Key Insights:

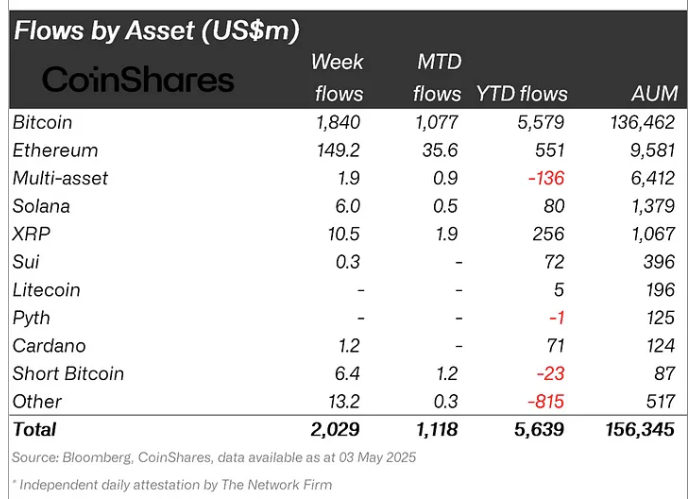

- XRP recorded $10.49 million in inflows last week following a previous weekly inflow of $31.6 million.

- Ripple remains focused due to speculation about a possible $20 billion acquisition deal involving Circle.

- Total assets under management for XRP-based products now stand at $1.067 billion.

XRP recorded $10.49 million in fresh inflows this past week, reflecting continued market interest in Ripple-based products. This figure comes after a $31.6 million inflow the previous week, signaling a strong upward trend.

Ripple is gaining attention amid speculation about a $20 billion acquisition. The deal reportedly involves Circle, the USDC issuer.

XRP Sees Consistent Capital Movement

XRP experienced growing interest, establishing it as the fifth-ranked digital asset in weekly capital investment. XRP-based products currently hold $1.067 billion in assets. They continue to attract steady inflows as public interest in Ripple’s growth increases.

The recent $10.49 million weekly inflow has revived XRP’s previous momentum. Previously, Ripple had attracted $31 million in inflows during its last surge.

Ripple has expanded its crypto profile through strategy and growing financial interest in its XRP-based products. A total influx worth $256.49 million has reached XRP this year.

Ripple’s market position is strengthening as it attracts positive fund inflows. This marks its third consecutive week of sustained investor interest.

Multiple digital asset categories achieved solid market performance during this period. Still, XRP alone brought higher weekly figures than other tokens. The rising inflow activity did not prevent XRP from experiencing a 2% value decrease over 24 hours.

Ripple’s Potential $20B Circle Deal

Speculation continues around Ripple’s potential $20 billion deal to acquire Circle, fueling renewed attention on XRP’s market standing. Several reports indicate this acquisition would happen after the failed $5 billion transaction.

Ripple’s $20 billion valuation is still under discussion. Meanwhile, the company has showcased its readiness for major expansion by acquiring multiple businesses.

The financial services company made its largest acquisition in April 2020, purchasing Hidden Road for $1.25 billion. This purchase allowed Ripple to reach more institutional finance companies while reinforcing its asset management services capabilities.

Rumors about the Circle acquisition and the other recent deal confirm that Ripple aims to achieve growth through market consolidation. The market forces strongly react to rumors about Ripple and Circle discussions, even though Ripple holds no official stance.

The combination of Ripple infrastructure with Circle stablecoin technology potentially brings valuable benefits in the long term. Some market experts doubt the likelihood of achieving such a high $20 billion valuation under market conditions.

XRP ETF Approval Hype Drives Sentiment

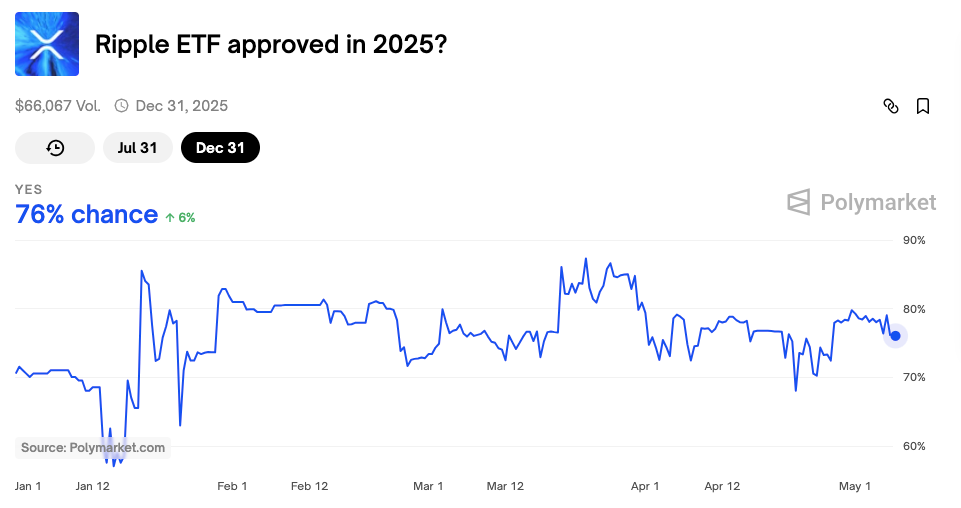

Approving the XRP Futures ETF has increased discussion around a potential spot XRP ETF. Polymarket data shows approval expectations for the XRP Futures ETF are above 79%.

This prediction is based on forecasts before December 31. The speculation also fuels broader interest and trading volume within the XRP ecosystem.

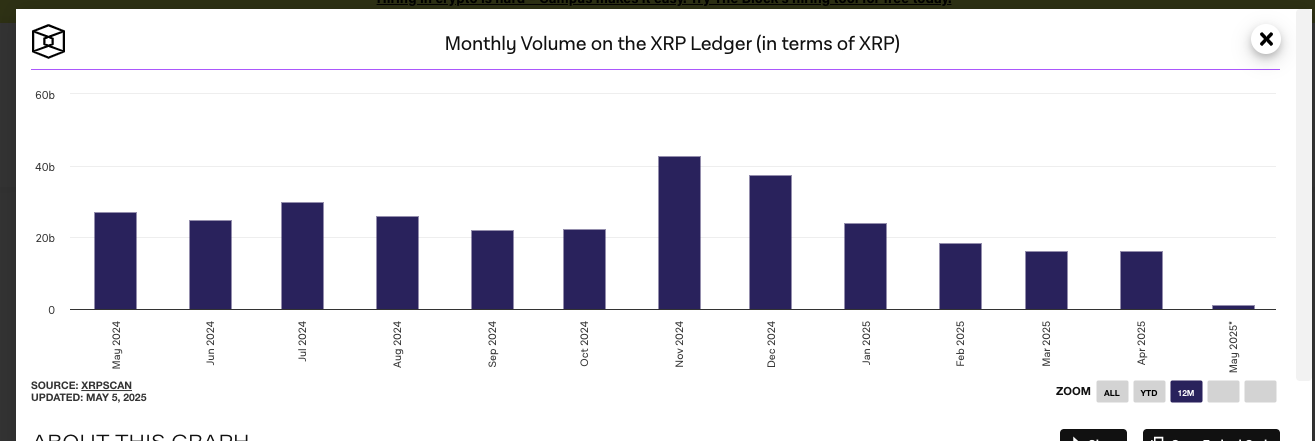

In April 2025, the XRP Ledger processed 16.17 billion XRP in monthly transactions, slightly up from 16.05 billion in March.

The increasing level of on-chain operations strengthens the argument for increasing institutional product demand. While ETF approvals for other coins remain pending, XRP is gaining unique momentum.

XRP’s market narrative is further strengthened by growing support across regions outside the United States. While inflows into Ripple remain led by the US, international activity reflects broader enthusiasm for XRP-linked financial products.

Global Crypto Market Trends Highlight U.S. Dominance

Global crypto inflows reached $1.92 billion recently as the United States continued its position as the leading contributor. German investors contributed $47.2 million to the digital asset product industry.

Meanwhile, Swiss investors provided $34.2 million, and Canadian investors added $20.1 million. Regional market participation was strong but failed to achieve the extensive levels observed in the United States.

CoinShares data shows that most markets are seeing increased interest. However, Sweden and Brazil experienced slight cash outflows, bucking the overall trend.

The outflow from Sweden amounted to $0.5 million, while Brazilian investors withdrew $0.2 million from digital asset markets. Hong Kong introduced $2.7 million in assets to the market. Meanwhile, unlisted markets contributed $2.5 million.

The cryptocurrency market has maintained positive growth for three consecutive weeks. Minor regional fluctuations have not disrupted this upward trend.

Short BTC investments saw a $6.4 million increase in value. At the same time, Solana exchanges gained momentum, collecting $6.03 million. The recorded figures specify that investor interest goes beyond premier assets and extends to multiple digital product categories.