Key Insights:

- XRP has formed bullish inverse Head and Shoulders pattern, targets $3.14.

- Break above $2.20 confirms bullish breakout after consolidation.

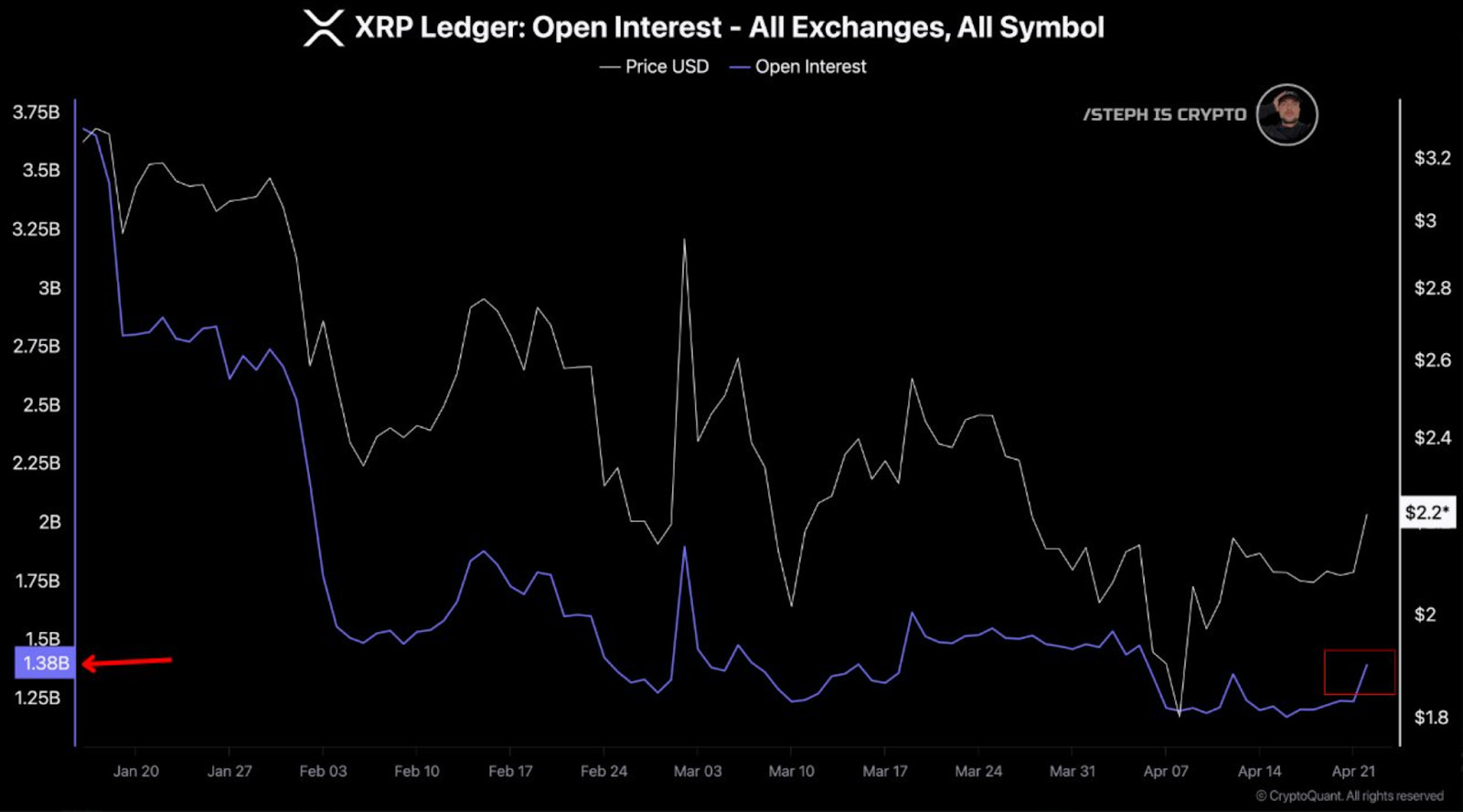

- Open interest rises to $1.38B as whales increase their positions.

Price action is breaking above key resistance near $2.25, and XRP is gaining traction. The bullish chart pattern has a target of $3.14.

At the same time, open interest has risen sharply, along with whale activity. This indicates a stronger market setup ahead.

Inverse Head and Shoulders Signals Potential Rally

XRP is forming a clear inverse Head and Shoulders pattern, a sign of a bullish breakout. This is a pattern that includes two shoulders and a deeper trough in between (the head), which occurs before the upward price movement. This setup has its neckline around the $2.23 level, and XRP just closed above it.

A close above this level on a daily basis could be a breakout. As per chart analysis shared by Steph_iscrypto, the possible upside target for XRP from this pattern is about $3.14.

This target is measured by the height of the pattern and projecting it above the neckline. At the time of writing, XRP is trading around $2.24, which gives it room to move up by 40% if momentum holds.

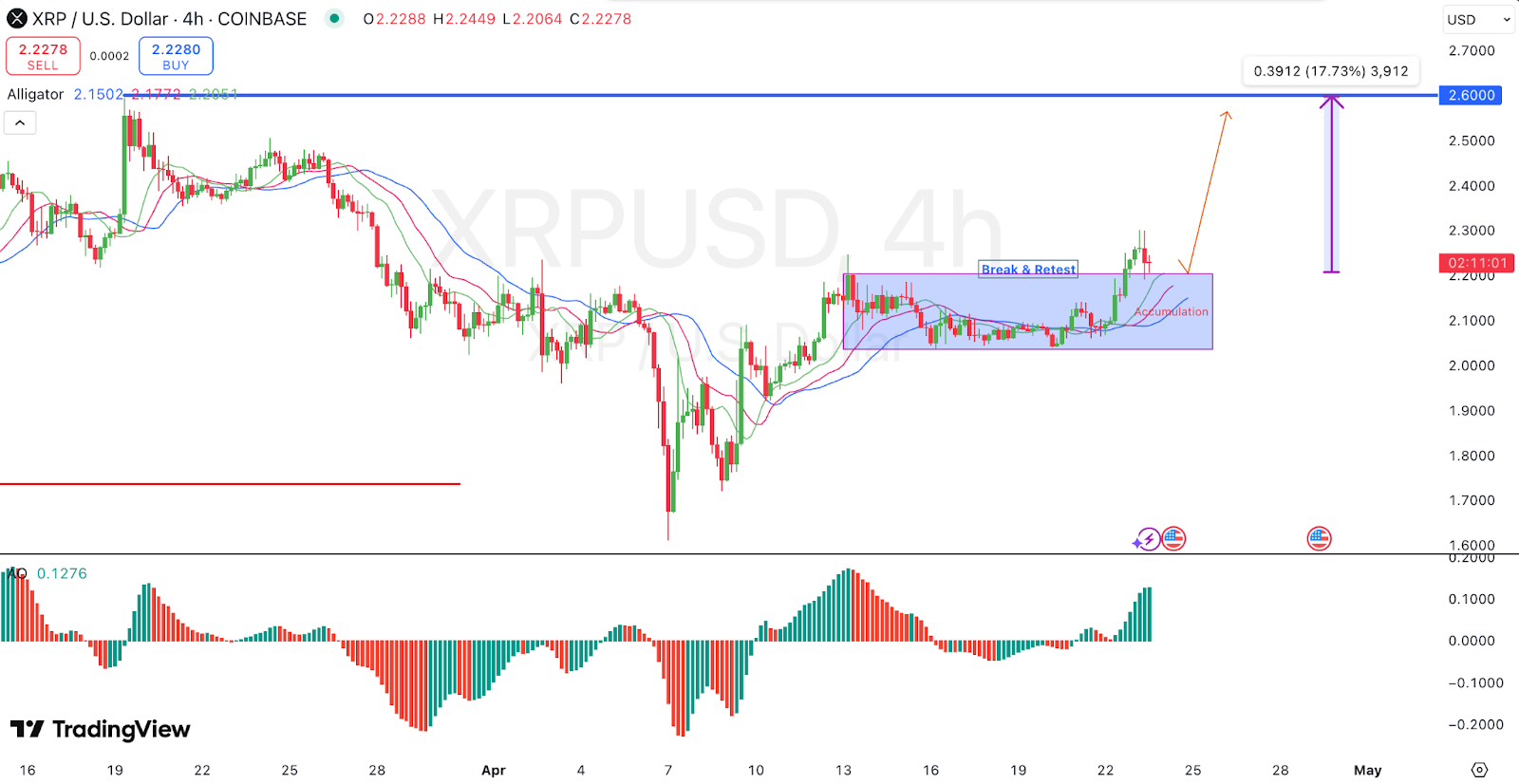

Price Consolidation Breaks, Trend Turns Positive

In the past two weeks, XRP had been consolidating between $2.00 and $2.20. During this accumulation phase, price action was sideways and volatility was decreasing. However, the price just broke out of this zone, which confirms the change in trend direction.

According to technical data from TradingView, this accumulation range has seen a breakout and retest of the upper boundary.

The retest was met with a good price reaction, which bounced back above $2.21. The move also came as trading volume picked up, and the Awesome Oscillator turned positive after several days of flat movement.

Together, these signals indicate that the previous resistance zone is now support. If this level is held, it could lead the price to continue moving towards the next resistance area around $2.60, and possibly further to $3.14.

Open Interest Rises as Whales Take Control

Additionally, data from the XRP Ledger’s market shows open interest has jumped sharply from recent lows.

Open interest, which dipped to around $1.2 Billion in early April, is now rising again and getting close to the $1.5 Billion mark. This indicates increasing trader involvement and fresh positioning in XRP futures.

The price chart with open interest data also indicates that the XRP price has been steadily rising, but the rise in open interest has been sharper.

This typically means more leveraged positions, which could drive prices further in the short term if momentum keeps going.

According to Steph_iscrypto, retail traders may have exited during previous price declines. As open interest increases and the price makes bullish patterns, larger holders or whales are accumulating.

Such activity usually results in larger price movements when retail volume is low and liquidity is thinner.

Institutions and Broader Sentiment Support

Meanwhile, Sal Gilbertie, CEO of Teucrium, made a separate public comment at an interview that XRP is “the coin with the most use case” and “has real utility.”

While this statement was not linked to any particular investment decision, it is the latest in a series of institutional interest in XRP’s ecosystem.

This is happening as broader crypto markets are seeing renewed interest from both retail and institutional sides.

Bitcoin and Ethereum remain the top fund flow recipients, but smaller-cap tokens such as XRP are seeing increased trading activity and price performance.

Technical indicators still indicate strength for XRP, while institutional figures are acknowledging the role of XRP in blockchain infrastructure, which may continue to draw attention to the asset.