Key Insights:

- XRP price is trading around $2.00, and analysts are pointing to $1.81 and $1.72 should there be a breakdown in support.

- BitGo CEO says RLUSD proves Ripple’s XRP bridge dream has failed.

- The liquidity points at $1.87 and 1.72 indicate potential bottom areas

XRP price is struggling to hold above $2 as traders assess technical chart signals pointing to further downside. At the same time, Ripple’s recent launch of the RLUSD stablecoin has reignited conversations about XRP’s core utility. Analysts now caution a potential shift to $1.81, though new liquidity patterns and wave structures inform the anticipation of the next market development.

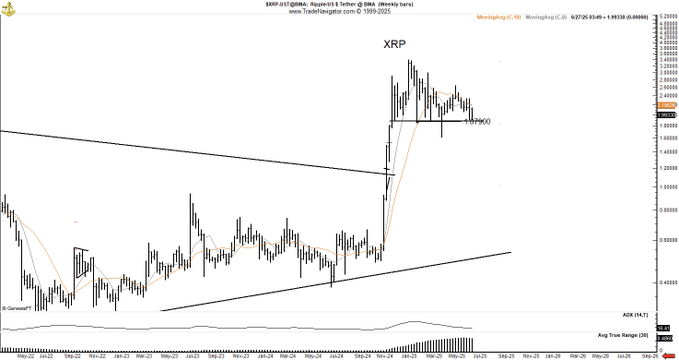

XRP Price Eyes $1.80 Neckline in H&S Formation

Market veteran Peter Brandt recently called attention to a potential Head-and-Shoulders (H&S) top forming on the XRP price chart. According to Brandt, the sharp move seen on April 7 may have been an “out-of-line movement,” and the pattern suggests that XRP price could be topping out unless support holds. The neckline, which is trading around $1.80, is a critical support.

Brandt explained that the chart is not necessarily bearish unless the $1.80 level breaks. Price is now at support, and he added that he will revise his outlook should the price close below the 1.8xxx range. His assessment underscores a growing caution among technical traders, especially as XRP price continues to hover near key breakdown levels.

In case the H&S pattern is correct, it may indicate an end to the strong upward trend in recent weeks. A break at a price level below the neckline would signal more downside, and earlier support areas are at risk of becoming resistance areas. As such, XRP’s ability to remain above this zone may determine the short-term market bias.

Elliott Wave Structure Signals Drop To $1.81

Further bearish confirmation comes from analyst Man of Bitcoin, who sees XRP price completing a wave 4 rally and preparing for a final fifth wave down. His 4-hour chart suggests that XRP price has already hit major resistance and is now likely targeting the 100% Fibonacci extension near $1.81.

The configuration showed future losses to $1.787, $1.709, and even towards $1.62 in case sellers take charge. The structure is textbook corrective by the wave count, with lower highs creating a declining wedge. This coincides with reduced volume and stalling RSI, which are indicators of declining bullish momentum.

Therefore, 0.618 retracement and Fibonacci confluence at this area make the area of $1.81 an important support target. To negate this scenario, XRP price will have to recover above the $2.11 level, rebounding beyond the short-term resistance and invalidating the formation of the fifth wave.

Liquidity Maps Highlight $1.87 and $1.72 Zones

To further add pressure, liquidity heatmaps on Cryptoinsightuk showed a heavy concentration of the price levels around $1.87 and $1.72, which can draw the price towards them. The 4-hour chart reveals a dense build-up of open orders below the current XRP price, suggesting market makers may drive the price down to fill those orders before any bounce.

The analyst noted that if support holds, targeting liquidity around $1.87 would be reasonable. If the price drops to $1.72, it could present an ideal entry point. This aligns with Fibonacci and wave projections. It is important to note that the lack of liquidity above the current price, compared with high demand below, supports the likelihood of a downside sweep.

RLUSD Launch Fuels Questions About XRP’s Future

Amid the technical pressures on XRP price, fundamental doubts about its utility are reemerging. Speaking on the Digital Banking 2025 conference, BitGo CEO Mike Belshe lamented the new RLUSD stablecoin released by Ripple, citing it being a failure of the XRP bridge currency idea. “USD stablecoins are just better,” Belshe said, citing the inefficiencies in XRP’s two-step conversion process.

Ripple CTO David Schwartz responded by stating that XRP would continue to function as a bridge asset alongside RLUSD, not in competition with it. RLUSD has already gained traction, receiving approval from the Dubai Financial Services Authority (DFSA) and approaching a $500 million market cap.