish. Caution warranted.”

Meanwhile, another expert stated that Pi crypto is nearing the oversold zone. Additionally, the post added, “The $0.4-0.35 zone might be coming. This will be your chance to buy. The altcoin Market is getting interesting. PI will also be juicy.”

Analysts typically view this surge in trading volume, combined with the price dip, as a sign of strong downside pressure, indicating increased selling activity and growing bearish sentiment in the market.

As of press time, the Pi crypto value stands at $0.4921, having recorded a price dip of over 3.85% in the past 24 hours. During the same period, trader and investor participation soared, resulting in a 10% surge in trading volume compared to the previous day.

Pi Crypto Price Action and Upcoming Levels

According to expert technical analysis, the Pi crypto value is poised for a potential reversal and may experience upside momentum due to the formation of bullish price action. On the daily chart, the asset is approaching a key support level at $0.497.

Historically, whenever the price reaches this level, it tends to reverse and gain upward momentum. However, this time, the pattern appears to be different.

The daily chart reveals that while the Pi crypto value has been forming lower lows, its Relative Strength Index (RSI) has been forming higher highs during the same period. This combination indicates a bullish divergence, suggesting that the price may be poised for a rally.

Based on recent price action and historical patterns, if the Pi crypto value holds this key support level, most likely, history will repeat itself. That is, the price could experience an upside momentum of up to 30%, potentially reaching the $0.65 level.

On the other hand, if the ongoing downside momentum continues, there is a strong possibility that the Pi crypto value could experience a further decline of over 20%, potentially reaching the $0.39 level in the coming days.

At press time, Pi crypto value is below the 50-day Exponential Moving Average (EMA), indicating that the asset is facing ongoing bearish pressure and lacks strong buying momentum, which could lead to further downside in the near term.

$160 Million Worth of Pi Scheduled to Unlock

However, the ongoing token unlock appears to be a red flag for the asset, as it could trigger selling pressure and limit further upside momentum.

Data from Pi Scan reveals that nearly 318 million Pi coins, worth approximately $160 million, are set to be unlocked gradually over the coming months. This could increase selling pressure and negatively impact the Pi crypto value.