Key Insights:

- Ripple’s CEO presented an ambitious future for XRP. He claimed it could capture as much as 14% of the SWIFT international cross-border payments volume in five years.

- The XRP is experiencing a second wave of growth amid a shocking SEC withdrawal that revived the hope of an ETF

- XRP is working within a narrow technical configuration, having declined from its $3.40 peak to beneath $2.20.

XRP news noted positives across the blockchain that stemmed from institutional adoption and the SEC announcement, among others. Despite this, prices struggled just like the whole crypto market.

XRP News: Can Ripple Capture 14% Of SWIFT Volume?

Ripple CEO Brad Garlinghouse presented an ambitious future for XRP. He claimed it could capture as much as 14% of the SWIFT international cross-border payments volume in five years.

Ripple is growing more ambitious in its effort to disrupt traditional financial systems using blockchain technology. Garlinghouse emphasized XRP’s speed, cost-efficiency, and scalability.

He believes these strengths position XRP to handle massive daily transactions. With trillions of dollars moving through financial networks, XRP aims to compete at scale.

The statement highlighted Ripple’s aim to modernize, move-border bills, and reduce dependency on the vintage system. Although SWIFT currently processes about $5 trillion daily, even 14% would be an enormous step toward the utility and adoption of XRP.

The world is seeing a growing demand for real-time settlement and decentralized financial systems. Financial institutions are actively exploring new options to adapt to these evolving needs.

XRP Market Sentiment

XRP experienced a second wave of growth amid a SEC withdrawal that revived the hope of an ETF. After positive XRP news on an ETF approval, Polymarket showed an 88% chance of such an approval by the end of the year. This would meaningfully increase institutional inflows and legitimization.

The move is in line with the wider regulatory certainty. This strengthens the potential of XRP as a primary asset in the world financial rails.

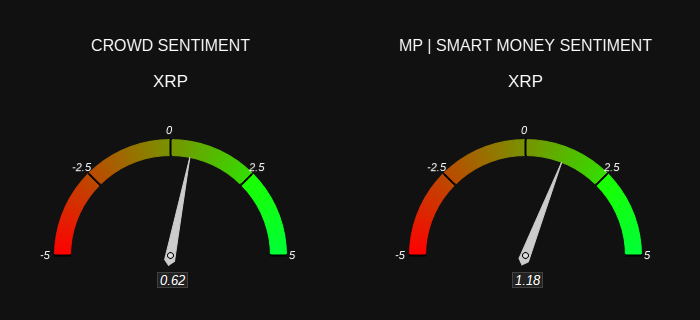

Sentiment indicators backed this bullish change. As indicated by the gauges, the Crowd Sentiment was 0.62, and the Smart Money Sentiment was higher at 1.18.

Both readings leaned bullish, and the smart money was significantly more certain about XRP in the short term. This indicated that institutional traders might be looking forward to regulatory developments and accumulation phases.

To this impetus, comments made by the CFTC Chair that large U.S. banks will accelerate crypto services are an institutional game-changer.

XRP, already compliant with frameworks such as ISO 20022, is in a good position to take advantage of this trend. With the momentum maintained, XRP may become a key actor in the compliant cross-border digital finance.

XRP Price Action

XRP traded within a wedge pattern, declining from its $3.40 peak to beneath $2.20. The well-defined falling triangle of lower highs and flat base near the $1.91 support level coincided with the 0.5 Fibonacci support level.

The price action continued to be squeezed below the 50-day EMA, validating bearish influence. The demand area at $2 has been defended multiple times, yet a loss of $1.91 may open the doors to a decline to the $1 area. There, the 0.786 Fibonacci retracement level comes in at $1.096.

Conversely, a fierce breakout beyond the downward resistance trend of the triangle would negate the bearish formation. It could set sights on a move towards $2.70, followed by $3.40 as the subsequent resistance level.

The volume is drying up, which is an indication of a potential volatility burst in the future. The zone is crucial: XRP will either find support at important levels to reverse the upside or validate the triangle breakdown to continue towards the downside. The level of $1.91 is under the observation of traders.