Key Insights:

- XRP price fell below the $2 mark, signaling increased bearish sentiment in the market.

- The token is trading at around $1.96 after dropping 4.02% in the past 24 hours.

- XRP has recorded a 12.51 percent decline year-to-date, placing it in the red for 2025.

XRP price had a turbulent start to April, facing a sharp price drop. A sudden surge followed this in trading activity.

The token broke below the $2 mark, triggering bearish sentiment, while its futures volume soared to a new monthly high. Despite a rise in on-chain metrics, indicators suggest continued market pressure and potential downside ahead.

XRP Price Breaks Below $2 as Bearish Momentum Strengthens

XRP price dropped below the essential $2 mark. This demonstrated growing sell-off momentum and traders’ growing skepticism about market conditions.

During the previous 24 hours, XRP lost 4.02% of its value when trading at a current market price of $1.96. The token indicated negative yearly performance because it has declined by 12.51% since the beginning of the year.

XRP’s previous resistance has given way to the diminished short-term sentiment that emerged through recent market developments. The heightened market volatility caused traders to make successive daily price declines.

XRP’s market value decreased by 13.36% during the previous week. This strengthened predictions about its continuous descending trend.

According to technical indicators, trading momentum has changed because XRP stays under its twenty-day average mark of $2.155. The Bollinger Band indicator displays rising market volatility because the lower limit is $1.781.

The current price range implied that XRP price may fall to additional support levels whenever market sellers intensify.

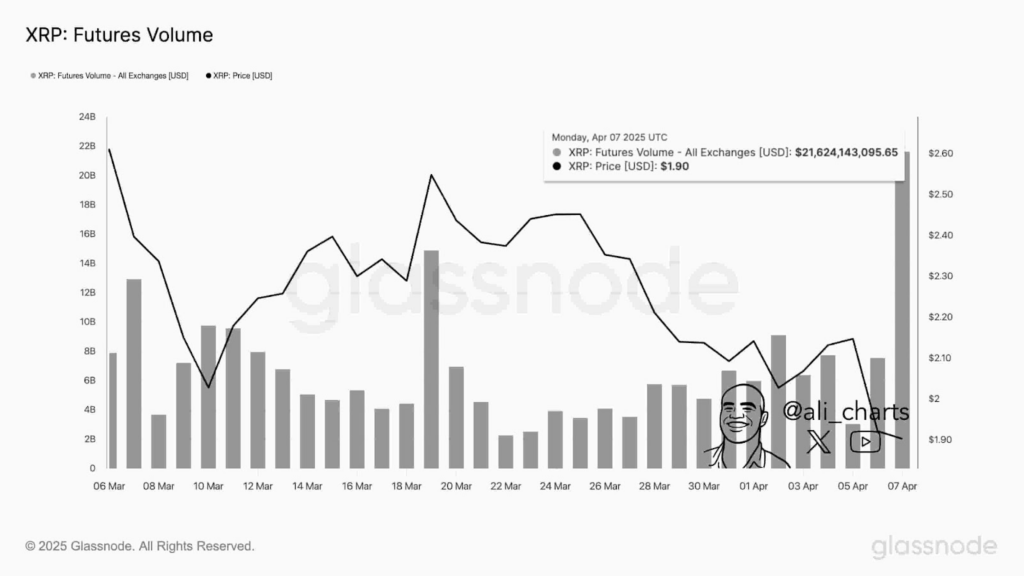

Futures Volume Reaches $21.6 Billion Following ETF Launch

XRP futures trading volume achieved its highest monthly level on April 8. At that time, it surpassed the amount from Monday by $500 Million at $21.6 Billion.

Numerous traders started buying the Teucrium 2x XRP ETF when it was launched in the market after its release. Analysts identify the new listing as the main reason behind the sudden increase in volume.

Leveraged ETFs employ derivatives, possibly leading to a dramatic increase in XRP futures market transactions. Recent address data indicated that retail participants mainly drive market activity.

Institutional participants may be entering, but their involvement remained lower than that of retail consumers. The broader market exposure from XRP provides opportunities for new speculative buying pressure in the XRP asset class.

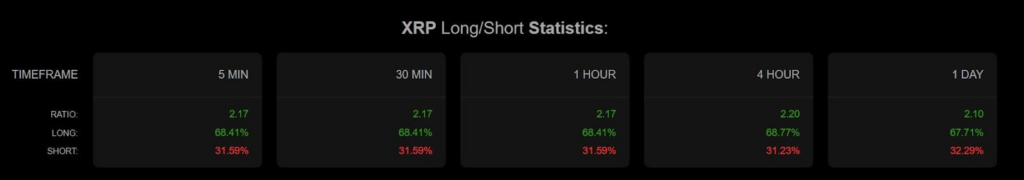

The heightened volume does not indicate panic selling because holders maintain long futures positions. According to market analysis, the current holding of long positions in the futures market makes up almost 68% of the total positions.

The current market positioning revealed uneven trader commitment to XRP price decline. This suggests varying sentiments and strategies among participants.

XRP Key Indicators Signal Persistent Weakness Despite On-Chain Growth

The RSI value was recorded at 42.75, signaling neutral-to-bearish market conditions. It also showed signs of weakening momentum and the possibility of downward pressure. The bulls do not control the market since the scoring remained below 50.

The RSI-based moving average stood at 39.65. This highlighted ongoing bearish signals. Meanwhile, the MACD lines confirmed the bearish outlook, indicating -0.10976 and -0.09547 values.

The current negative value in the histogram showed no indication of a bullish crossover, thus indicating downtrend persistence. The market stayed cautious because there has been no indication of upcoming short-term price reversals.

On-chain metrics reveal that the number of XRP addresses holding at least $1 worth of tokens has reached an all-time high. This surge contradicted professional analysis, highlighting a divergence in market perspectives.

The rising number of market participants demonstrates how retail investors enter the market during price decreases. The positive metric fails to prove an immediate price increase in the market.

XRP Price Faces Pressure Below Key Resistance

The current market condition for XRP presented a high risk. Most technical indicators signal bearish tendencies, and traders predict additional price drops.

The current market doubt stems from active weakness in crypto assets and stock market performance. A previous rebound attempted during this month proved short-lived. This indicates an upcoming extensive price correction may take place.

The bearish crossover on the MACD and sustained pressure below the 20-day moving average show a lack of buyer support. XRP price faced significant barriers to upward movement if it stayed under the main resistance point of $2.155.

XRP holder acquisitions suggest enduring interest in the long term. However, that might not shield it from current market threats.

XRP is increasingly likely to experience a sharp price correction. Downward market pressure could push it toward $1.781, aligning with its lower Bollinger Band range. Traders need to pay attention to technical levels and volume patterns to find indications of price recovery.